The Canadian market is navigating a period of uncertainty with shifting political landscapes and rising government bond yields, which have put pressure on high-valuation stocks. Amidst this backdrop, penny stocks—often smaller or newer companies—offer a unique investment opportunity due to their affordability and growth potential when supported by strong financials. In this article, we explore several standout penny stocks that present promising prospects for investors seeking hidden gems in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.30 | CA$397.24M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.41 | CA$125.57M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.42 | CA$996.43M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$656.66M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$13.18M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.22 | CA$223.45M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.36M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.69 | CA$319.02M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$176.7M | ★★★★★☆ |

Click here to see the full list of 930 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Sharc International Systems (CNSX:SHRC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sharc International Systems Inc. offers wastewater energy transfer products and services for various sectors in Canada and the United States, with a market cap of CA$25.56 million.

Operations: The company generates revenue from the sales and marketing of WET equipment, amounting to CA$2.20 million.

Market Cap: CA$25.56M

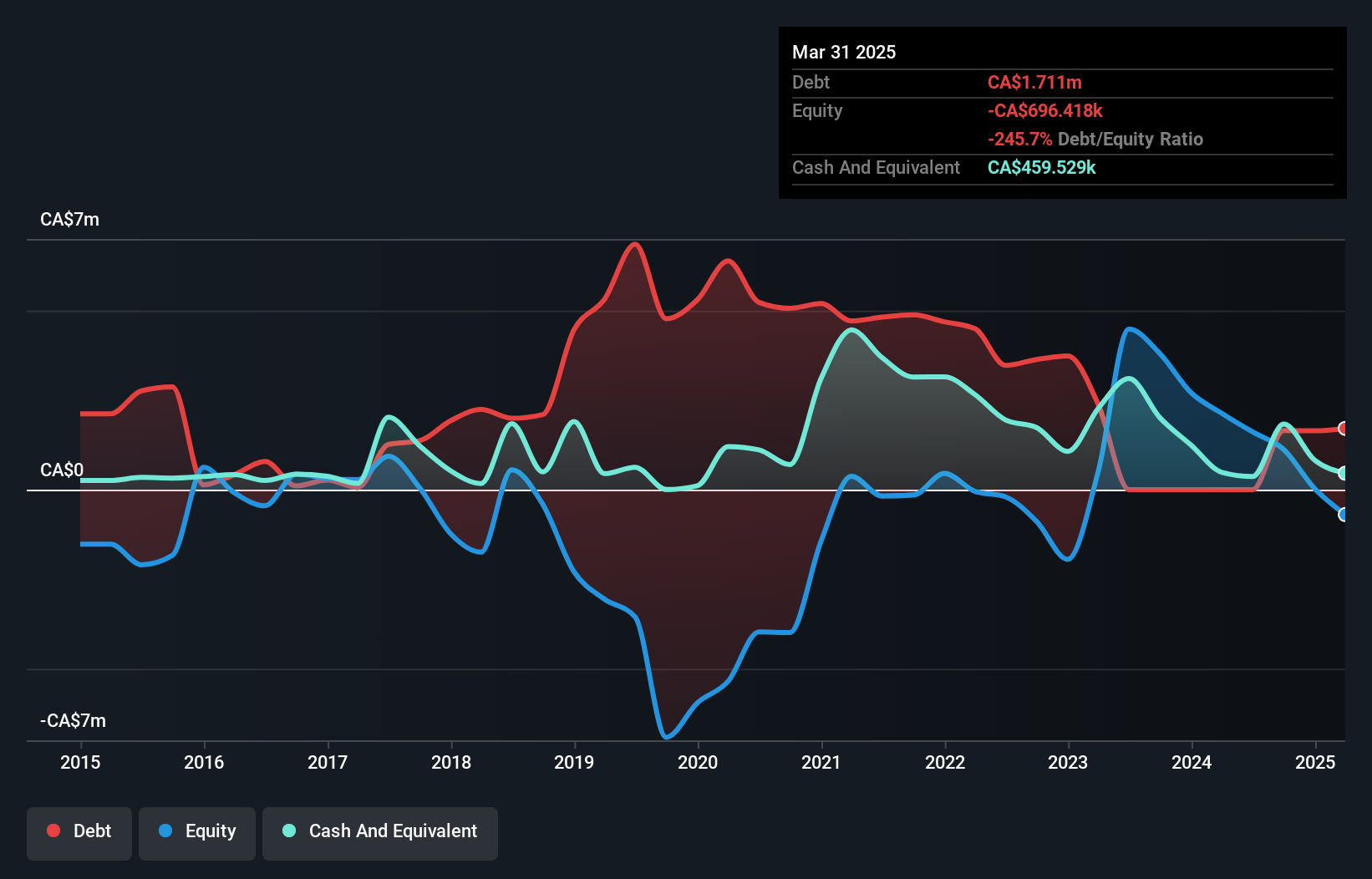

Sharc International Systems Inc. operates in the wastewater energy transfer sector, with a market cap of CA$25.56 million and recent revenue of CA$2.34 million for the first nine months of 2024. Despite its unprofitability and high volatility, Sharc's financial position shows short-term assets exceeding liabilities, providing some stability amid its cash runway challenges. The company recently appointed Michael Albertson as CEO, bringing significant industry experience to potentially drive growth and innovation in sustainable energy solutions. However, investors should consider Sharc's limited cash runway and negative return on equity when evaluating this penny stock opportunity in Canada.

- Get an in-depth perspective on Sharc International Systems' performance by reading our balance sheet health report here.

- Learn about Sharc International Systems' historical performance here.

Solstice Gold (TSXV:SGC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Solstice Gold Corp. is involved in the exploration and development of mineral resource properties in Canada, with a market cap of CA$3.11 million.

Operations: Solstice Gold Corp. currently does not report any revenue segments as it focuses on the exploration and development of mineral resource properties in Canada.

Market Cap: CA$3.11M

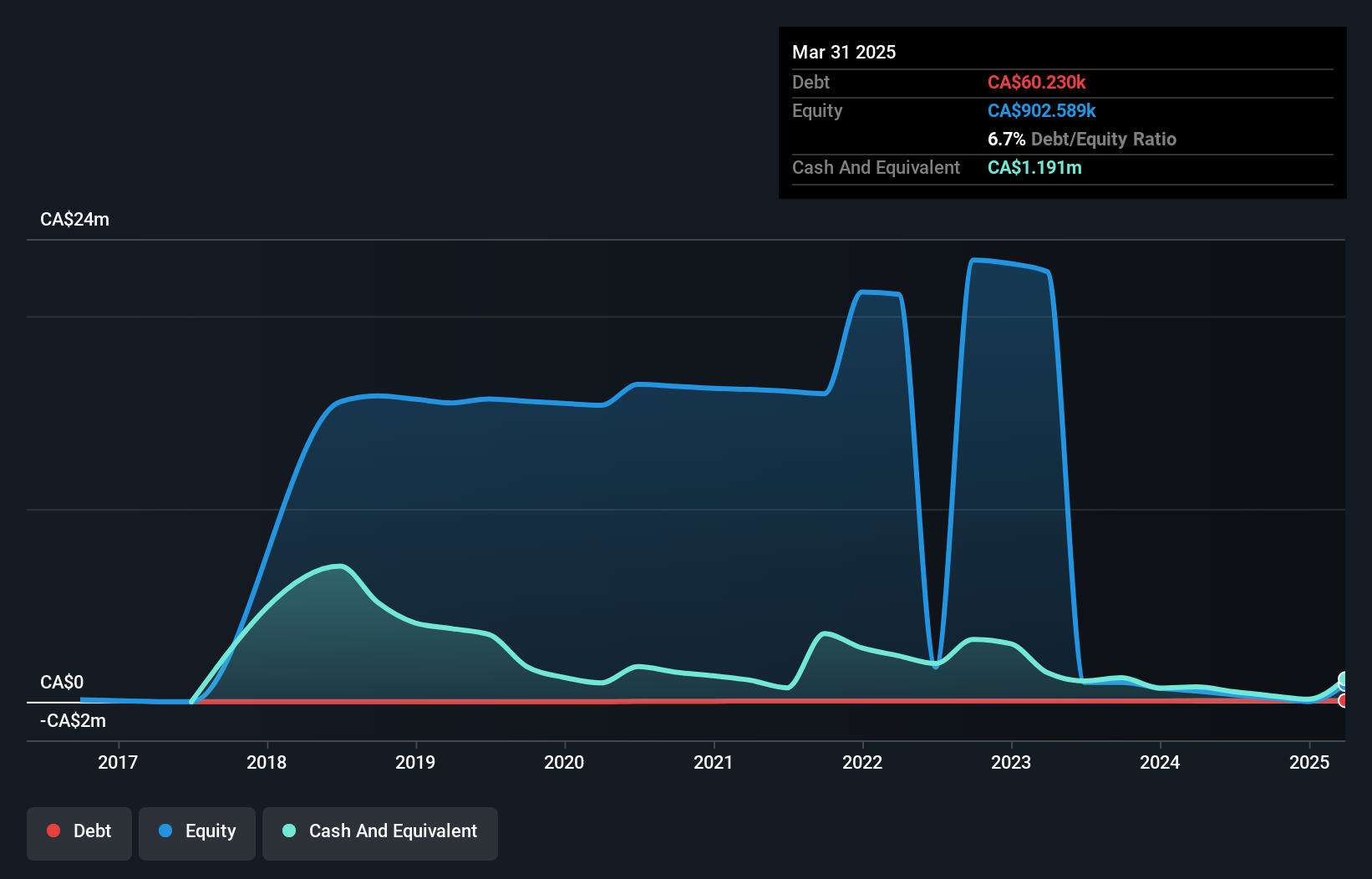

Solstice Gold Corp., with a market cap of CA$3.11 million, is a pre-revenue exploration company focused on mineral resources in Canada. The management team is relatively new, while the board has more experience. Recent surveys at their Strathy Gold Project identified 50 high-priority drill-ready targets, suggesting potential for significant discoveries. Despite the promising exploration results and strategic land positioning around the Leckie Gold Zone, Solstice faces challenges such as increased debt levels and short cash runway projections. Investors should weigh these factors alongside the company's unprofitable status and volatile share price when considering this penny stock opportunity.

