- Canada

- /

- Metals and Mining

- /

- TSXV:EMPR

Empress Royalty Corp.'s (CVE:EMPR) 27% Price Boost Is Out Of Tune With Revenues

Empress Royalty Corp. (CVE:EMPR) shareholders have had their patience rewarded with a 27% share price jump in the last month. The annual gain comes to 211% following the latest surge, making investors sit up and take notice.

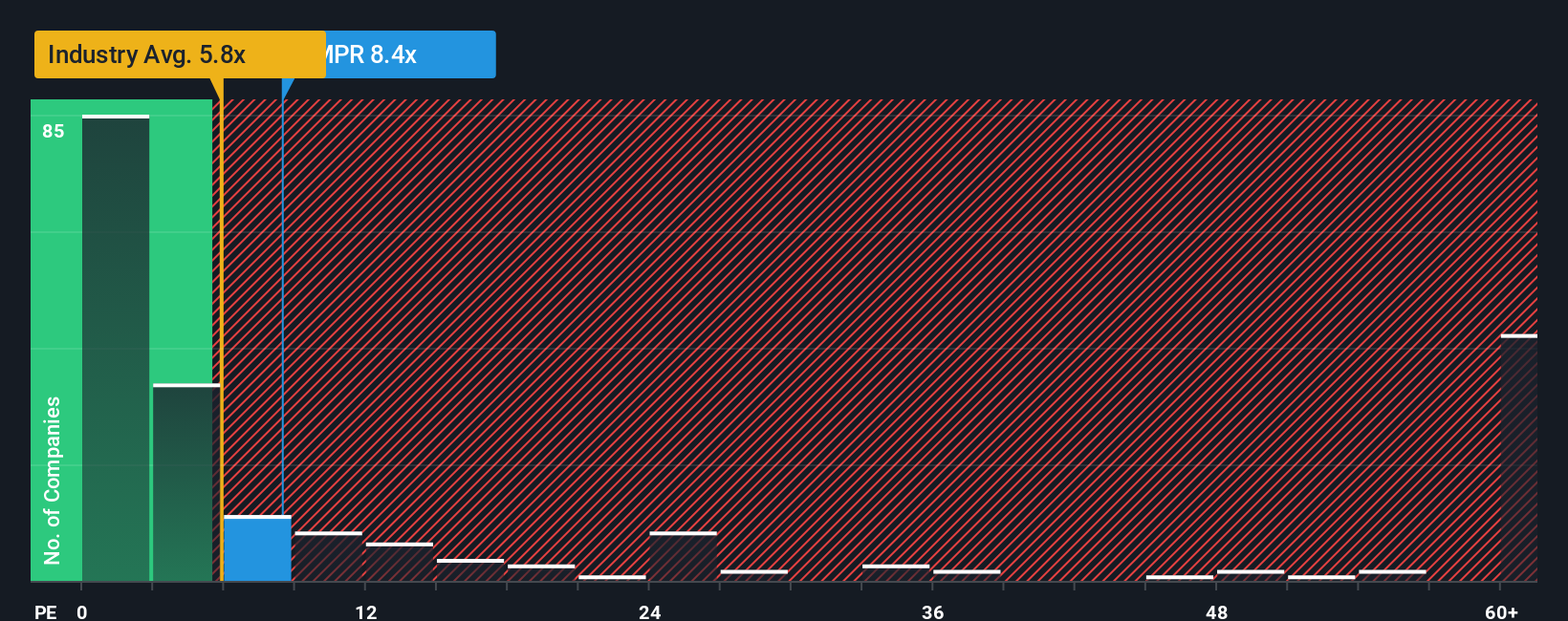

Since its price has surged higher, Empress Royalty may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 8.4x, since almost half of all companies in the Metals and Mining in Canada have P/S ratios under 5.8x and even P/S lower than 2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Empress Royalty

How Empress Royalty Has Been Performing

Empress Royalty certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Empress Royalty.Is There Enough Revenue Growth Forecasted For Empress Royalty?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Empress Royalty's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 216%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 32% over the next year. Meanwhile, the rest of the industry is forecast to expand by 53%, which is noticeably more attractive.

In light of this, it's alarming that Empress Royalty's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Empress Royalty's P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It comes as a surprise to see Empress Royalty trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Empress Royalty that you should be aware of.

If these risks are making you reconsider your opinion on Empress Royalty, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Empress Royalty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:EMPR

Empress Royalty

Engages in creating and investing in a portfolio of precious metal royalty and streaming interests in Canada.

Excellent balance sheet and fair value.

Market Insights

Community Narratives