- Canada

- /

- Metals and Mining

- /

- TSXV:MMY

Exploring Canada's Undiscovered Gems This November 2025

Reviewed by Simply Wall St

As November 2025 unfolds, the Canadian market finds itself navigating a landscape shaped by AI-driven enthusiasm and recent equity market fluctuations. Amidst this backdrop, discovering promising small-cap stocks requires a keen eye for companies with strong fundamentals and growth potential that can withstand valuation adjustments and capitalize on innovation trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.62% | 30.86% | ★★★★★★ |

| Clairvest Group | NA | -8.94% | -11.82% | ★★★★★★ |

| Itafos | 20.68% | 9.86% | 37.00% | ★★★★★★ |

| Mako Mining | 5.45% | 22.24% | 62.70% | ★★★★★★ |

| Auxly Cannabis Group | 35.65% | 21.33% | 26.00% | ★★★★★☆ |

| Corby Spirit and Wine | 58.35% | 10.79% | -4.77% | ★★★★☆☆ |

| Melcor Developments | 47.67% | 8.75% | 12.05% | ★★★★☆☆ |

| Soma Gold | 142.85% | 31.11% | 38.09% | ★★★★☆☆ |

| Goldmoney | 48.02% | -46.91% | 0.88% | ★★★★☆☆ |

| Dundee | 1.89% | -35.40% | 52.34% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Guardian Capital Group (TSX:GCG.A)

Simply Wall St Value Rating: ★★★★☆☆

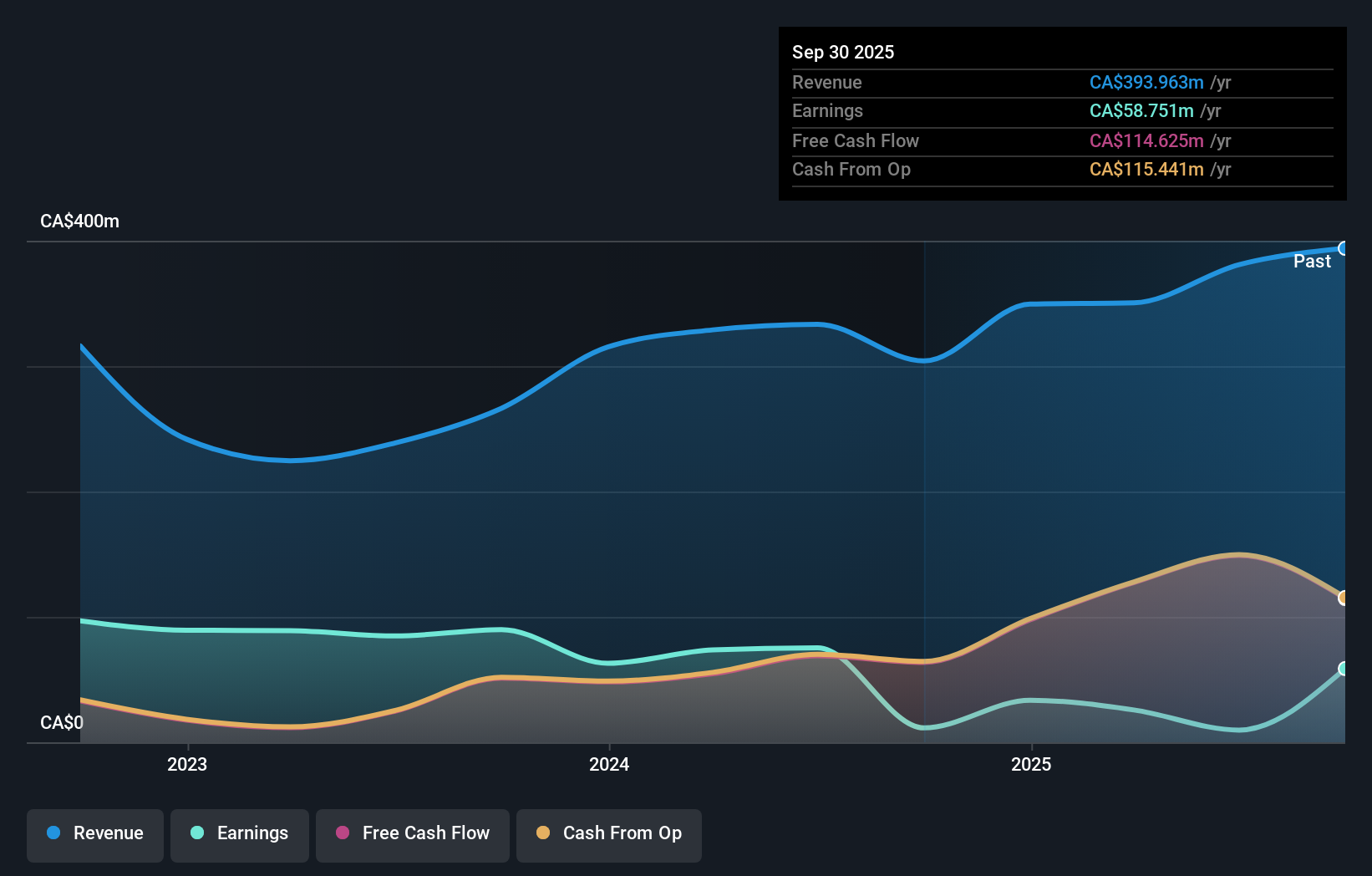

Overview: Guardian Capital Group Limited operates by providing investment services across Canada, the United States, the United Kingdom, and internationally with a market cap of approximately CA$1.55 billion.

Operations: Guardian Capital Group Limited generates revenue primarily through investment services, with CA$346.21 million attributed to segment adjustments and CA$37.72 million from corporate activities and investments.

Guardian Capital, a notable player in Canada's financial sector, has seen its debt to equity ratio rise from 9.9% to 11.2% over five years, yet it holds more cash than total debt, indicating robust financial health. Its earnings growth of 141.5% in the past year outpaced the industry average significantly and was influenced by a one-off gain of CA$148 million. Despite share price volatility recently, Guardian's price-to-earnings ratio at 10.3x suggests good value compared to the broader Canadian market's 16.4x, making it an intriguing prospect amidst ongoing acquisition talks with Desjardins Global Asset Management Inc., valued at CAD 1.7 billion.

- Click here and access our complete health analysis report to understand the dynamics of Guardian Capital Group.

Understand Guardian Capital Group's track record by examining our Past report.

Melcor Developments (TSX:MRD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Melcor Developments Ltd. is a real estate development company operating in the United States and Canada, with a market cap of CA$445.33 million.

Operations: Melcor Developments generates revenue through real estate development activities in North America. The company's financial performance includes a focus on managing costs and optimizing profit margins.

Melcor Developments, a notable player in the real estate sector, has shown impressive earnings growth of 412.9% over the past year, significantly outpacing its industry peers. Trading at 84.2% below its estimated fair value indicates potential undervaluation. The company's net debt to equity ratio stands at a high 41.2%, but it has improved from 65.4% five years ago to 47.7%. Recent financial results highlight strong performance with third-quarter sales reaching CAD 72.54 million and net income of CAD 14.09 million, reversing last year's loss of CAD 34.98 million and affirming robust operational recovery efforts this year.

- Dive into the specifics of Melcor Developments here with our thorough health report.

Gain insights into Melcor Developments' past trends and performance with our Past report.

Monument Mining (TSXV:MMY)

Simply Wall St Value Rating: ★★★★★★

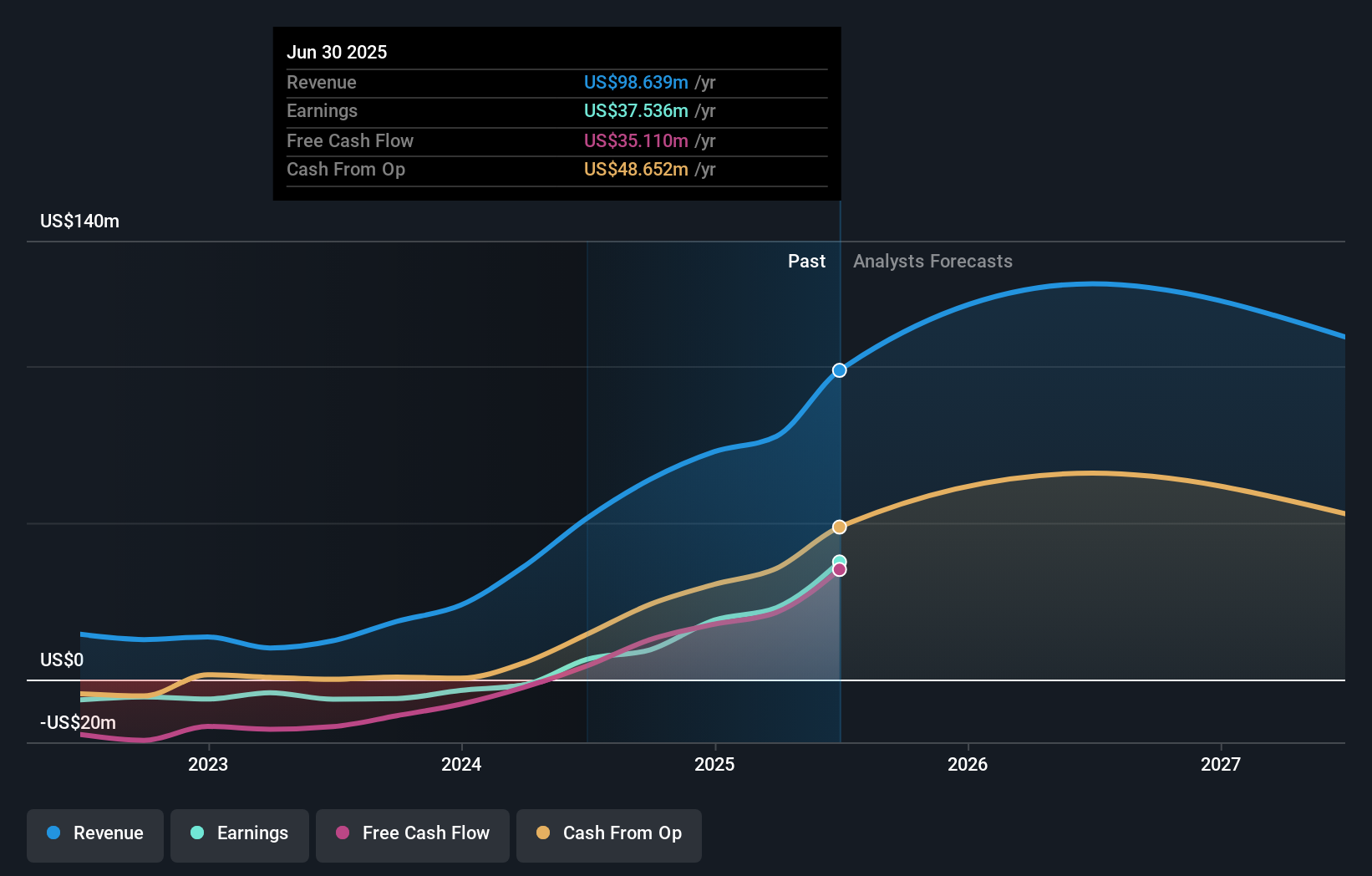

Overview: Monument Mining Limited is involved in the production, exploration, and development of precious metals across Canada, Australia, and Malaysia with a market capitalization of CA$351.67 million.

Operations: Monument Mining generates revenue primarily from its gold mine operations, totaling $98.64 million. The company's financial performance is influenced by the profitability of these mining activities, with a focus on managing costs to optimize net profit margins.

Monument Mining, a small player in the mining sector, has demonstrated significant growth and potential. Over the past year, earnings skyrocketed by 482.6%, far outpacing the industry average of 35.5%. This impressive performance is bolstered by their debt-free status, which simplifies financial management and reduces risk. Recent results show gold production increased to 38,530 oz from last year's 31,542 oz while sales jumped to US$98.64 million from US$51.42 million previously. Despite a volatile share price recently, Monument's high-quality earnings and value trading at nearly 96% below estimated fair value make it noteworthy for investors seeking growth opportunities in Canada’s mining landscape.

- Navigate through the intricacies of Monument Mining with our comprehensive health report here.

Examine Monument Mining's past performance report to understand how it has performed in the past.

Where To Now?

- Dive into all 45 of the TSX Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MMY

Monument Mining

Engages in the production, exploration, and development of precious metals in Canada, Australia, and Malaysia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives