- Canada

- /

- Metals and Mining

- /

- TSXV:NWST

Bri-Chem And 2 Other TSX Penny Stocks Worth Watching

Reviewed by Simply Wall St

The Canadian stock market has been on a steady climb, with the TSX hitting new highs amid trade optimism and solid corporate earnings. This positive momentum creates an intriguing backdrop for exploring investment opportunities, particularly in penny stocks. While the term "penny stocks" might seem outdated, these smaller or newer companies can present unique growth opportunities when backed by strong financial health and fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Foraco International (TSX:FAR) | CA$1.60 | CA$160.77M | ✅ 4 ⚠️ 1 View Analysis > |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.73 | CA$492.32M | ✅ 3 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.58 | CA$99M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.91 | CA$194.9M | ✅ 2 ⚠️ 1 View Analysis > |

| Avino Silver & Gold Mines (TSX:ASM) | CA$4.44 | CA$638.9M | ✅ 3 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.91 | CA$168.32M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.89 | CA$186.17M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.40 | CA$7.19M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 451 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Bri-Chem (TSX:BRY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bri-Chem Corp., along with its subsidiaries, is involved in the wholesale distribution of oilfield chemicals for the oil and gas industry across North America, with a market cap of CA$7.93 million.

Operations: The company's revenue is derived from four segments: Fluids Distribution in the USA (CA$45.86 million), Fluids Distribution in Canada (CA$10.64 million), Fluids Blending & Packaging in the USA (CA$7.94 million), and Fluids Blending & Packaging in Canada (CA$19.01 million).

Market Cap: CA$7.93M

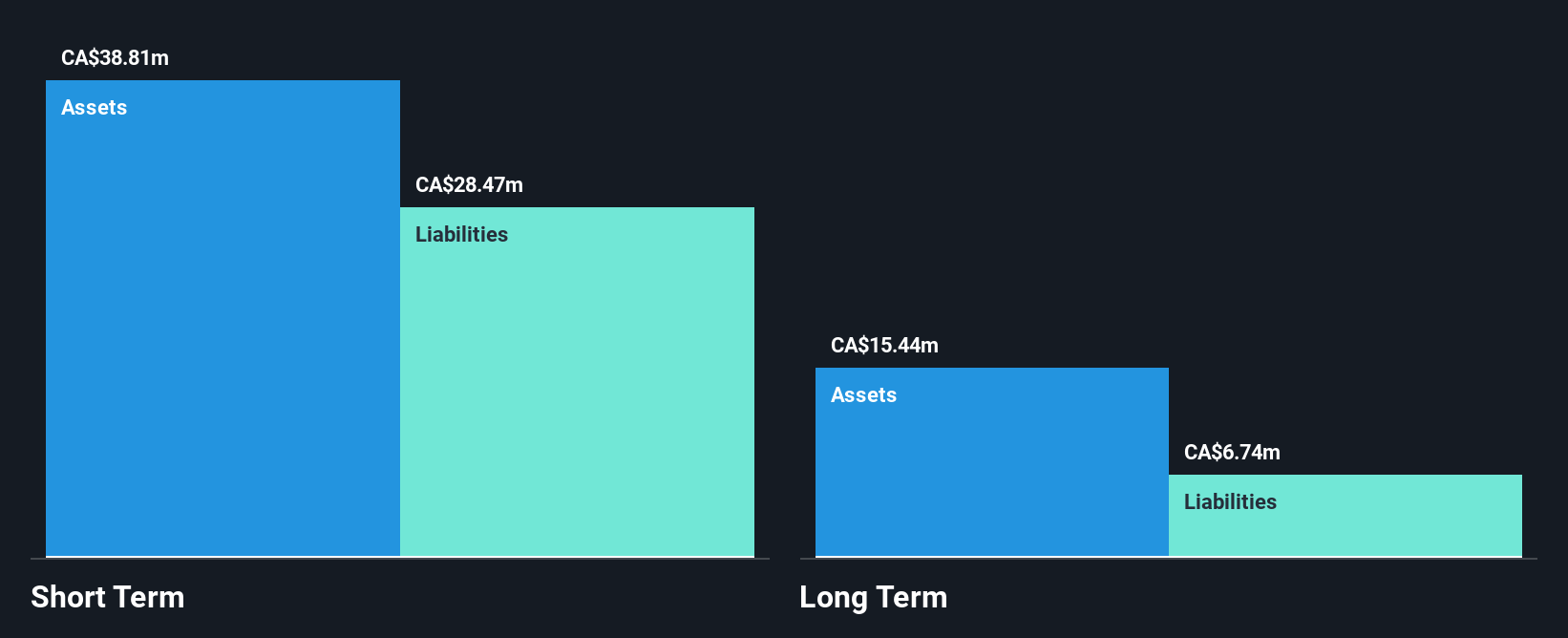

Bri-Chem Corp., with a market cap of CA$7.93 million, remains unprofitable but has shown progress by reducing its net loss from CA$1.51 million to CA$0.41 million year-over-year for Q1 2025. Despite high debt levels, the company maintains a strong cash position with short-term assets exceeding both its long and short-term liabilities, providing a cash runway of over three years even if free cash flow declines slightly. Trading significantly below estimated fair value, Bri-Chem's stock price is highly volatile, yet shareholders have not faced dilution recently and the board boasts substantial experience with an average tenure of 18.8 years.

