- Canada

- /

- Metals and Mining

- /

- TSXV:GMA

Geomega Resources And 2 Other Promising Penny Stocks On The TSX

Reviewed by Simply Wall St

As the Canadian economy navigates a period of cooling labor markets and potential rate cuts by the Bank of Canada, investors are keenly observing how these macroeconomic shifts might influence financial markets. In this context, penny stocks—often representing smaller or newer companies—offer intriguing opportunities for growth at accessible price points. Despite their vintage label, these stocks can present substantial value when backed by robust financial health and sound business fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.80 | CA$175.73M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$593.32M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.81 | CA$283.52M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$117.08M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.33 | CA$212.76M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.03M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.28 | CA$313.02M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.96 | CA$205.89M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.09 | CA$127.98M | ★★★★☆☆ |

Click here to see the full list of 964 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Geomega Resources (TSXV:GMA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Geomega Resources Inc. focuses on the acquisition, evaluation, and exploration of mining properties in Canada, with a market cap of CA$10.04 million.

Operations: Geomega Resources Inc. does not report any specific revenue segments.

Market Cap: CA$10.04M

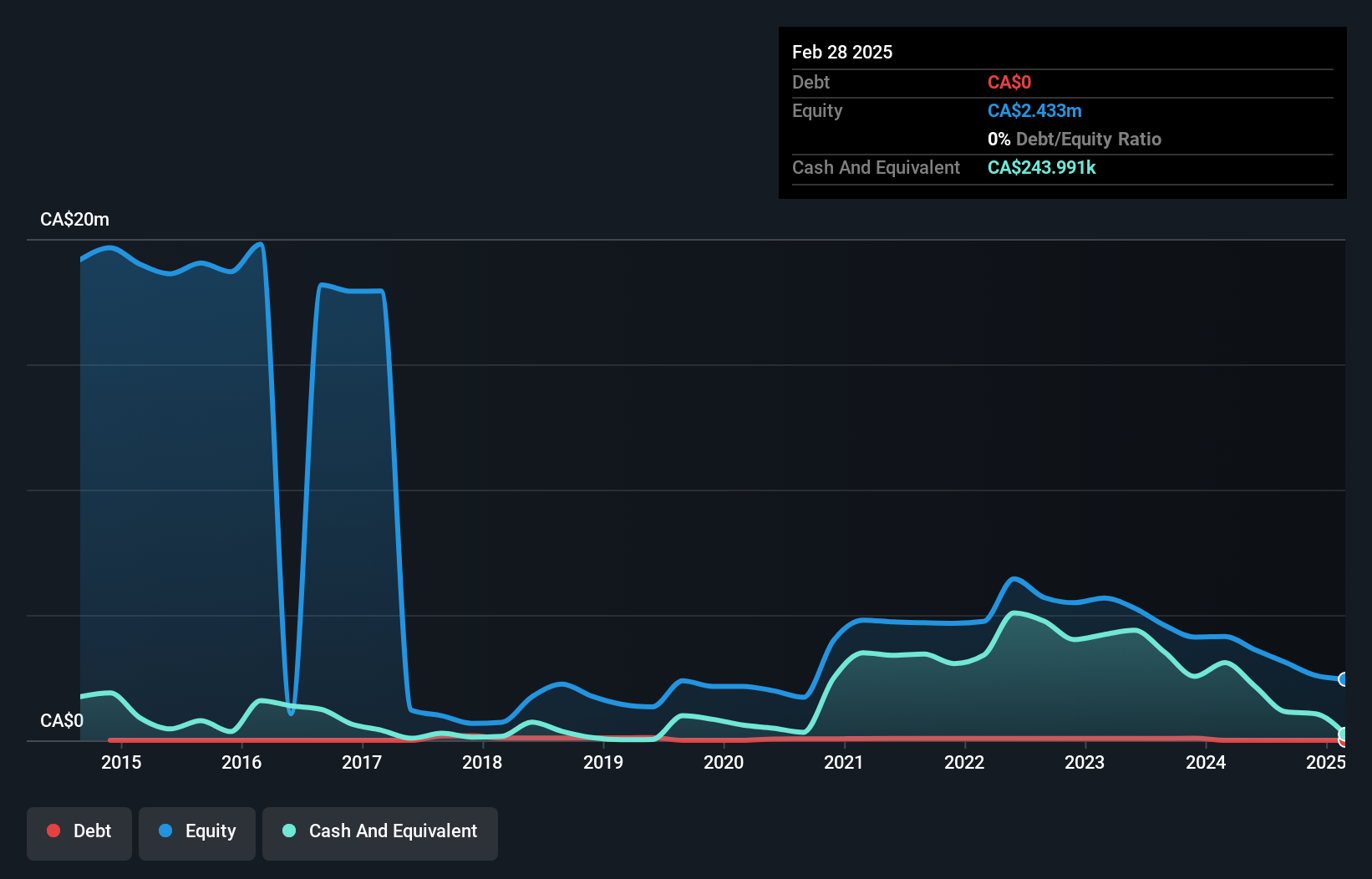

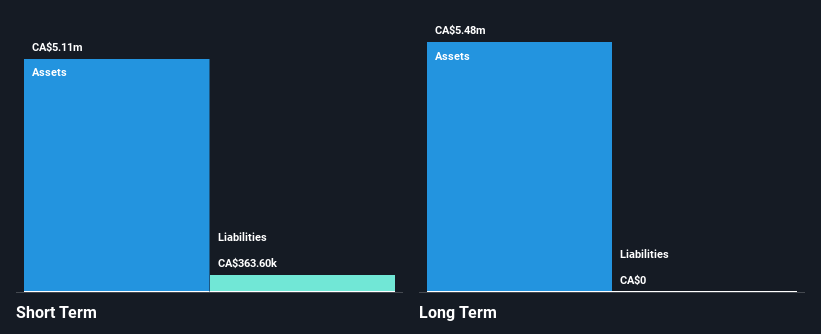

Geomega Resources Inc., with a market cap of CA$10.04 million, remains pre-revenue but is advancing its rare earth magnets recycling demonstration plant, a key project incorporating core technologies like reagent recycling and critical metal extraction. Despite having less than a year of cash runway and experiencing increased share price volatility, the company benefits from an experienced management team and board. Its short-term assets exceed both short- and long-term liabilities, indicating some financial stability. Recent updates highlight significant progress in engineering and procurement for the plant, although earnings continue to reflect net losses with CAD 2.02 million reported for the last fiscal year.

- Unlock comprehensive insights into our analysis of Geomega Resources stock in this financial health report.

- Gain insights into Geomega Resources' historical outcomes by reviewing our past performance report.

Noble Mineral Exploration (TSXV:NOB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Noble Mineral Exploration Inc. is a junior exploration company focused on the exploration and evaluation of mineral properties in Canada, with a market cap of CA$8.31 million.

Operations: Noble Mineral Exploration Inc. does not report any revenue segments as it is primarily engaged in the exploration and evaluation of mineral properties in Canada.

