- Canada

- /

- Metals and Mining

- /

- TSX:SVM

How a Surprise Net Loss and New Dividend at Silvercorp Metals (TSX:SVM) Reframes Its Investment Story

Reviewed by Sasha Jovanovic

- Silvercorp Metals Inc. recently declared a semi-annual dividend of US$0.0125 per share for shareholders of record as of November 28, 2025, with payment scheduled on or before December 12, 2025.

- The announcement followed the release of mixed second-quarter results, where higher sales were accompanied by a swing from net income to a net loss, offering a complex picture for investors.

- We will now explore how this combination of rising sales and declining profitability impacts Silvercorp Metals’ future investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Silvercorp Metals Investment Narrative Recap

To be a Silvercorp Metals shareholder, you need to believe in the sustained global demand for silver, especially as clean energy and electrification trends drive long-term pricing prospects and production growth. The recent dividend announcement and mixed second-quarter results do not materially change the most important short-term catalyst, which remains the successful expansion and de-risking of operations both inside and outside China; however, persistent cost pressures continue to pose the biggest risk to near-term profitability. Among the recent company news, the declared semi-annual dividend stands out for income-oriented investors. While the dividend may signal stability, it follows a quarter where net margins deteriorated despite higher sales, a clear sign that cost inflation and operational efficiency will be front of mind as catalysts for future performance. However, investors should also be aware that cost pressures are rising and, if not managed, could undermine...

Read the full narrative on Silvercorp Metals (it's free!)

Silvercorp Metals' outlook anticipates $504.4 million in revenue and $143.0 million in earnings by 2028. This reflects a forecasted annual revenue growth rate of 17.9% and an earnings increase of $88.6 million from current earnings of $54.4 million.

Uncover how Silvercorp Metals' forecasts yield a CA$12.87 fair value, a 45% upside to its current price.

Exploring Other Perspectives

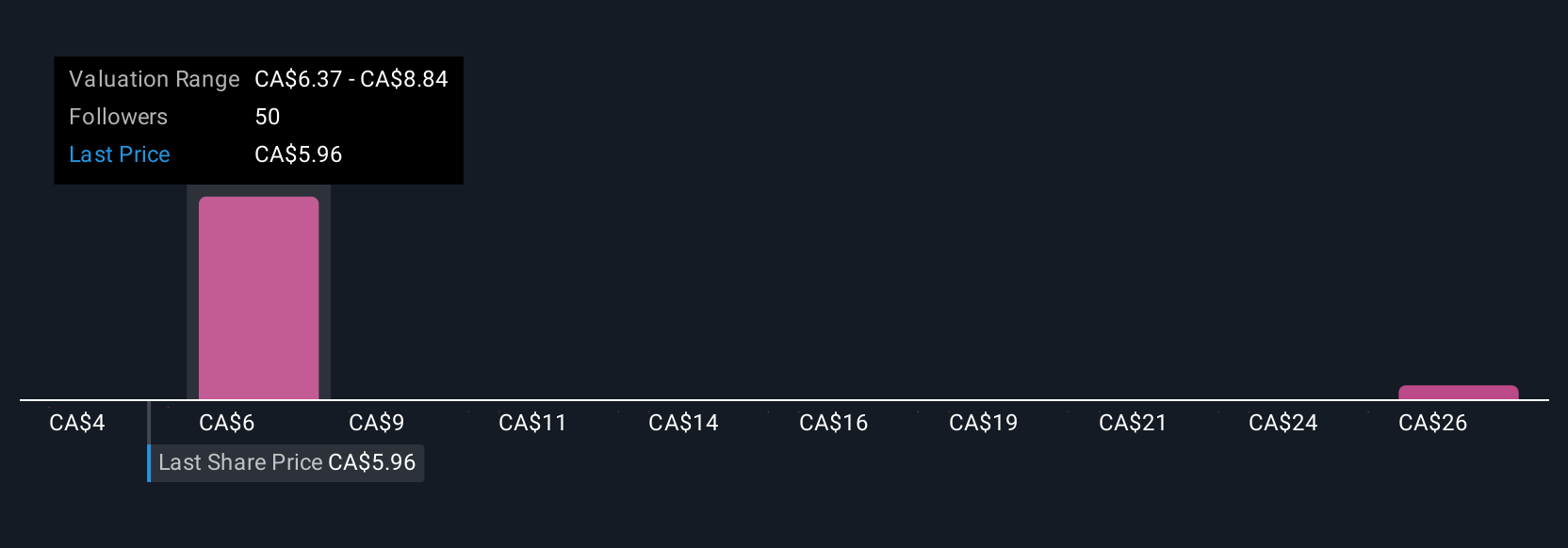

Nine fair value estimates from the Simply Wall St Community range widely from US$0.89 to US$28.58 per share. This diversity of outlooks contrasts with recent company results where higher sales met sharply compressed profits, explore these viewpoints to see how peers are weighing opportunity versus execution risk.

Explore 9 other fair value estimates on Silvercorp Metals - why the stock might be worth over 3x more than the current price!

Build Your Own Silvercorp Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silvercorp Metals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Silvercorp Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silvercorp Metals' overall financial health at a glance.

No Opportunity In Silvercorp Metals?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives