- Canada

- /

- Metals and Mining

- /

- TSXV:HSTR

Will Heliostar Metals' (TSXV:HSTR) Fast-Track Strategy Shift Its Long-Term Value Potential?

Reviewed by Sasha Jovanovic

- Heliostar Metals recently announced plans to present the highlights of its Preliminary Economic Assessment (PEA), share the path toward a Feasibility Study, and outline an accelerated development plan for its projects.

- This update signals the company's intent to fast-track project development, potentially reshaping its operational outlook and future milestones for stakeholders.

- We'll explore how the upcoming PEA and accelerated development plan presentation could influence Heliostar Metals' investment narrative.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

What Is Heliostar Metals' Investment Narrative?

To be a shareholder in Heliostar Metals at this point, you’d need to see real potential in its rapid shift toward advanced project development, supported by strong recent financials and improved operations. The company has just announced it will share the Preliminary Economic Assessment (PEA) highlights and outline its accelerated development plan, news that may become a short-term catalyst if it leads to clearer paths toward feasibility and production expansion. That said, the significant changes at the board level, with both the Chairman and a director stepping down, present a risk of near-term disruption or shifting priorities as new leadership settles in. While Heliostar’s financial recovery and revenue growth in the last year have been impressive, accelerating project timelines does introduce execution risk, particularly with a relatively new management team. Investors will want to weigh these shifting catalysts and risks carefully as the story evolves.

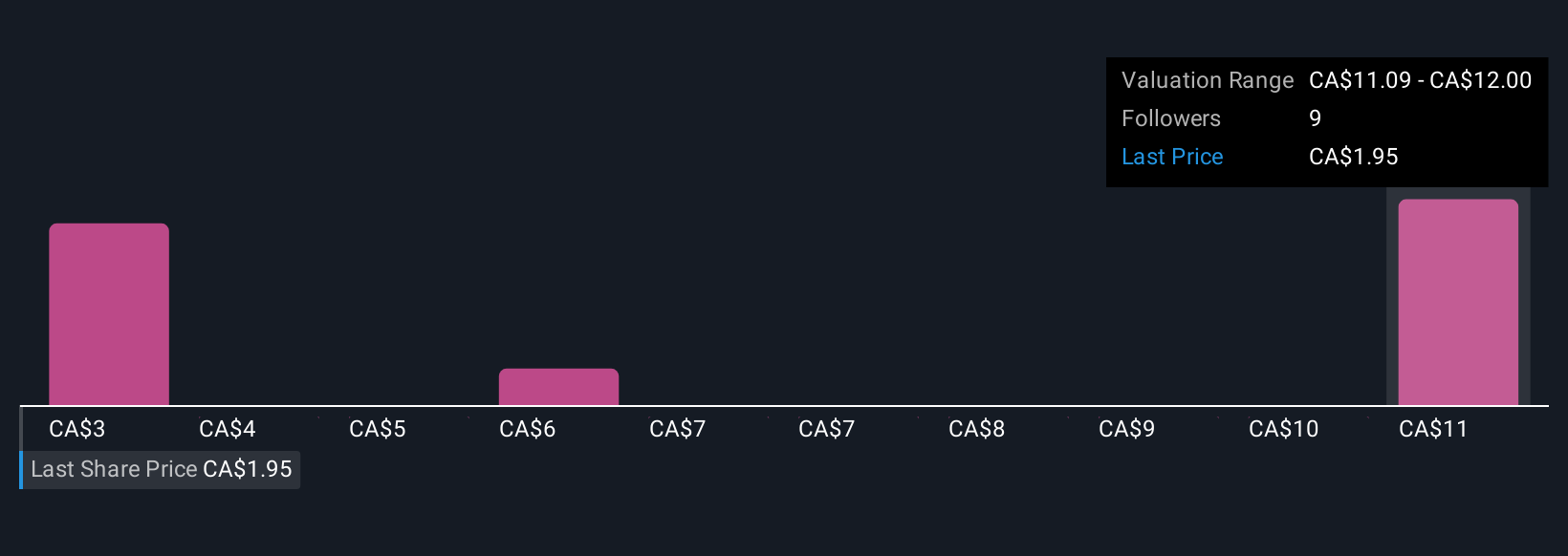

But emerging leadership changes could affect near-term stability, investors should watch this closely. Our valuation report here indicates Heliostar Metals may be undervalued.Exploring Other Perspectives

Explore 4 other fair value estimates on Heliostar Metals - why the stock might be worth just CA$3.11!

Build Your Own Heliostar Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Heliostar Metals research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Heliostar Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Heliostar Metals' overall financial health at a glance.

No Opportunity In Heliostar Metals?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heliostar Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HSTR

Heliostar Metals

Engages in the identification, acquisition, evaluation, and exploration of mineral properties in North America.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives