- Canada

- /

- Metals and Mining

- /

- TSX:GOLD

3 TSX Penny Stocks With Market Caps Under CA$400M To Consider

Reviewed by Simply Wall St

As the Canadian market navigates recent volatility, driven by AI valuation concerns and employment shifts, investors are reminded of the importance of maintaining a balanced portfolio. Penny stocks, often representing smaller or newer companies, continue to capture interest as they offer potential growth opportunities at lower price points. By focusing on those with strong financials and clear growth trajectories, these stocks can provide both stability and upside in a diversified investment strategy.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.27 | CA$55.62M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.11 | CA$220.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.41 | CA$3.51M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.15 | CA$731.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.08 | CA$21.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.24 | CA$928.32M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.80 | CA$142.62M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.13 | CA$201.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.77 | CA$9.08M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 415 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

GoldMining (TSX:GOLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoldMining Inc. is a mineral exploration company focused on acquiring, exploring, and developing gold and copper assets in the Americas, with a market cap of CA$356.40 million.

Operations: GoldMining Inc. currently does not report any revenue segments as it is focused on the exploration and development of gold and copper assets in the Americas.

Market Cap: CA$356.4M

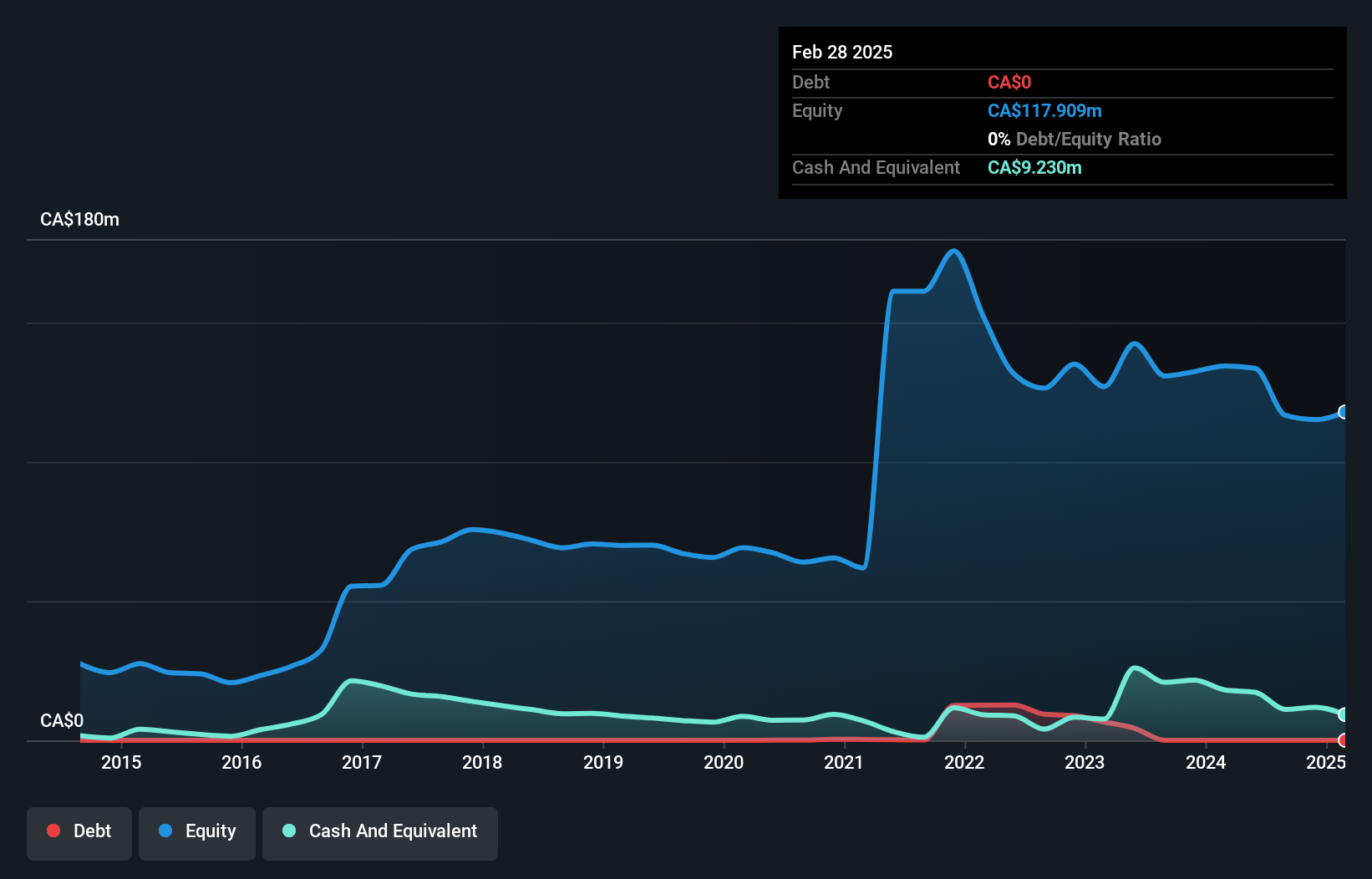

GoldMining Inc., with a market cap of CA$356.40 million, is a pre-revenue company focused on gold and copper exploration in the Americas. Recent drilling at its SJ Jorge Project in Brazil revealed promising new gold prospects, enhancing its exploration potential. The company recently announced a private placement to raise CA$1 million, which could aid ongoing projects despite having only four months of cash runway based on free cash flow estimates. While GoldMining has no debt and experienced management, it remains unprofitable with declining earnings over the past five years but continues to explore strategic mineral opportunities like antimony at its Crucero Project in Peru.

