- Canada

- /

- Specialty Stores

- /

- TSX:LNF

Undiscovered Canadian Gems to Watch in August 2024

Reviewed by Simply Wall St

As markets have welcomed easing inflation and better-than-expected economic data, the Canadian TSX has rebounded by over 5%, signaling a return of positive sentiment. With central banks potentially cutting rates and broader market leadership emerging, now is an opportune time to explore promising small-cap stocks that could benefit from these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Jaguar Mining | 1.19% | 5.49% | 5.12% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Amerigo Resources | 12.87% | 7.49% | 12.97% | ★★★★★☆ |

| Reconnaissance Energy Africa | NA | 31.73% | -6.92% | ★★★★★☆ |

| Firan Technology Group | 17.91% | 3.75% | 23.32% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Cipher Pharmaceuticals (TSX:CPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Cipher Pharmaceuticals Inc. operates as a specialty pharmaceutical company in Canada with a market cap of CA$407.88 million.

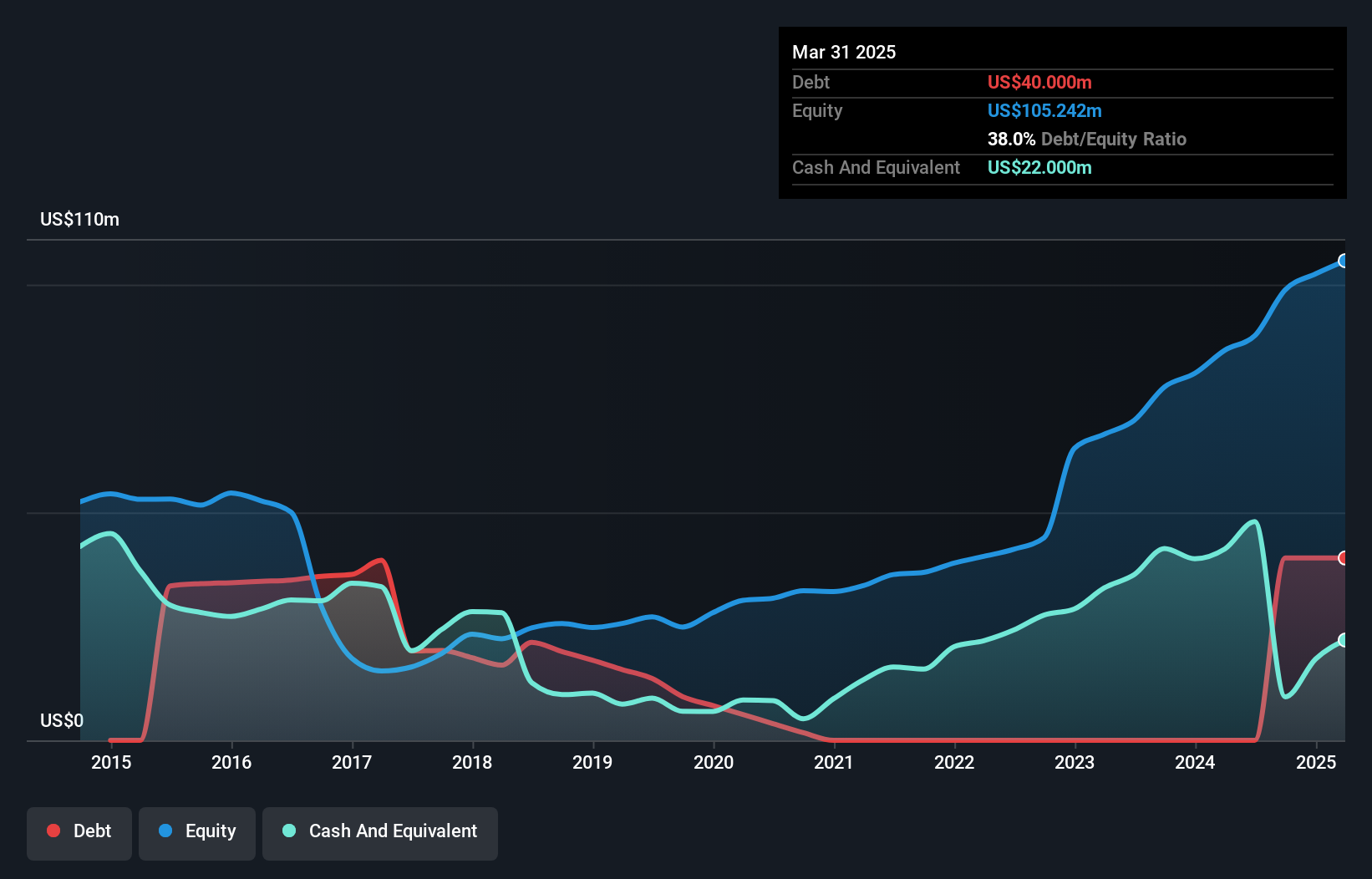

Operations: Cipher Pharmaceuticals generates revenue primarily through its Specialty Pharmaceuticals segment, amounting to CA$22.16 million.

Cipher Pharmaceuticals, a small cap player in the Canadian market, is trading at 59.9% below its estimated fair value and boasts high-quality earnings. Despite having no debt now compared to five years ago when its debt-to-equity ratio was 50.1%, the company experienced negative earnings growth of -19.4% over the past year. Recent Q2 results showed stable revenue at US$5.3 million and net income of US$3 million, with basic EPS from continuing operations steady at US$0.12.

- Take a closer look at Cipher Pharmaceuticals' potential here in our health report.

Explore historical data to track Cipher Pharmaceuticals' performance over time in our Past section.

Leon's Furniture (TSX:LNF)

Simply Wall St Value Rating: ★★★★★★

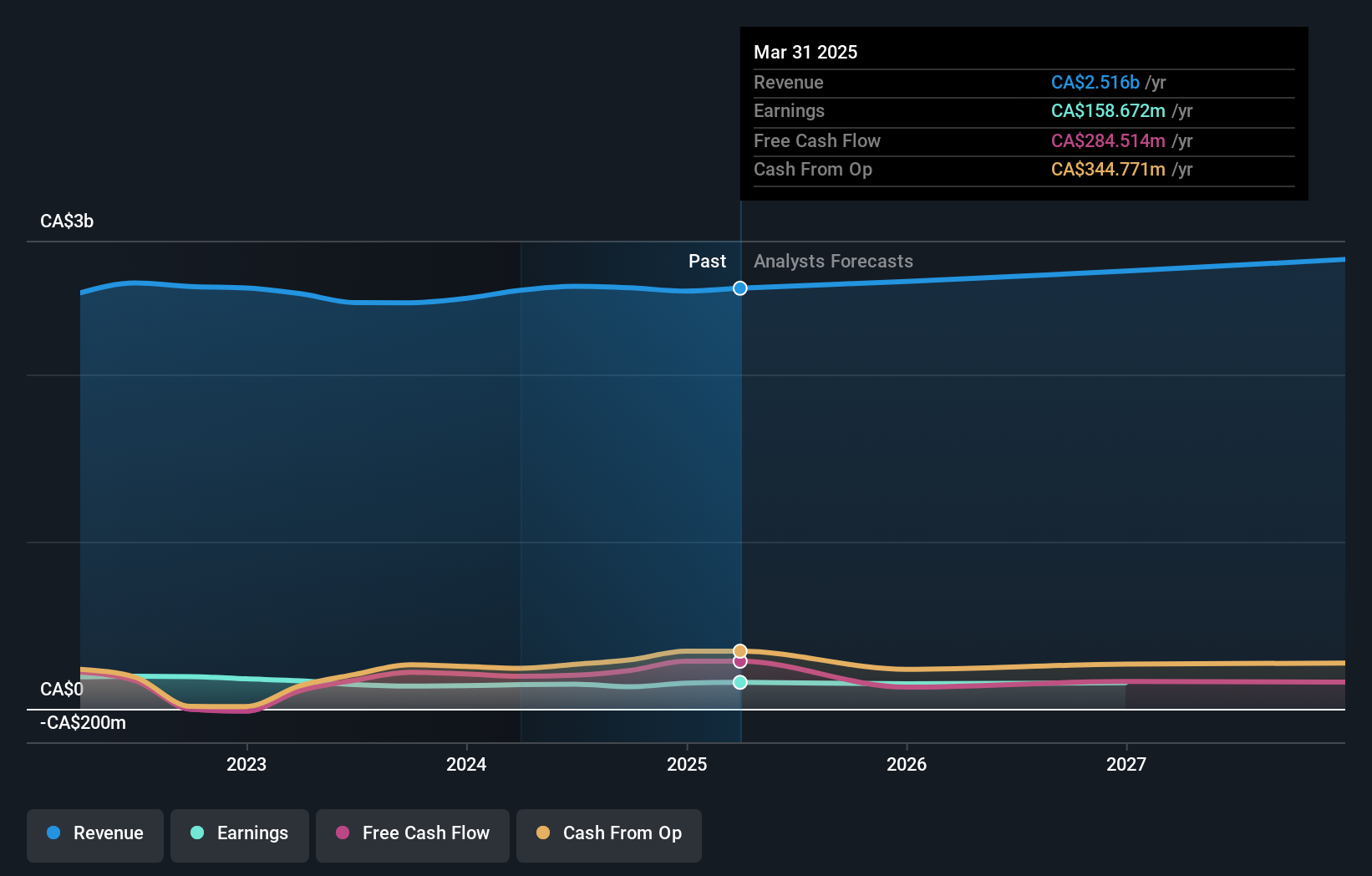

Overview: Leon's Furniture Limited, with a market cap of CA$1.98 billion, operates as a retailer of home furnishings, mattresses, appliances, and electronics in Canada.

Operations: Leon's Furniture Limited generates revenue primarily through the sale of home furnishings, mattresses, appliances, and electronics amounting to CA$2.53 billion. The company's net profit margin stands at 7.5%.

Leon's Furniture has shown solid performance with its debt to equity ratio dropping from 20.4% to 10.4% over the past five years, indicating a stronger balance sheet. The company reported CAD 617.66 million in sales for Q2 2024, up from CAD 593.84 million a year ago, and net income rose to CAD 30.17 million from CAD 27.42 million in the same period last year. Additionally, Leon's increased its quarterly dividend by $0.02 to $0.20 per share, reflecting confidence in future earnings growth of around 2.75% annually.

- Get an in-depth perspective on Leon's Furniture's performance by reading our health report here.

Gain insights into Leon's Furniture's past trends and performance with our Past report.

Silvercorp Metals (TSX:SVM)

Simply Wall St Value Rating: ★★★★★★

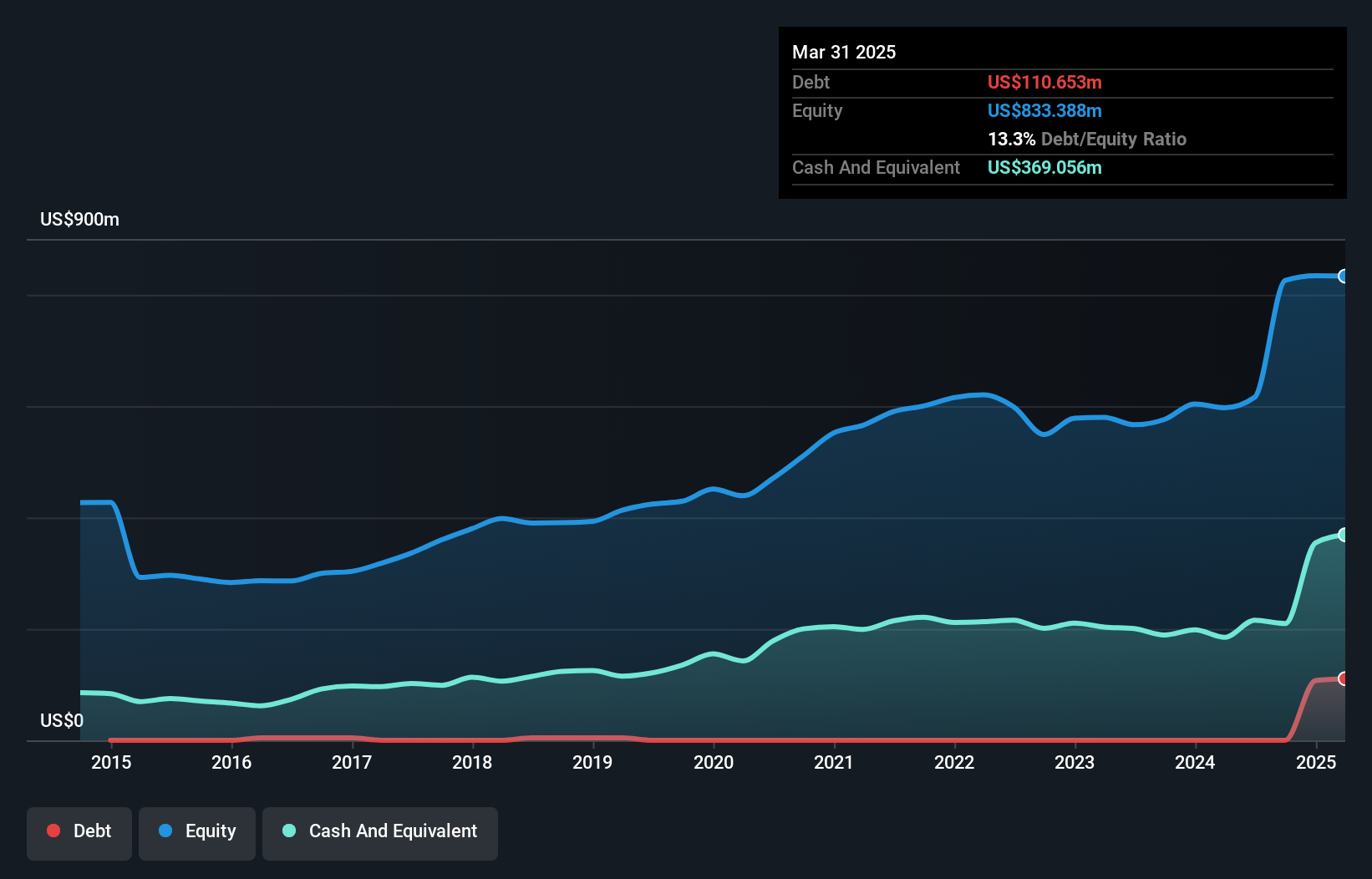

Overview: Silvercorp Metals Inc., along with its subsidiaries, focuses on the acquisition, exploration, development, and mining of mineral properties and has a market cap of CA$1.15 billion.

Operations: Silvercorp Metals generates revenue primarily from its mining operations in Guangdong ($27.35 million) and Henan Luoning ($200 million).

Silvercorp Metals, a small cap in the mining sector, recently reported Q1 2024 earnings of US$21.94 million, up from US$9.22 million last year. Sales for the quarter were US$72.17 million compared to US$60.01 million previously. Despite a slight dip in silver production to 1,717,000 ounces from 1,780,000 ounces, the company remains debt-free and boasts high-quality earnings with free cash flow positive status. The firm also repurchased 191,770 shares for $0.61 million this year.

- Click here and access our complete health analysis report to understand the dynamics of Silvercorp Metals.

Examine Silvercorp Metals' past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Access the full spectrum of 44 TSX Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LNF

Leon's Furniture

Operates as a retailer of home furnishings, mattresses, appliances, and electronics in Canada.

Flawless balance sheet, undervalued and pays a dividend.