- Canada

- /

- Metals and Mining

- /

- TSX:USA

The Bull Case For Americas Gold and Silver (TSX:USA) Could Change Following Surge in Silver Output and Antimony Breakthrough

Reviewed by Sasha Jovanovic

- Americas Gold and Silver reported a nearly twofold year-over-year increase in silver production for Q3 2025, supported by operational improvements at the Galena Complex and higher grades at Cosalá.

- The company also achieved a breakthrough in antimony extraction, solidifying its position as the sole U.S. antimony producer after securing full ownership of the Galena Complex.

- We'll review how these operational improvements and U.S. antimony production could reshape Americas Gold and Silver's investment outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Americas Gold and Silver Investment Narrative Recap

For those considering Americas Gold and Silver, the key story centers on the potential for improved margins and growth from sharply higher silver output and progress in antimony extraction, balanced against the challenge of turning recent operational wins into sustained profitability. The latest surge in silver production at Galena and Cosalá is promising, yet the company's reliance on debt and history of net losses remains the biggest near-term risk. The impact of these results is positive for production growth but doesn't fundamentally alter the company's most significant risk profile for now.

Among recent announcements, the completion of phase 1 upgrades to the Galena No. 3 Shaft stands out. By boosting hoisting capacity and mine productivity, this enhancement underpins the short-term production catalyst highlighted by the Q3 results, reinforcing Americas Gold and Silver's ability to capture higher margins, so long as operational stability is maintained.

Yet, it’s important not to overlook the company’s exposure to potential equity dilution, as...

Read the full narrative on Americas Gold and Silver (it's free!)

Americas Gold and Silver's narrative projects $343.0 million revenue and $98.5 million earnings by 2028. This requires 52.6% yearly revenue growth and a $158.1 million increase in earnings from the current -$59.6 million.

Uncover how Americas Gold and Silver's forecasts yield a CA$8.04 fair value, a 46% upside to its current price.

Exploring Other Perspectives

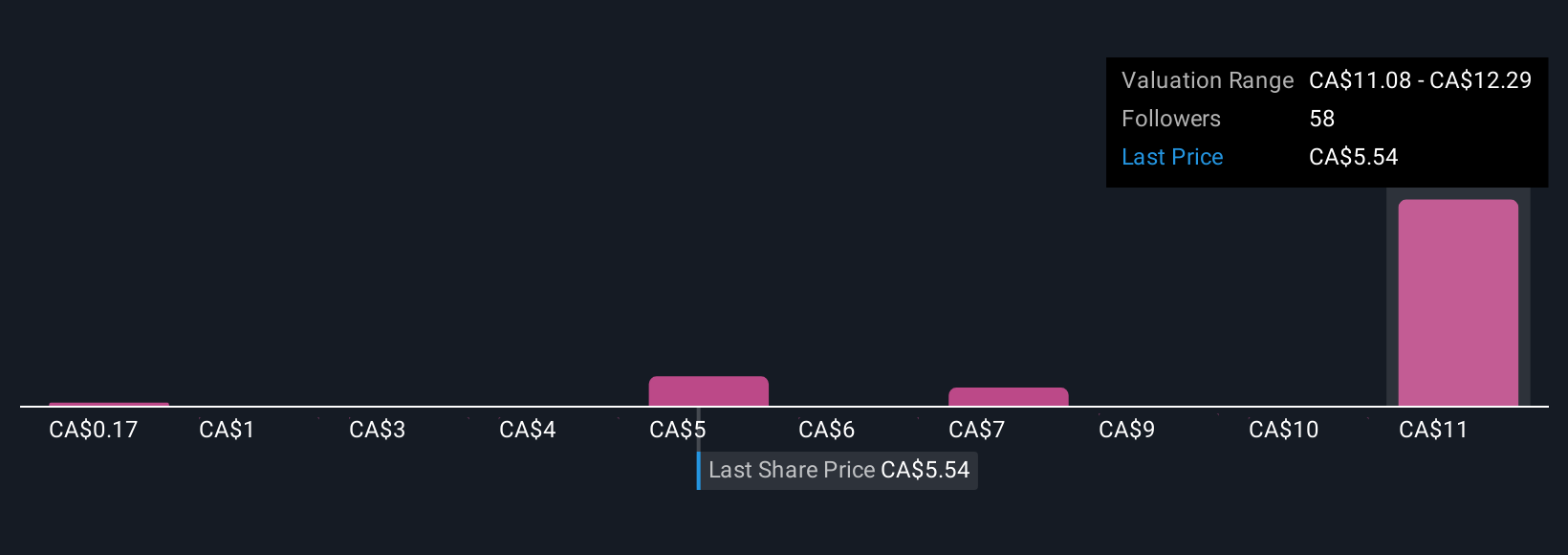

Community fair value opinions for Americas Gold and Silver span a wide range, from US$0.17 to US$12.29, based on 8 distinct Simply Wall St Community forecasts. While some see strong upside aligned with increased silver production and critical metals breakthroughs, ongoing debt reliance leaves open questions for future performance.

Explore 8 other fair value estimates on Americas Gold and Silver - why the stock might be worth over 2x more than the current price!

Build Your Own Americas Gold and Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Americas Gold and Silver research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Americas Gold and Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Americas Gold and Silver's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:USA

Americas Gold and Silver

Engages in the exploration, development, and production of mineral properties in the Americas.

Exceptional growth potential and good value.

Market Insights

Community Narratives