- Get an in-depth perspective on Bri-Chem's performance by reading our balance sheet health report here.

- Examine Bri-Chem's past performance report to understand how it has performed in prior years.

Consolidated Lithium Metals (TSXV:CLM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Consolidated Lithium Metals Inc. is a junior mining exploration company focused on acquiring, exploring, producing, and developing mining properties in Canada with a market cap of CA$3.89 million.

Operations: Consolidated Lithium Metals Inc. does not currently report any revenue segments.

Market Cap: CA$3.89M

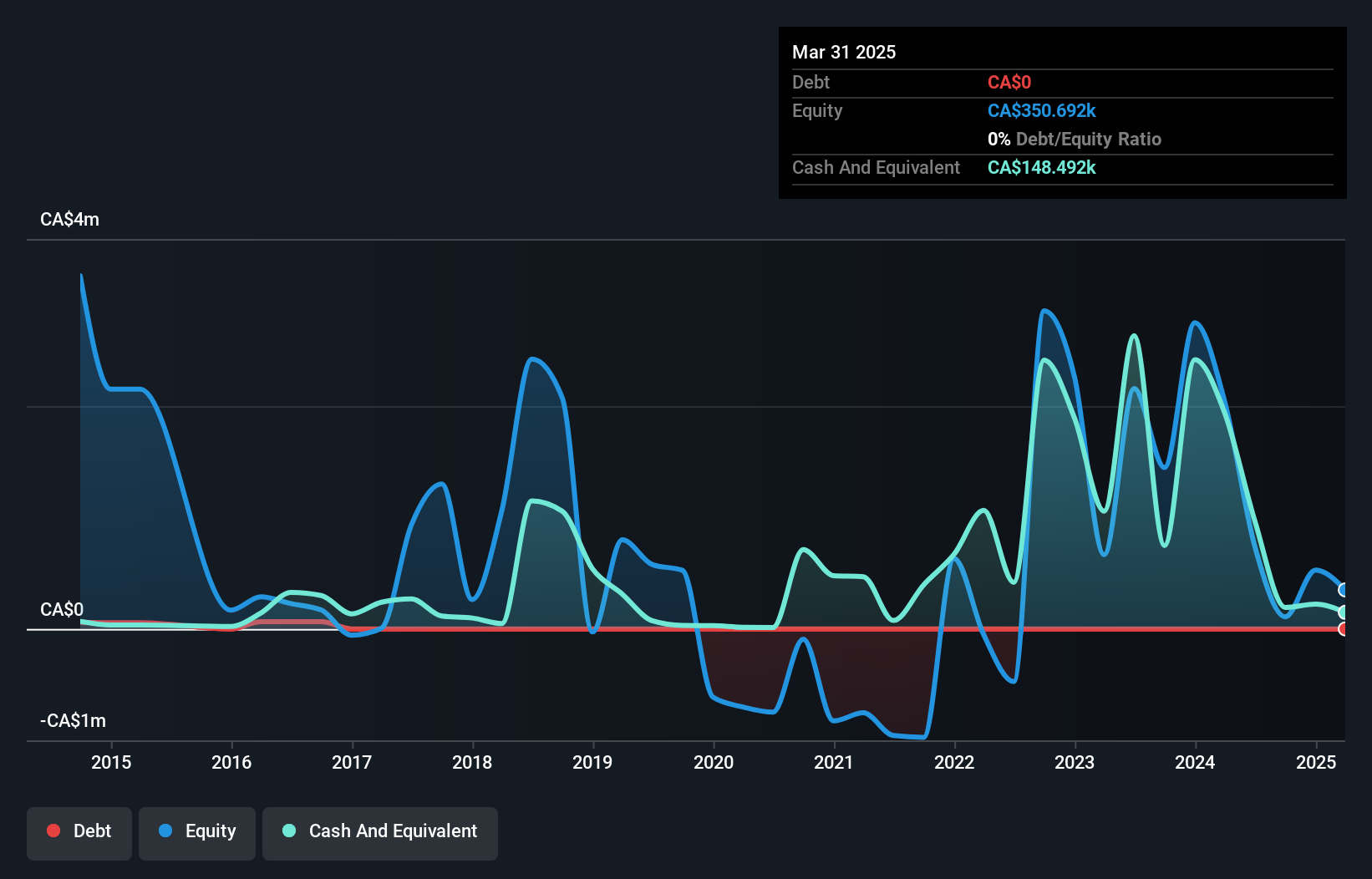

Consolidated Lithium Metals Inc., with a market cap of CA$3.89 million, is pre-revenue and currently unprofitable, having reported a net loss for Q1 2025. The company recently closed a private placement raising CA$300,000 to support its operations. Its exploration efforts at the Preissac Project have shown promising results with the exposure of an 18-meter-wide pegmatite body, indicating potential lithium deposits. Despite high volatility in its share price and limited cash runway previously projected at one month, the absence of debt and recent capital infusion provide some financial flexibility as it continues exploration activities.

- Click here and access our complete financial health analysis report to understand the dynamics of Consolidated Lithium Metals.

- Understand Consolidated Lithium Metals' track record by examining our performance history report.

NorthWest Copper (TSXV:NWST)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NorthWest Copper Corp. is involved in acquiring and exploring mineral properties in Canada, with a market cap of CA$46.62 million.

Operations: NorthWest Copper Corp. has not reported any revenue segments.

Market Cap: CA$46.62M

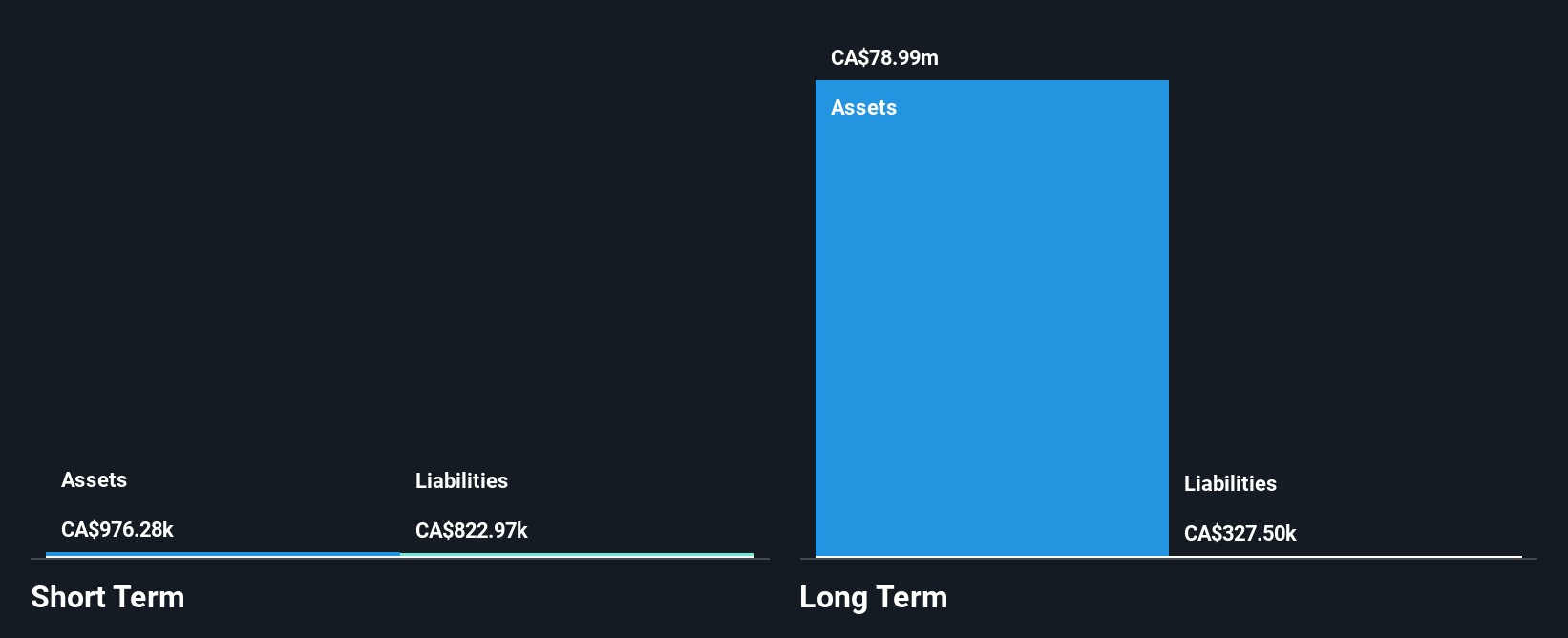

NorthWest Copper Corp., with a market cap of CA$46.62 million, is pre-revenue and unprofitable, having reported a net loss for Q1 2025. The company recently engaged in multiple private placements, raising approximately CA$3.55 million to bolster its financial position and support exploration activities. Despite being debt-free and having short-term assets exceeding liabilities, the management team is relatively inexperienced with an average tenure of 0.6 years. The recent capital infusion offers some runway for operations; however, the company's lack of revenue generation remains a significant challenge as it progresses in its mineral exploration endeavors.

- Click to explore a detailed breakdown of our findings in NorthWest Copper's financial health report.

- Evaluate NorthWest Copper's historical performance by accessing our past performance report.

Make It Happen

- Explore the 451 names from our TSX Penny Stocks screener here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthWest Copper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NWST

NorthWest Copper

Engages in the acquisition and exploration of mineral properties in Canada.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives