- Canada

- /

- Metals and Mining

- /

- TSXV:BTU

Bri-Chem And 2 More Promising Penny Stocks On The TSX

Reviewed by Simply Wall St

As the Canadian economy navigates a period of cooling labor markets and potential interest rate cuts, investors are closely watching for opportunities that arise from these shifting conditions. Penny stocks, often overlooked due to their association with smaller or newer companies, still hold potential for significant returns when backed by solid financials. In this article, we explore three promising penny stocks on the TSX that combine balance sheet strength with growth potential, offering investors a chance to uncover hidden value in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.99 | CA$175.73M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$611.57M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$300.1M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$120.62M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.34 | CA$230.57M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.425 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.14 | CA$5.03M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.32 | CA$308.29M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.88 | CA$200.33M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.21 | CA$127.98M | ★★★★☆☆ |

Click here to see the full list of 966 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Bri-Chem (TSX:BRY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bri-Chem Corp., along with its subsidiaries, is involved in the wholesale distribution of oilfield chemicals for the oil and gas industry across North America, with a market cap of CA$6.34 million.

Operations: The company's revenue is derived from four segments: Fluids Distribution in the USA (CA$55.62 million), Fluids Distribution in Canada (CA$12.65 million), Fluids Blending & Packaging in the USA (CA$9.57 million), and Fluids Blending & Packaging in Canada (CA$21.13 million).

Market Cap: CA$6.34M

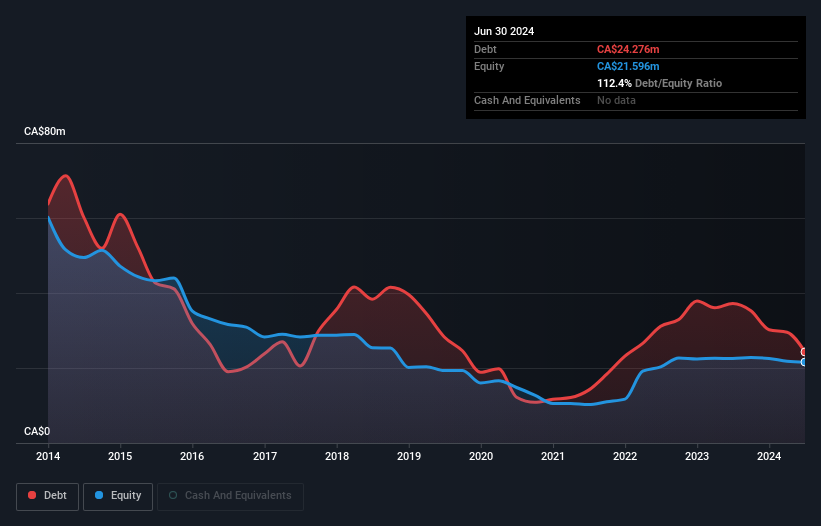

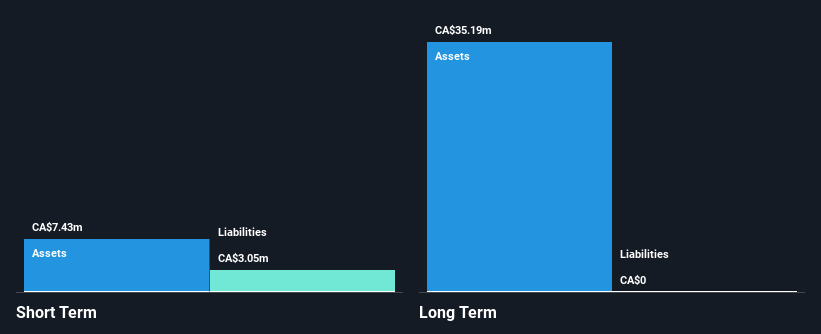

Bri-Chem Corp. faces challenges as a penny stock, with recent earnings showing a net loss of CA$1.99 million for the first half of 2024, compared to a profit last year. Despite being unprofitable, the company has reduced its debt-to-equity ratio from 146.3% to 112.4% over five years and maintains sufficient cash runway for more than three years due to positive free cash flow. The seasoned board adds stability, while short-term assets cover both short- and long-term liabilities comfortably. Recent renewal of credit facilities with CIBC provides financial flexibility through April 2026, supporting operational needs amidst volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Bri-Chem.

- Assess Bri-Chem's previous results with our detailed historical performance reports.

BTU Metals (TSXV:BTU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BTU Metals Corp. is involved in the identification, exploration, and evaluation of mineral properties in Canada and Ireland, with a market cap of CA$4.44 million.

Operations: The company does not report any revenue segments.

Market Cap: CA$4.44M

BTU Metals Corp., with a market cap of CA$4.44 million, is pre-revenue and unprofitable, reporting a net loss of CA$0.261584 million for Q1 2024. Despite this, it remains debt-free and its short-term assets significantly exceed liabilities, reflecting strong liquidity management. The company has experienced shareholder dilution over the past year but maintains an experienced board and management team with average tenures exceeding six years. Although its share price is highly volatile compared to most Canadian stocks, BTU has a cash runway sufficient for more than a year based on current free cash flow trends.

- Click to explore a detailed breakdown of our findings in BTU Metals' financial health report.

- Learn about BTU Metals' historical performance here.

Midland Exploration (TSXV:MD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Midland Exploration Inc. is a mineral exploration company focused on acquiring, exploring, and evaluating mineral properties in Canada, with a market cap of CA$28.67 million.

Operations: The company's revenue segment is derived from the acquisition, exploration, and evaluation of exploration properties, totaling CA$0.30 million.

Market Cap: CA$28.67M

Midland Exploration Inc., with a market cap of CA$28.67 million, is pre-revenue and focuses on mineral exploration in Canada. Recent announcements highlight promising findings at multiple projects, including significant copper anomalies at the Saruman project and high-grade lithium results from the Galinée project in partnership with Rio Tinto Exploration Canada Inc. Despite being unprofitable, Midland remains debt-free with short-term assets exceeding liabilities, indicating sound financial management. The board and management team are experienced, though shareholders faced dilution over the past year. Midland's cash runway is sufficient for over a year based on current free cash flow trends.

- Navigate through the intricacies of Midland Exploration with our comprehensive balance sheet health report here.

- Understand Midland Exploration's track record by examining our performance history report.

Seize The Opportunity

- Jump into our full catalog of 966 TSX Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BTU Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BTU

BTU Metals

Engages in the identification, exploration, and evaluation of mineral properties in Canada and Ireland.

Flawless balance sheet moderate.