Market Cap: CA$8.31M

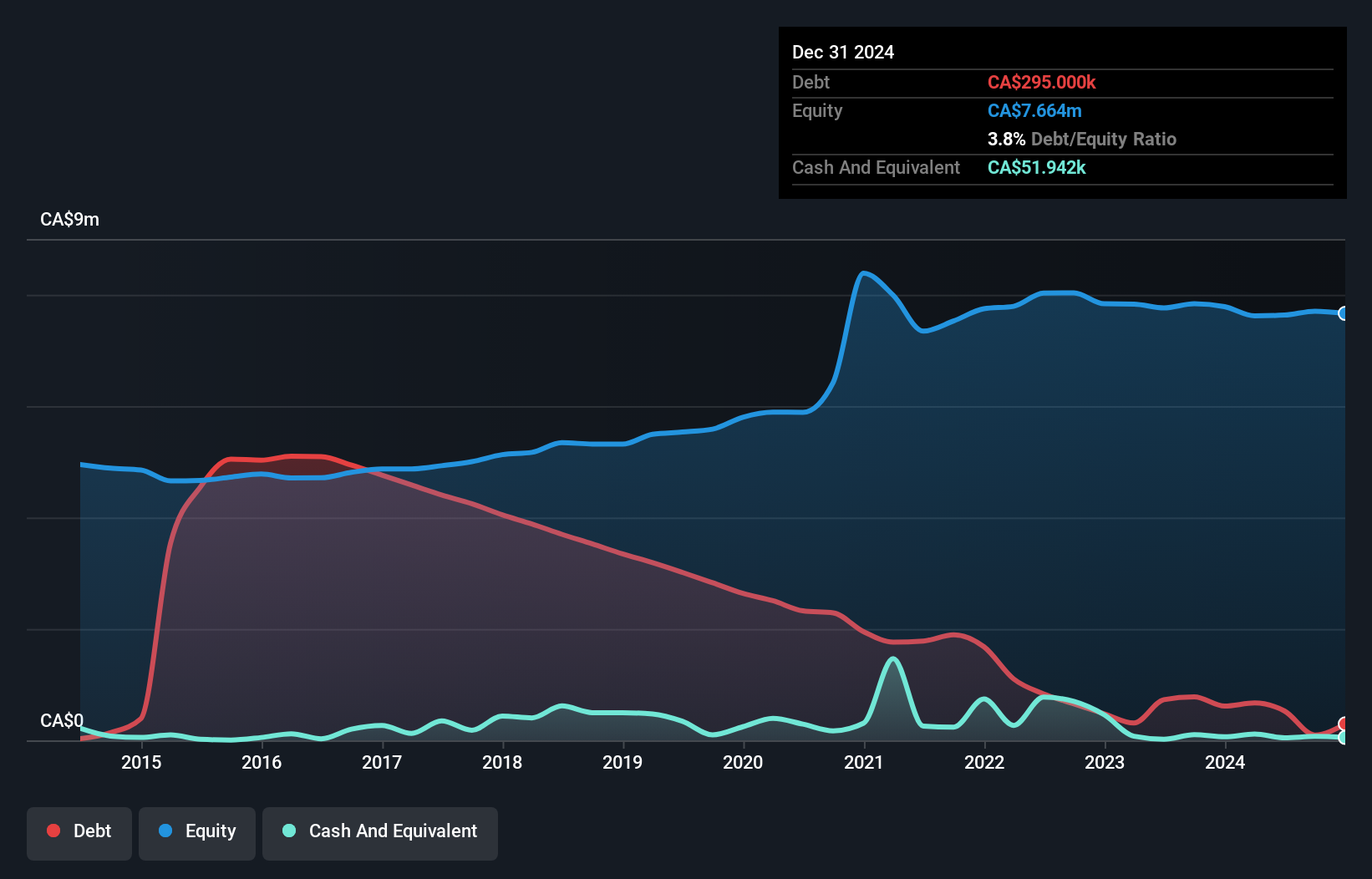

Noble Mineral Exploration Inc., with a market cap of CA$8.31 million, is pre-revenue and has recently become profitable. The company has no debt or long-term liabilities, providing some financial stability despite the high share price volatility and shareholder dilution over the past year. Recent developments include completing Phase 1 drilling at the Boulder Project in Ontario, partially funded by government support, which identified several promising anomalies for further exploration in 2025. Additionally, a joint venture with Canada Nickel on properties near Timmins shows potential for nickel mineralization, though assay results are pending for many drill holes.

- Click to explore a detailed breakdown of our findings in Noble Mineral Exploration's financial health report.

- Examine Noble Mineral Exploration's past performance report to understand how it has performed in prior years.

WestBond Enterprises (TSXV:WBE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: WestBond Enterprises Corporation, through its subsidiary WestBond Industries Inc., manufactures and sells disposable paper products for medical, hygienic, and industrial uses in Canada and the United States with a market cap of CA$6.95 million.

Operations: The company's revenue is derived entirely from its Disposable Paper Products segment, totaling CA$9.12 million.

Market Cap: CA$6.95M

WestBond Enterprises Corporation, with a market cap of CA$6.95 million, faces challenges typical of penny stocks, including high share price volatility and unprofitability. Recent earnings show a slight improvement in net income to CA$0.012566 million for the first quarter ending June 30, 2024, compared to a loss last year. Despite this, revenue decreased slightly to CA$2.27 million from CA$2.37 million year-on-year. The company has reduced its debt significantly over five years and maintains satisfactory short-term asset coverage over liabilities but continues to struggle with profitability and negative return on equity at -1.69%.

- Click here and access our complete financial health analysis report to understand the dynamics of WestBond Enterprises.

- Explore historical data to track WestBond Enterprises' performance over time in our past results report.

Turning Ideas Into Actions

- Explore the 964 names from our TSX Penny Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GMA

Geomega Resources

Engages in the acquisition, evaluation, and exploration of mining properties in Canada.

Moderate with adequate balance sheet.