Stella-Jones (TSX:SJ) Is Up 5.2% After Q3 Earnings Beat and Expanded Buyback Program - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Earlier this week, Stella-Jones Inc. reported third quarter 2025 earnings, highlighting sales of CA$958 million and net income of CA$88 million, alongside an expanded share buyback program targeting up to 1.5 million shares by November 2026.

- A key insight is that the rise in both earnings and shareholder-focused initiatives, such as share repurchases and dividend affirmations, underscores management’s confidence in ongoing business performance.

- We'll explore how the strong earnings results and updated buyback program shape Stella-Jones' investment narrative and future outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Stella-Jones Investment Narrative Recap

To be a shareholder in Stella-Jones, you need to believe in the ongoing North American infrastructure renewal cycle and consistent replacement demand for utility poles and railway ties, which underpin long-term revenue stability. The Q3 2025 earnings and share buyback news reinforce management’s confidence, but do not materially shift the near-term catalyst: sustained infrastructure investment and visible order volumes. The biggest immediate risk, slower-than-expected utility spending in Canada and the US, remains unaffected by these results.

The most relevant announcement for investors here is the expanded share repurchase program, authorizing up to 1.5 million shares through November 2026. This move, combined with steady dividends and higher year-over-year earnings, supports the story of shareholder returns while highlighting the company’s focus on efficient capital allocation in a period with some demand uncertainty.

However, the risk many may overlook is that, even with apparent resilience, mounting pressure from deferred utility pole replacements could...

Read the full narrative on Stella-Jones (it's free!)

Stella-Jones is projected to reach CA$3.8 billion in revenue and CA$308.4 million in earnings by 2028. This outlook assumes annual revenue growth of 3.7% and a decrease in earnings of CA$22.6 million from the current CA$331.0 million.

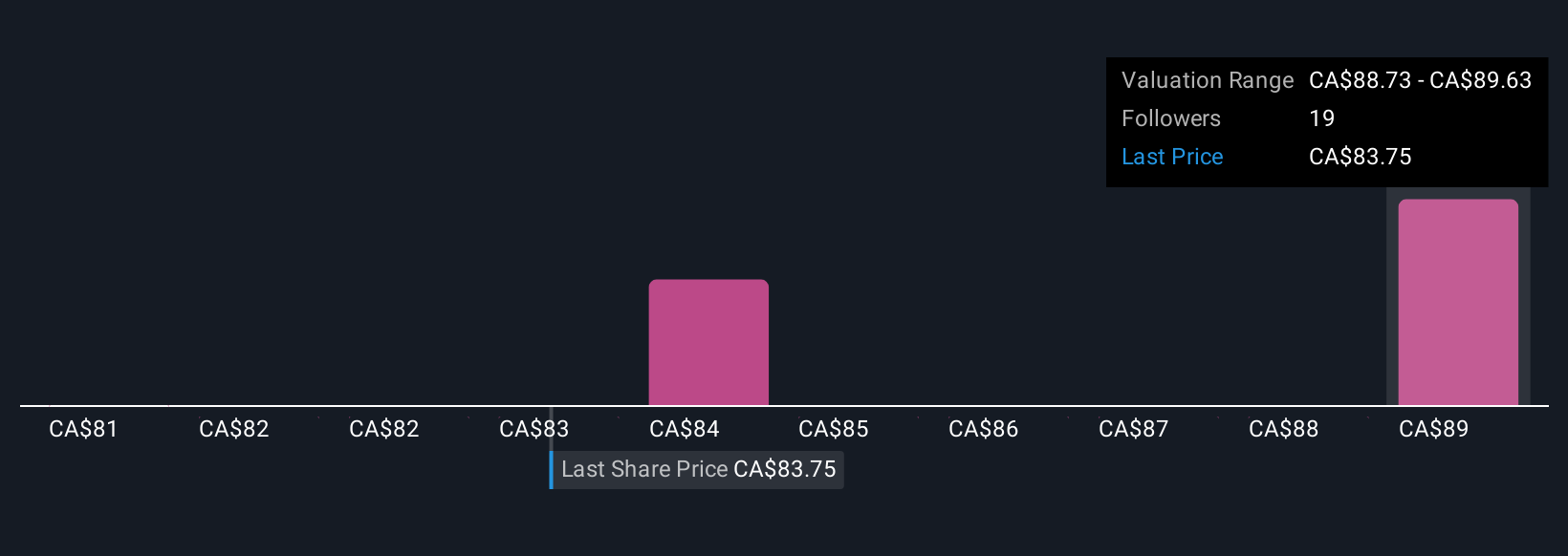

Uncover how Stella-Jones' forecasts yield a CA$89.62 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Three community members from Simply Wall St estimate Stella-Jones’ fair value in a tight CA$80.64 to CA$89.63 band. Some point to deferred utility investments as a factor that could influence future revenue streams, inviting you to compare these views and consider what drives your own outlook.

Explore 3 other fair value estimates on Stella-Jones - why the stock might be worth as much as 7% more than the current price!

Build Your Own Stella-Jones Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stella-Jones research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Stella-Jones research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stella-Jones' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SJ

Stella-Jones

Manufactures and sells industrial pressure-treated wood products in Canada and the United States.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives