- Canada

- /

- Metals and Mining

- /

- TSXV:SCZ

TSX Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

As Canadian investors navigate a landscape marked by potential changes in U.S. tax policies and rising bond yields, the focus on smaller market segments like penny stocks becomes increasingly relevant. Penny stocks, despite their somewhat outdated label, represent an intriguing investment area for those interested in exploring opportunities among smaller or newer companies. By examining financial strength and growth potential, these stocks can offer both affordability and promising returns; this article will highlight three such Canadian penny stocks that stand out for their robust foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.76 | CA$73.84M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.67 | CA$107.9M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.26 | CA$132.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.70 | CA$465.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.23 | CA$669.5M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.84 | CA$4.57M | ✅ 2 ⚠️ 5 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.80 | CA$173.01M | ✅ 3 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.60 | CA$539.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.63 | CA$131.96M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.75M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 899 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

PetroTal (TSX:TAL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PetroTal Corp. is involved in the exploration, appraisal, and development of oil and natural gas in Peru, South America, with a market cap of CA$539.84 million.

Operations: The company generates revenue from its oil and gas exploration and production activities, amounting to $340.62 million.

Market Cap: CA$539.84M

PetroTal Corp., with a market cap of CA$539.84 million, has shown robust revenue generation from its oil and gas operations in Peru, reporting US$97.71 million for Q1 2025. Despite a decline in net income to US$30.85 million compared to the previous year, production increased significantly, setting new records at the Bretana field. The company maintains strong financial health with short-term assets exceeding liabilities and manageable debt levels supported by cash flow. Recent strategic moves include a $65 million term loan for infrastructure investments and ongoing share buybacks, reflecting confidence in its operational stability despite current earnings challenges.

- Unlock comprehensive insights into our analysis of PetroTal stock in this financial health report.

- Review our growth performance report to gain insights into PetroTal's future.

Santacruz Silver Mining (TSXV:SCZ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Santacruz Silver Mining Ltd. is involved in the acquisition, exploration, development, and operation of mineral properties in Latin America, with a market cap of CA$249.10 million.

Operations: No specific revenue segments have been reported for Santacruz Silver Mining Ltd.

Market Cap: CA$249.1M

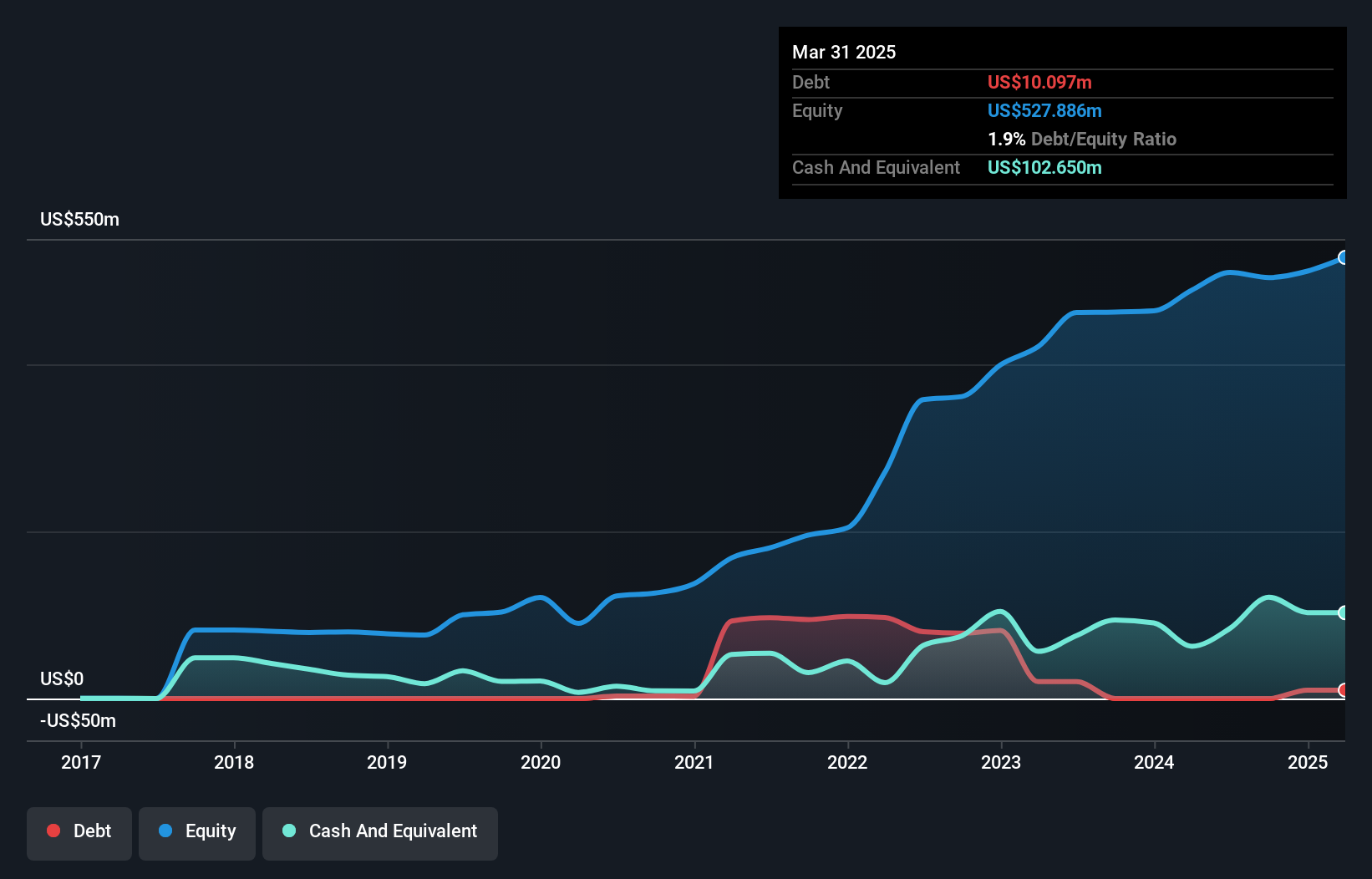

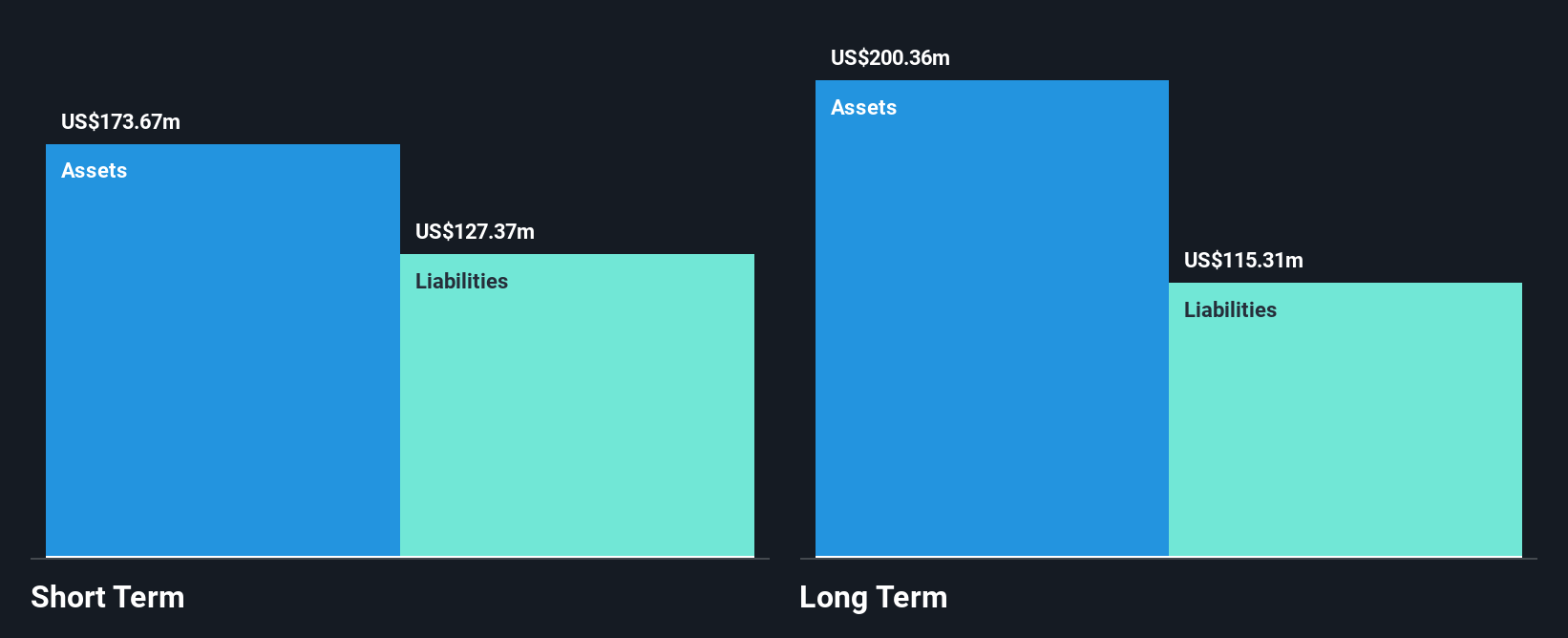

Santacruz Silver Mining Ltd., with a market cap of CA$249.10 million, has demonstrated significant earnings growth, achieving a net income of US$164.48 million in 2024 compared to a loss the previous year. The company processed nearly two million tonnes of ore, producing over 18 million silver equivalent ounces despite minor production declines in some operations. Financially disciplined, Santacruz has structured payments for its Bolivian assets acquisition and maintains more cash than debt. However, interest coverage remains low at 1.8x EBIT, and management lacks experience with an average tenure of just 0.6 years amidst recent executive changes.

- Dive into the specifics of Santacruz Silver Mining here with our thorough balance sheet health report.

- Explore historical data to track Santacruz Silver Mining's performance over time in our past results report.

Soma Gold (TSXV:SOMA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Soma Gold Corp. is a natural resource company focused on acquiring, exploring, and developing mineral properties in South America, with a market cap of CA$98.62 million.

Operations: Soma Gold Corp. has not reported any specific revenue segments.

Market Cap: CA$98.62M

Soma Gold Corp., with a market cap of CA$98.62 million, has shown impressive financial performance, reporting sales of CA$27.88 million and net income of CA$3.17 million for Q1 2025, reversing a loss from the previous year. Earnings growth significantly outpaced the industry average, but high debt levels remain a concern despite interest payments being well covered by EBIT at 3.2x coverage. The company is actively expanding its exploration efforts in Colombia's Machuca Project and has acquired additional mining concessions to bolster its resource base, although short-term assets do not cover long-term liabilities fully.

- Take a closer look at Soma Gold's potential here in our financial health report.

- Gain insights into Soma Gold's past trends and performance with our report on the company's historical track record.

Make It Happen

- Get an in-depth perspective on all 899 TSX Penny Stocks by using our screener here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SCZ

Santacruz Silver Mining

Engages in the acquisition, exploration, development, production, and operation of mineral properties in Latin America.

Flawless balance sheet and good value.

Market Insights

Community Narratives