- Jump into the full analysis health report here for a deeper understanding of Solstice Gold.

- Review our historical performance report to gain insights into Solstice Gold's track record.

Wi2Wi (TSXV:YTY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wi2Wi Corporation manufactures and sells wireless connectivity solutions, precision timing devices, frequency control products, and microwave filters in the United States and internationally, with a market cap of CA$9.91 million.

Operations: The company generates revenue of $6.43 million from its wireless communications equipment segment.

Market Cap: CA$9.91M

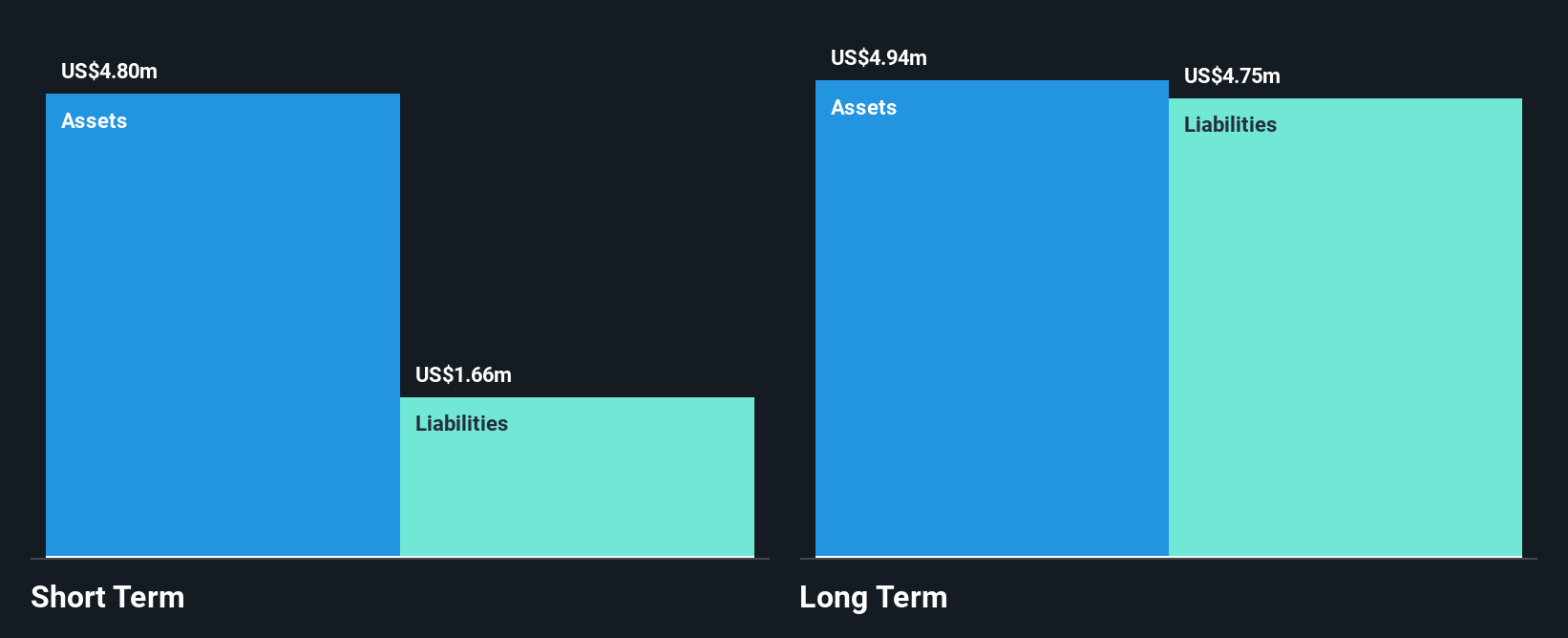

Wi2Wi Corporation, with a market cap of CA$9.91 million, operates in the wireless communications sector, generating US$6.43 million in revenue from its equipment segment. Despite recent earnings showing improved sales and reduced net losses compared to last year, the company remains unprofitable with a negative return on equity of -31.4%. The firm's short-term assets exceed its short-term liabilities but fall short against long-term obligations. Wi2Wi's board is experienced; however, the management team is relatively new. The company has conducted private placements to raise capital but faces challenges such as high share price volatility and limited cash runway.

- Click to explore a detailed breakdown of our findings in Wi2Wi's financial health report.

- Understand Wi2Wi's track record by examining our performance history report.

Taking Advantage

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 927 more companies for you to explore.Click here to unveil our expertly curated list of 930 TSX Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:SHRC

Sharc International Systems

Together with its subsidiary, provides wastewater energy transfer products and services for commercial, industrial, public utilities, and residential development projects in Canada and the United States.

Moderate risk with imperfect balance sheet.

Market Insights

Community Narratives