- Dive into the specifics of GoldMining here with our thorough balance sheet health report.

- Gain insights into GoldMining's outlook and expected performance with our report on the company's earnings estimates.

Golconda Gold (TSXV:GG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Golconda Gold Ltd. is engaged in the exploration, development, and operation of gold mining properties across Canada, the United States, and South Africa with a market capitalization of CA$127.88 million.

Operations: The company generates $22.95 million in revenue from its activities related to gold mining properties.

Market Cap: CA$127.88M

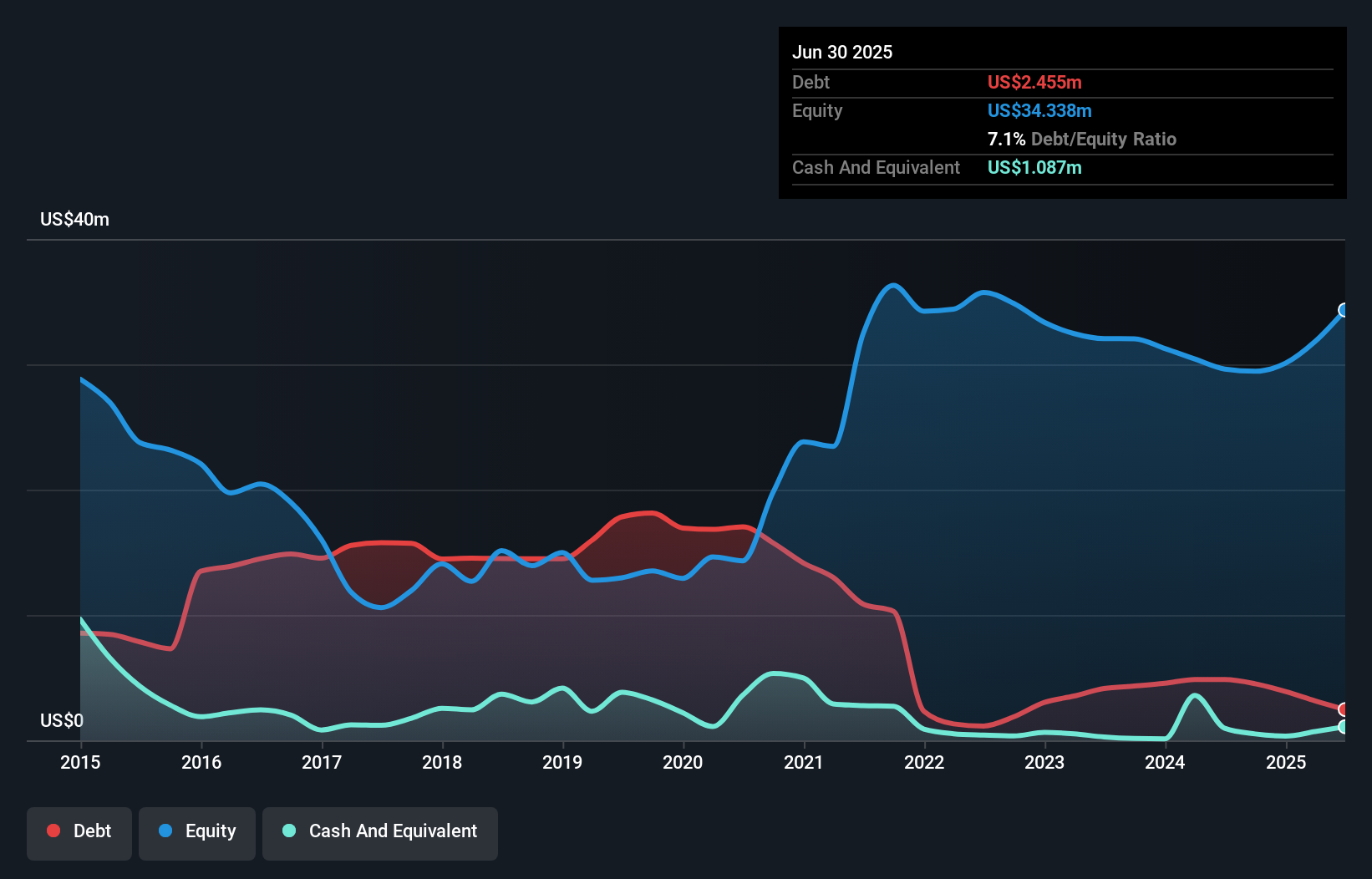

Golconda Gold Ltd. has demonstrated significant growth, with recent earnings results showing a net income of US$2.36 million for Q2 2025, reversing a loss from the previous year. The company's gold production increased to 3,588 ounces in Q3 2025 compared to last year's figures, reflecting operational improvements. Despite having high-quality past earnings and reduced debt levels over five years, Golconda faces challenges with short-term assets not covering liabilities and insider selling activity recently observed. The management team is seasoned, and the company benefits from satisfactory debt coverage by cash flow and interest payments well covered by EBIT.

- Jump into the full analysis health report here for a deeper understanding of Golconda Gold.

- Understand Golconda Gold's track record by examining our performance history report.

Majestic Gold (TSXV:MJS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Majestic Gold Corp. is a mining company engaged in the exploration, development, and operation of mining properties in China, with a market cap of CA$166.83 million.

Operations: The company generates $80.08 million in revenue from its activities related to the exploration, development, and operation of mining properties.

Market Cap: CA$166.83M

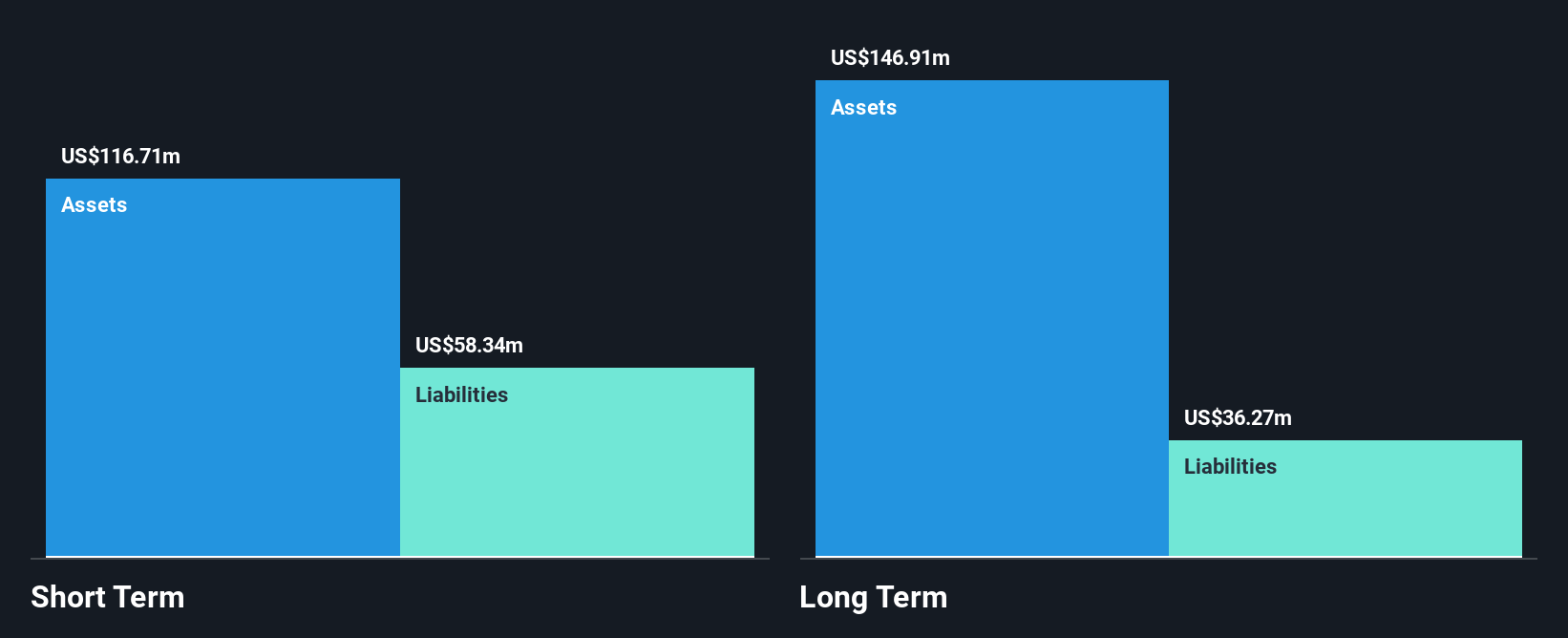

Majestic Gold Corp., with a market cap of CA$166.83 million, has shown resilience in its operations despite recent challenges. The company resumed production at the DGZ Mine after a temporary suspension due to safety investigations following an accident. While the Songjiagou Underground Mine awaits permit renewal, operations continue at the open-pit site. Majestic's financials reveal steady revenue growth but declining net income, with earnings for Q2 2025 showing US$23.26 million in sales and US$1.15 million net income compared to higher figures last year. The company's balance sheet is strong, with short-term assets exceeding liabilities and cash surpassing debt levels.

- Unlock comprehensive insights into our analysis of Majestic Gold stock in this financial health report.

- Evaluate Majestic Gold's historical performance by accessing our past performance report.

Key Takeaways

- Unlock our comprehensive list of 415 TSX Penny Stocks by clicking here.

- Looking For Alternative Opportunities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GOLD

GoldMining

A mineral exploration company, engages in the acquisition, exploration, and development of gold and copper assets in the Americas.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives