Stock Analysis

- Canada

- /

- Paper and Forestry Products

- /

- TSX:WEF

Revenues Tell The Story For Western Forest Products Inc. (TSE:WEF)

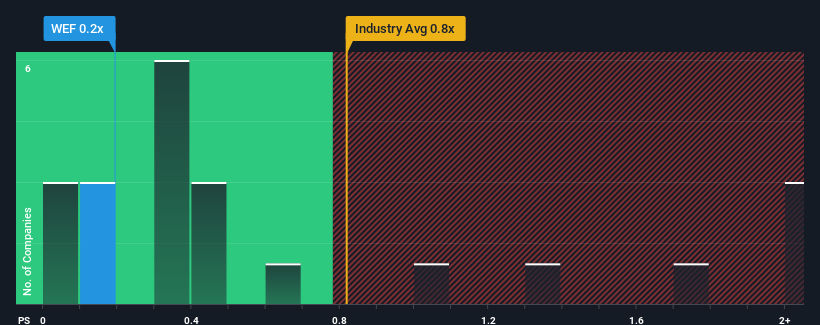

There wouldn't be many who think Western Forest Products Inc.'s (TSE:WEF) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Forestry industry in Canada is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Western Forest Products

How Western Forest Products Has Been Performing

With revenue that's retreating more than the industry's average of late, Western Forest Products has been very sluggish. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Western Forest Products.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Western Forest Products would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 5.5% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 0.2% as estimated by the four analysts watching the company. With the industry predicted to deliver 1.3% growth , the company is positioned for a comparable revenue result.

With this information, we can see why Western Forest Products is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Western Forest Products' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Forestry industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Western Forest Products with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Western Forest Products is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WEF

Western Forest Products

Western Forest Products Inc. operates as an integrated softwoods forest products company in Canada, the United States, Japan, China, Europe, and internationally.

Good value with mediocre balance sheet.