- Canada

- /

- Metals and Mining

- /

- TSX:SXGC

Southern Cross Gold (TSX:SXGC): Dissecting Valuation After Recent Share Price Surge Without Major News

Reviewed by Simply Wall St

Southern Cross Gold Consolidated (TSX:SXGC) has caught investors’ eyes recently, with share price action that stands out even without a single headline event behind it. When a stock moves like this, it prompts a closer look. Are buyers seeing something the rest of the market is missing, or is this just a case of shifting sentiment that raises more questions than answers? Whether you’re a long-term shareholder or just tracking exploration plays, any unexplained price momentum is worth dissecting. Sometimes the lack of news is as telling as a big decision or discovery.

In the bigger picture, Southern Cross Gold Consolidated has seen a surge in momentum this year. The stock is up over 108% year-to-date, with a 37% climb in the past month and a gain of almost 14% this week alone. While there’s no specific company announcement driving this trend, such strong and consistent moves often hint at a change in market perception or expectations about what’s next. The broader mining sector has seen its share of volatility lately, setting the stage for stocks like SXGC to stand out when sentiment shifts.

That brings us to the real question: is Southern Cross Gold Consolidated undervalued with further upside, or are these recent gains simply the market pricing in future growth potential?

Price-to-Book of 7.2x: Is it justified?

Based on its price-to-book ratio, Southern Cross Gold Consolidated appears expensive compared to the broader Canadian Metals and Mining sector. The company trades at a 7.2x multiple, significantly higher than the industry average of 2.2x.

The price-to-book ratio compares a company’s current share price to its net asset value. In capital-intensive sectors like mining, this metric helps investors assess whether a stock is priced attractively relative to its underlying assets.

In SXGC’s case, the market is pricing in a premium well above the industry average. This suggests strong expectations for future growth or discovery, even though the company is currently unprofitable with minimal revenue. Whether that optimism is justified will depend on future developments and the company’s ability to deliver on exploration potential.

Result: Fair Value of $6.69 (OVERVALUED)

See our latest analysis for Southern Cross Gold Consolidated.However, limited revenue and ongoing net losses could quickly shift sentiment, particularly if anticipated exploration progress or positive news does not materialize soon.

Find out about the key risks to this Southern Cross Gold Consolidated narrative.Another View: What Does Our DCF Model Say?

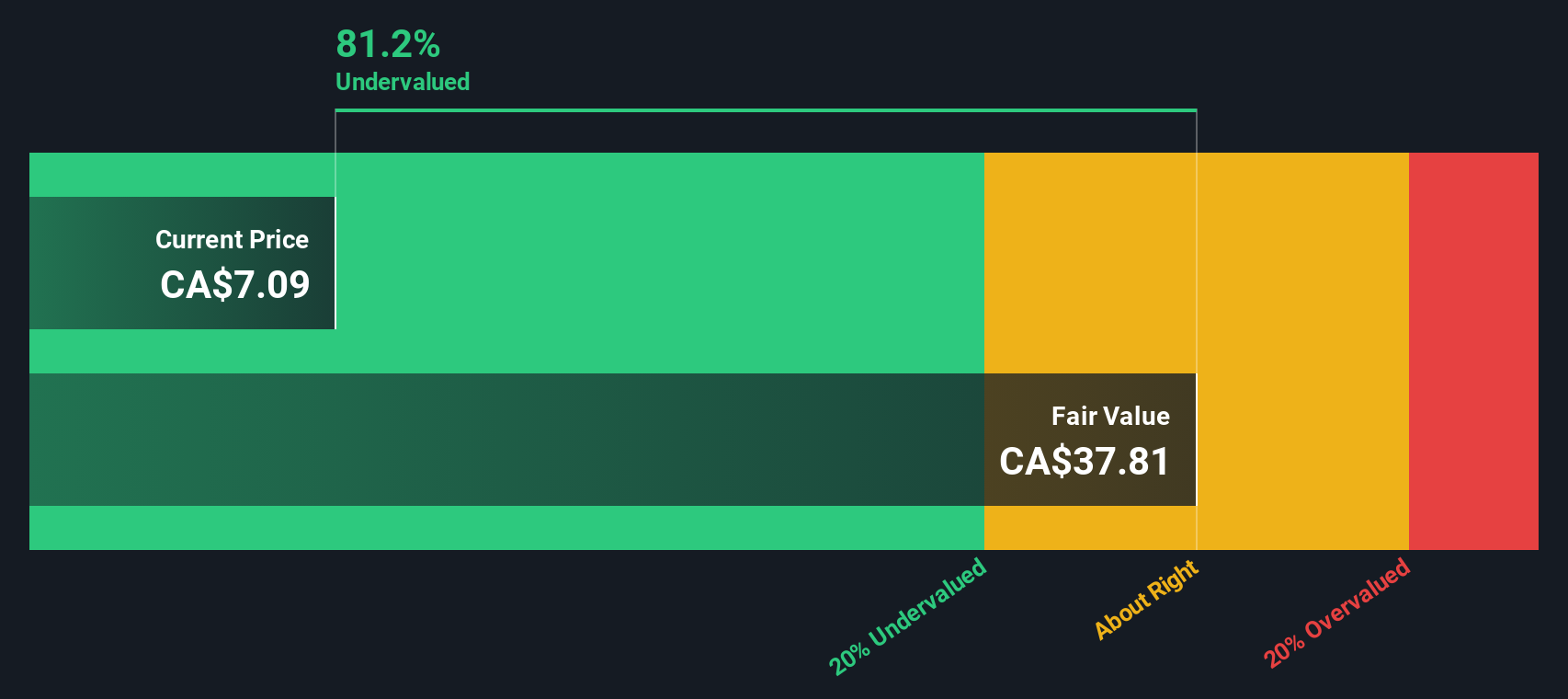

While the price-to-book ratio suggests Southern Cross Gold Consolidated is expensive, our SWS DCF model actually points to the stock being undervalued. These methods send mixed messages. Which one offers the most reliable signal for investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Southern Cross Gold Consolidated Narrative

If you want to dig deeper or chart out your own view, you can easily explore the data and draw your own conclusions in just a few minutes. Do it your way.

A great starting point for your Southern Cross Gold Consolidated research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t wait for opportunities to pass you by. Uncover stocks with real upside and stay ahead of shifting trends by searching sectors and themes that matter most.

- Unlock growth by targeting innovators using artificial intelligence. See which companies are leading the way with AI penny stocks.

- Benefit from stable income streams as you review opportunities among companies offering high yields with dividend stocks with yields > 3%.

- Seize undervalued stocks trading below their potential by starting your search with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:SXGC

Southern Cross Gold Consolidated

Engages in the acquisition and exploration of precious and energy mineral interests in Australia.

Flawless balance sheet and good value.

Market Insights

Community Narratives