- Canada

- /

- Metals and Mining

- /

- TSXV:ETL

TSX Penny Stocks Spotlight Benton Resources And Two More Hidden Opportunities

Reviewed by Simply Wall St

As the Canadian market navigates through a period of elevated inflation and potential volatility, investors are keeping a close eye on opportunities that may arise amidst these challenges. Though the term 'penny stock' might sound like a relic of past trading days, it still highlights smaller or less-established companies that can offer great value. By focusing on those with robust financials and clear growth trajectories, investors can find diamonds in the rough among penny stocks in Canada.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.18 | CA$55.89M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.80 | CA$22.99M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.315 | CA$2.67M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.28 | CA$42.06M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.07 | CA$738.48M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.02 | CA$18.83M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.32 | CA$371.43M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.55 | CA$187.79M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$186.53M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.66 | CA$8.21M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 407 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Benton Resources (TSXV:BEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Benton Resources Inc. is involved in the acquisition, exploration, and development of mineral properties with a market cap of CA$13.43 million.

Operations: Benton Resources Inc. does not report any specific revenue segments.

Market Cap: CA$13.43M

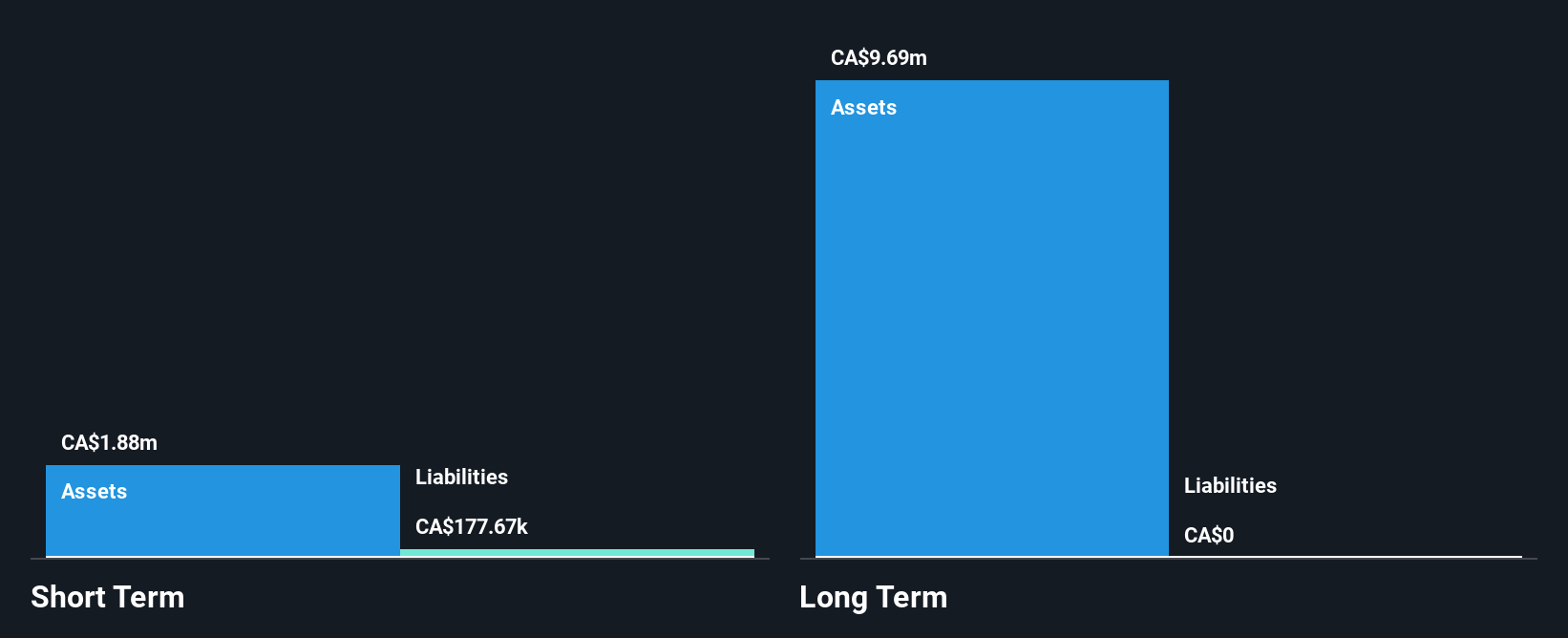

Benton Resources Inc., with a market cap of CA$13.43 million, is pre-revenue and focuses on mineral property development. Despite being unprofitable, the company is debt-free and has seasoned management and board members. Recent expansions include acquiring strategic land positions in Newfoundland with promising geological settings for copper, zinc, and gold exploration. Notable discoveries include high-grade copper intersections at the Great Burnt Project and significant gold values at various zones. However, Benton faces challenges with less than a year of cash runway if its free cash flow continues to decline at historical rates.

- Navigate through the intricacies of Benton Resources with our comprehensive balance sheet health report here.

- Learn about Benton Resources' historical performance here.

E3 Lithium (TSXV:ETL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: E3 Lithium Limited focuses on developing and extracting lithium resources in Alberta, with a market cap of CA$96.72 million.

Operations: Currently, the company does not have any reported revenue segments.

Market Cap: CA$96.72M

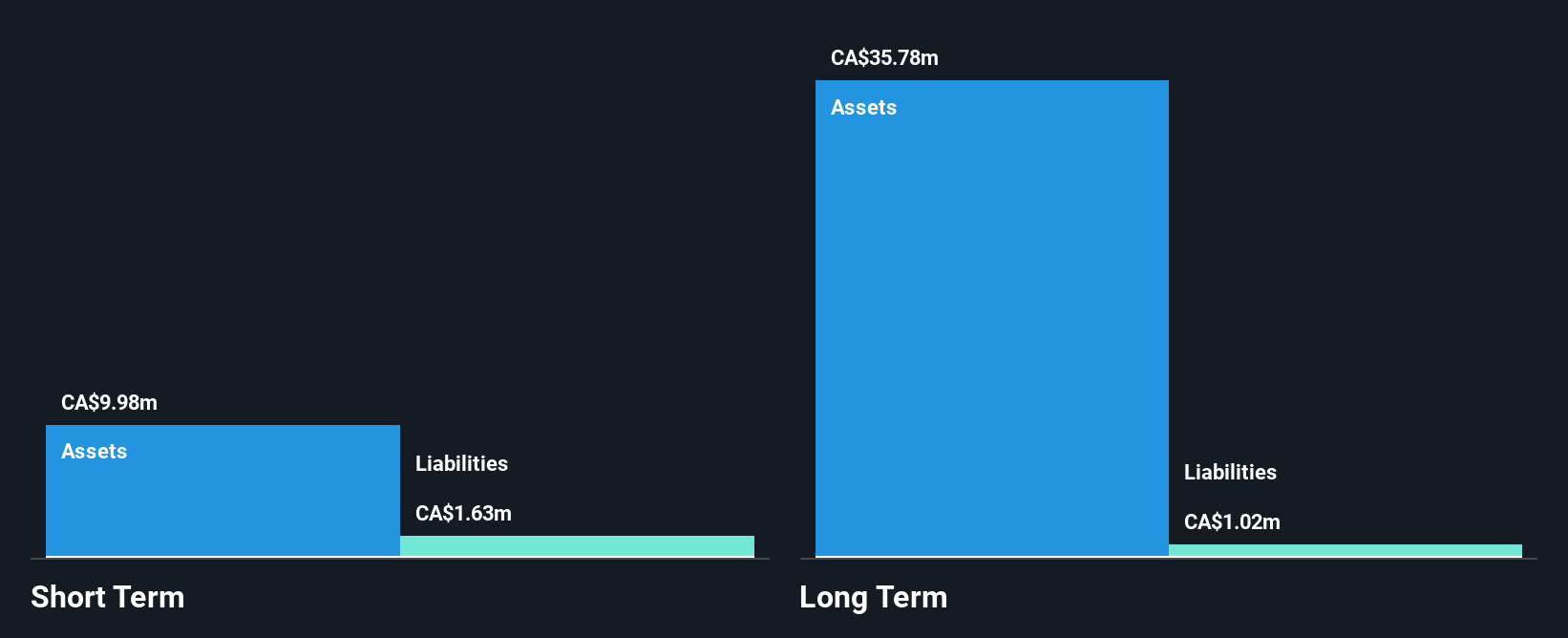

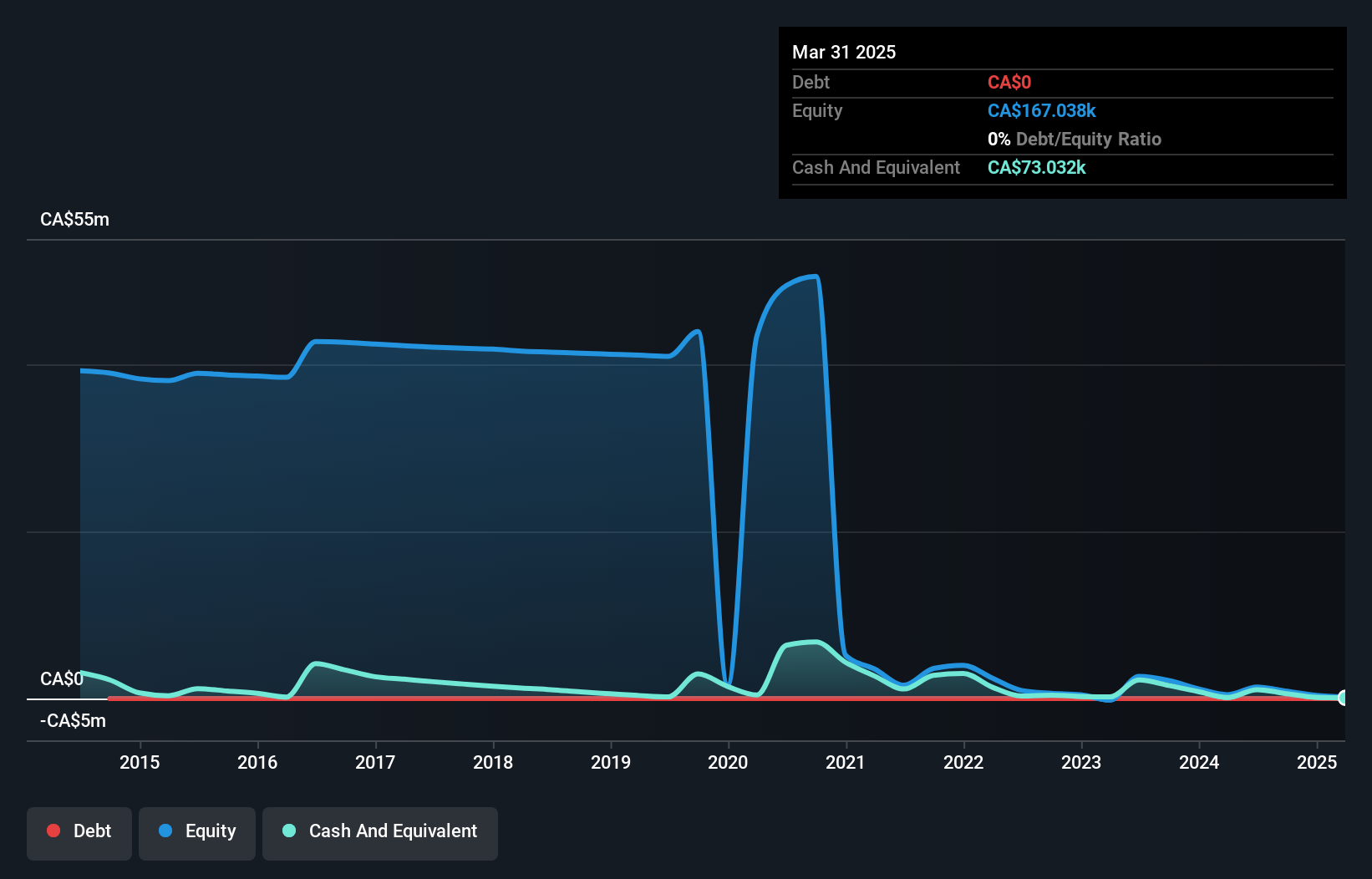

E3 Lithium, with a market cap of CA$96.72 million, is pre-revenue and unprofitable but debt-free, positioning it uniquely in the lithium extraction sector. The company's short-term assets of CA$10 million exceed both its short and long-term liabilities. Recent milestones include securing permits from the Alberta Energy Regulator to advance Phase 2 of its Clearwater Project Demonstration Facility, crucial for developing a fully integrated brine-to-battery-grade lithium carbonate process system. However, E3 faces challenges with less than a year of cash runway and no immediate profitability forecasted over the next three years despite ongoing project advancements.

- Dive into the specifics of E3 Lithium here with our thorough balance sheet health report.

- Assess E3 Lithium's future earnings estimates with our detailed growth reports.

Unigold (TSXV:UGD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Unigold Inc. is a junior natural resource company dedicated to exploring and developing gold projects in the Dominican Republic, with a market cap of CA$40.60 million.

Operations: Unigold Inc. has not reported any revenue segments.

Market Cap: CA$40.6M

Unigold Inc., with a market cap of CA$40.60 million, is pre-revenue and operates without debt, focusing on gold exploration in the Dominican Republic. The company has a seasoned management team and board, with no meaningful shareholder dilution over the past year. Despite being unprofitable, it has reduced losses by 18.6% annually over five years. Unigold's recent private placements have bolstered its cash position, extending its runway beyond previous estimates of 8 to 11 months based on free cash flow projections. However, high share price volatility remains a concern for investors seeking stability in penny stocks.

- Jump into the full analysis health report here for a deeper understanding of Unigold.

- Understand Unigold's track record by examining our performance history report.

Key Takeaways

- Navigate through the entire inventory of 407 TSX Penny Stocks here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E3 Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ETL

E3 Lithium

Engages in the development and extraction of lithium resources in Alberta.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives