- Canada

- /

- Metals and Mining

- /

- TSX:SVM

Will Silvercorp Metals’ (TSX:SVM) Record Revenue Shift Its Competitive Position in the Silver Market?

Reviewed by Sasha Jovanovic

- On October 15, 2025, Silvercorp Metals Inc. announced its consolidated operating and sales results for the second quarter and six months ended September 30, 2025, highlighting record revenue of approximately US$83.3 million and increased gold and lead production year-over-year.

- An interesting insight is that Silvercorp's strong operational performance and revenue growth coincide with renewed investor attention on silver following gold's record-breaking run in 2025, reinforcing its position as one of the industry's lowest-cost producers.

- We'll examine how Silvercorp's improved gold production and revenue growth shape its investment narrative amid rising interest in silver.

Find companies with promising cash flow potential yet trading below their fair value.

Silvercorp Metals Investment Narrative Recap

To be a shareholder in Silvercorp Metals, you generally need to believe that the company’s low-cost production profile and exposure to silver will outpace risks tied to operating mainly in China and new project execution. The company’s recent record quarterly revenue and increased gold and lead production do not appear to materially change the short-term catalyst, which remains higher realized silver prices, or the most significant risk: potential operational disruptions due to regulatory scrutiny in China.

Among Silvercorp’s recent developments, the August 2025 court decision upholding the environmental license for the El Domo Project in Ecuador is particularly relevant. Advancing El Domo is crucial for diversifying income beyond China, serving as a counterbalance to jurisdictional and regulatory risks as the company captures new growth opportunities.

By contrast, investors should be aware that any renewed operational restrictions or regulatory changes in China could quickly ...

Read the full narrative on Silvercorp Metals (it's free!)

Silvercorp Metals' narrative projects $504.4 million revenue and $143.0 million earnings by 2028. This requires 17.9% yearly revenue growth and a $88.6 million earnings increase from $54.4 million today.

Uncover how Silvercorp Metals' forecasts yield a CA$12.50 fair value, a 39% upside to its current price.

Exploring Other Perspectives

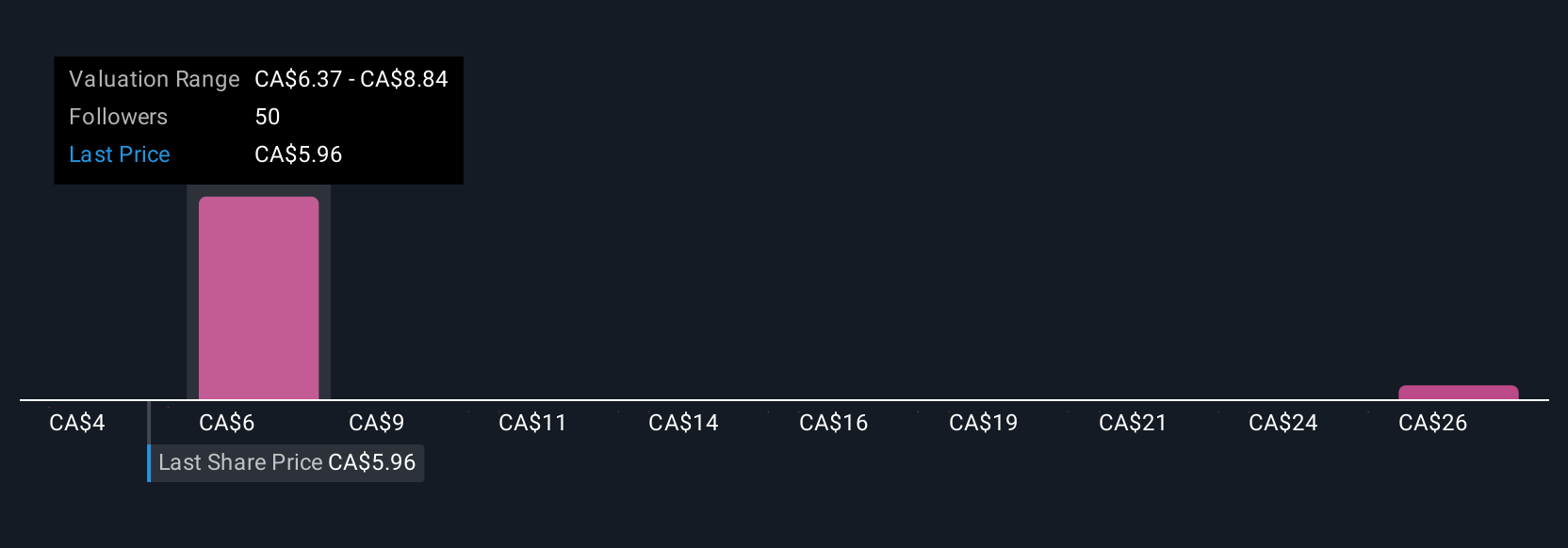

Eight fair value estimates from the Simply Wall St Community show a wide span for Silvercorp Metals, from CA$6.83 to CA$28.58 per share. Opinions differ significantly, especially considering how production or regulatory risks in China may affect long-term potential, so explore several viewpoints before forming your own outlook.

Explore 8 other fair value estimates on Silvercorp Metals - why the stock might be worth over 3x more than the current price!

Build Your Own Silvercorp Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silvercorp Metals research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Silvercorp Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silvercorp Metals' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives