- Canada

- /

- Metals and Mining

- /

- TSXV:KTN

How Investors Are Reacting To Kootenay Silver (TSXV:KTN) Advancing Columba Exploration With Major Drill Program

Reviewed by Simply Wall St

- Kootenay Silver Inc. recently announced the advancement of exploration at its 100%-owned Columba Silver Project in Chihuahua, Mexico, with two drill rigs completing five drillholes on the D and I-Vein targets and results anticipated soon.

- This drilling marks the first phase of a major 50,000-meter program aimed at expanding the project's newly reported mineral resource estimate, which includes significant silver, lead, and zinc resources.

- We will explore how the active expansion drilling at Columba could shape Kootenay Silver's overall investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Kootenay Silver's Investment Narrative?

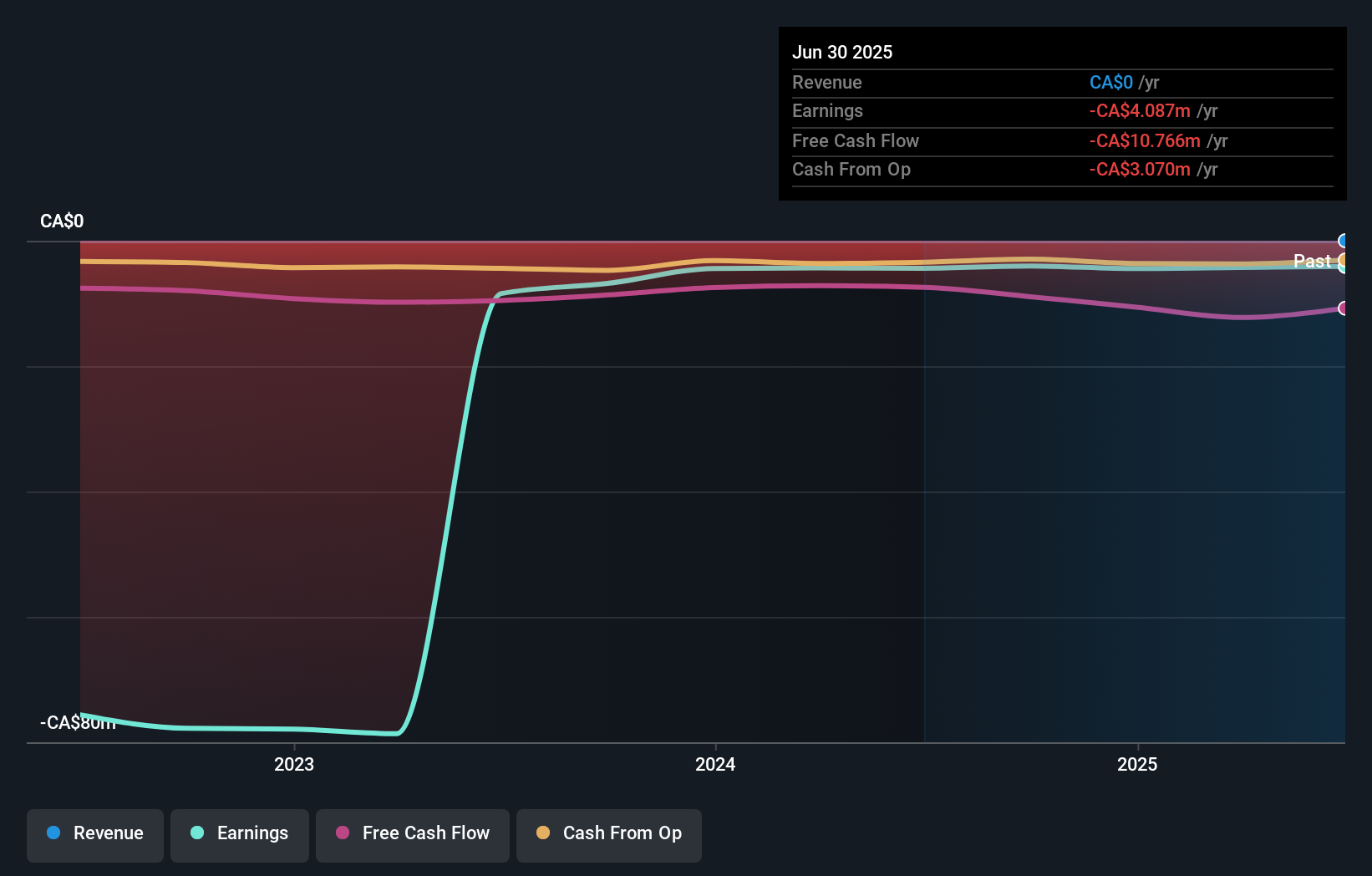

Kootenay Silver’s progress at the Columba Silver Project highlights what shareholders need to believe in: the long-term upside of resource expansion in a company that remains unprofitable without current revenue. The latest news of advancing a major 50,000-meter drill program adds momentum to near-term catalysts, especially with assay results expected soon from key vein targets. This could shift sentiment, as the project’s maiden mineral resource underscores untapped potential. However, persistent losses, recent auditor concerns about financial stability, and heavy shareholder dilution spotlight the biggest risks. While strong price moves suggest optimism, the sustainability of this momentum will hinge on both exploration success and Kootenay’s ability to secure financial footing without excessive dilution. For now, the latest drilling news injects hope but doesn’t remove the fundamental challenges.

But against the excitement surrounding new drilling, financial risks remain front and center for investors. The analysis detailed in our Kootenay Silver valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore another fair value estimate on Kootenay Silver - why the stock might be worth as much as 49% more than the current price!

Build Your Own Kootenay Silver Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kootenay Silver research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Kootenay Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kootenay Silver's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kootenay Silver might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:KTN

Kootenay Silver

An exploration stage company, engages in the acquisition, exploration, and development of mineral properties in Mexico and Canada.

Flawless balance sheet with low risk.

Market Insights

Community Narratives