- Canada

- /

- Metals and Mining

- /

- TSX:SVM

Silvercorp Metals (TSX:SVM): Assessing Valuation After Strong Revenue Growth and New Dividend Announcement

Reviewed by Simply Wall St

Silvercorp Metals (TSX:SVM) just posted a strong increase in revenue for Q2 Fiscal 2026 and reaffirmed its ongoing commitment to growth by declaring a semi-annual dividend. These moves have caught the attention of many investors.

See our latest analysis for Silvercorp Metals.

After a stellar run this year, Silvercorp Metals' share price has nearly doubled in 2025 with a 94.73% year-to-date gain. This performance reflects renewed investor confidence driven by robust quarterly results and strategic dividend affirmations. While recent weeks saw some profit-taking, the overall momentum remains positive. Its 55.66% total shareholder return over the past year stands out in a challenging sector.

If growth stories like this have you curious, now’s a great time to broaden your search and check out fast growing stocks with high insider ownership.

With Silvercorp's share price surge and a flurry of positive news, the real question now is whether the current valuation still leaves room for upside or if the market has already priced in its growth story.

Most Popular Narrative: 31.2% Undervalued

With the narrative’s fair value for Silvercorp Metals coming in at $12.87 versus a last close of $8.86, the case for significant upside hinges on ambitious growth and margin improvements projected by analysts. This sets the tone for a bullish outlook, as long as expectations align with reality.

The company's progress on new mine developments, particularly the construction ramp-up at El Domo and advancement of Kuanping, positions it to significantly expand production volumes and diversify beyond China. This enhances future revenue and mitigates single-jurisdiction risk. Record operating cash flow ($48.3 million in Q1) and a substantial cash position ($377 million), together with disciplined capital allocation and access to additional financing (such as the $175 million Wheaton stream), support higher earnings stability, potential dividend capacity, and the ability to invest in further growth projects.

Want to uncover what drives the optimism? Analysts are betting on aggressive production growth, boosted profitability, and a unique mix of new projects. Curious about which forecasts and financial moves push the fair value this much higher? Dive into the full narrative to see the bold calculations and what’s fueling this price target.

Result: Fair Value of $12.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased regulatory scrutiny in China or further production disruptions due to operational incidents could quickly dampen optimism around Silvercorp's outlook.

Find out about the key risks to this Silvercorp Metals narrative.

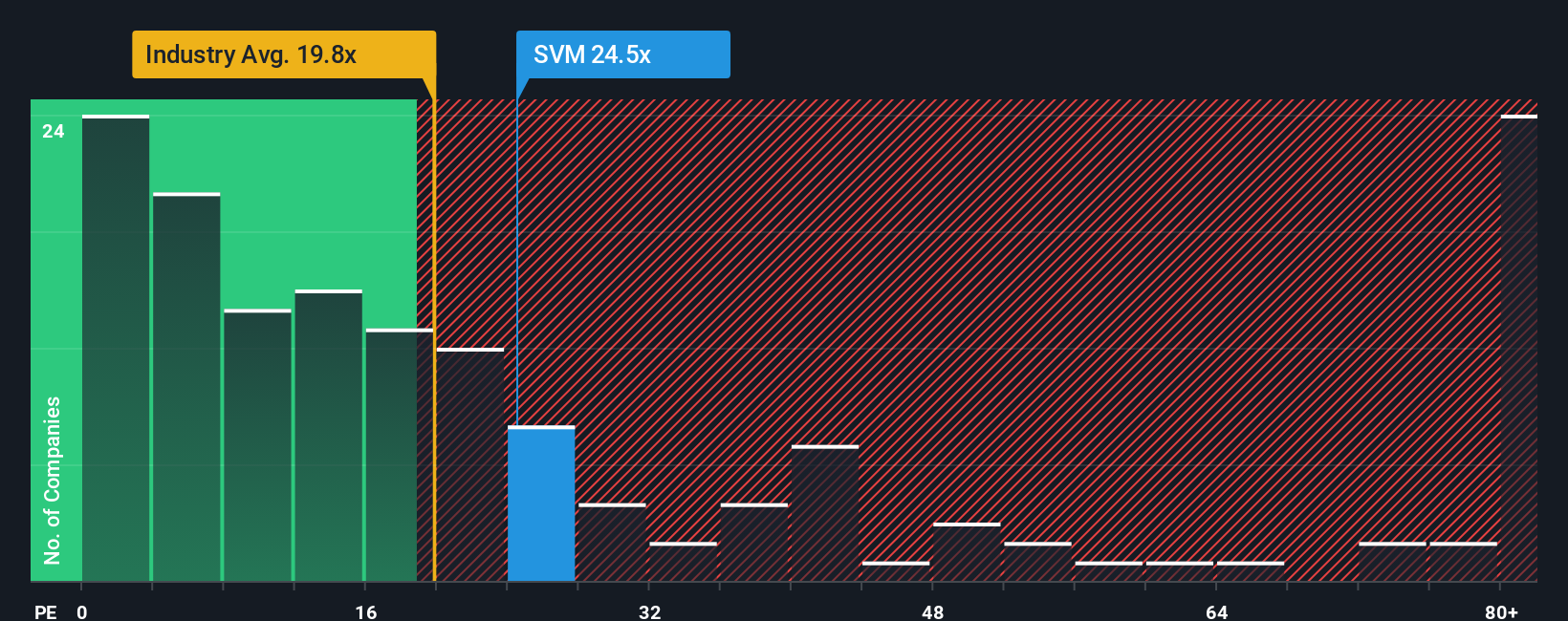

Another View: What Multiples Say

While the narrative suggests Silvercorp Metals is undervalued, the price-to-earnings ratio paints a more skeptical picture. Trading at 54.9 times earnings, the stock is priced much higher than both its industry peers (20.5x) and even above its fair ratio (40.3x). This hints at valuation risk if company growth falls short. Could the market be getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Silvercorp Metals Narrative

If you want to dig into the details yourself or challenge these conclusions, you can craft your own custom narrative in just a few minutes. Do it your way.

A great starting point for your Silvercorp Metals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know opportunity never rests. If you want to get ahead of the curve, check out these hand-picked strategies to add something powerful to your watchlist today:

- Capitalize on rapid market shifts by tapping into these 876 undervalued stocks based on cash flows and target stocks trading below their fair value for potential upside.

- Step into a new era of medicine by checking out these 32 healthcare AI stocks, highlighting companies using artificial intelligence to transform healthcare outcomes.

- Boost your income stream by choosing these 16 dividend stocks with yields > 3% with reliable, high-yield dividend payers, offering strong potential for steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives