- Canada

- /

- Metals and Mining

- /

- TSX:TECK.B

Earnings Not Telling The Story For Teck Resources Limited (TSE:TECK.B)

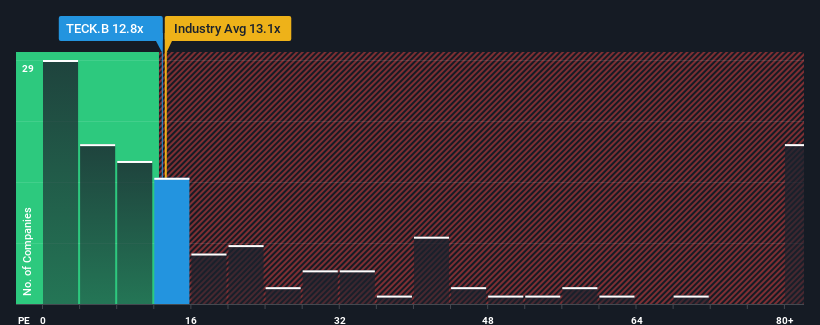

With a median price-to-earnings (or "P/E") ratio of close to 13x in Canada, you could be forgiven for feeling indifferent about Teck Resources Limited's (TSE:TECK.B) P/E ratio of 12.8x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Teck Resources has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Teck Resources

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Teck Resources' is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 59%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 4.5% per annum as estimated by the analysts watching the company. With the market predicted to deliver 9.1% growth per annum, that's a disappointing outcome.

With this information, we find it concerning that Teck Resources is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Teck Resources currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Teck Resources is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

Of course, you might also be able to find a better stock than Teck Resources. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Teck Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TECK.B

Teck Resources

Engages in exploring for, acquiring, developing, and producing natural resources in Asia, Europe, and North America.

Proven track record with adequate balance sheet.