- Canada

- /

- Paper and Forestry Products

- /

- TSX:WFG

Is West Fraser Timber (TSE:WFG) Using Debt In A Risky Way?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies West Fraser Timber Co. Ltd. (TSE:WFG) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for West Fraser Timber

What Is West Fraser Timber's Net Debt?

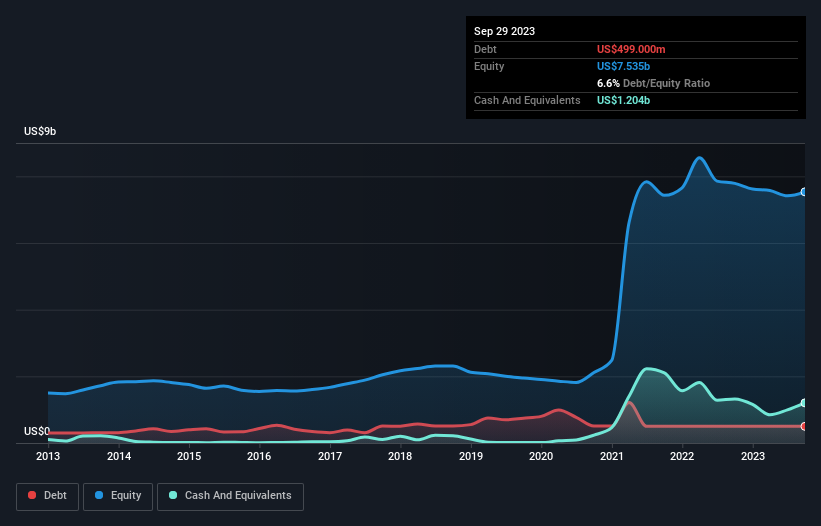

The chart below, which you can click on for greater detail, shows that West Fraser Timber had US$499.0m in debt in September 2023; about the same as the year before. But it also has US$1.20b in cash to offset that, meaning it has US$705.0m net cash.

A Look At West Fraser Timber's Liabilities

We can see from the most recent balance sheet that West Fraser Timber had liabilities of US$784.0m falling due within a year, and liabilities of US$1.47b due beyond that. Offsetting these obligations, it had cash of US$1.20b as well as receivables valued at US$499.0m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$546.0m.

Since publicly traded West Fraser Timber shares are worth a total of US$6.42b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, West Fraser Timber boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine West Fraser Timber's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, West Fraser Timber made a loss at the EBIT level, and saw its revenue drop to US$6.6b, which is a fall of 35%. That makes us nervous, to say the least.

So How Risky Is West Fraser Timber?

While West Fraser Timber lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow US$107m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. For riskier companies like West Fraser Timber I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if West Fraser Timber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WFG

West Fraser Timber

A diversified wood products company, engages in manufacturing, selling, marketing, and distributing lumber, engineered wood products, pulp, newsprint, wood chips, and other residuals and renewable energy.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives