- Canada

- /

- Metals and Mining

- /

- TSX:PPTA

Why Perpetua Resources (TSX:PPTA) Attracted Over US$325 Million in Equity Raises From Industry Leaders

Reviewed by Sasha Jovanovic

- In late October 2025, Perpetua Resources completed a series of equity capital raises, including a US$71.25 million follow-on offering and private placements attracting over US$254.99 million from investors such as Agnico Eagle and JPMorgan Chase.

- The participation of major industry players and the issuance of warrants with premium exercise prices highlight significant external confidence in Perpetua Resources' future prospects and project development plans.

- We'll explore how these substantial capital inflows from reputable investors may bolster Perpetua Resources' investment narrative and long-term growth ambitions.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Perpetua Resources' Investment Narrative?

To be a shareholder in Perpetua Resources, you generally need to buy into the vision that the Stibnite Gold Project will move from planning to production, unlocking new sources of gold and antimony in the US. Until now, short-term catalysts have focused on regulatory milestones, such as the recent notice to proceed with construction, as well as the company’s ability to secure substantial external funding. The late October equity raises, which delivered over US$332 million from both institutional and mining sector leaders, have the potential to reshape both the risk and opportunity profile for the business. This fresh capital meaningfully addresses funding risk for the next stages of project development, possibly removing near-term concerns around liquidity and financial runway. However, with profitability still years away and no revenue expected in the short term, key risks remain around project execution, potential delays, and an unresolved class action lawsuit. The capital infusion could accelerate progress, but core project and operational risks still remain front and center.

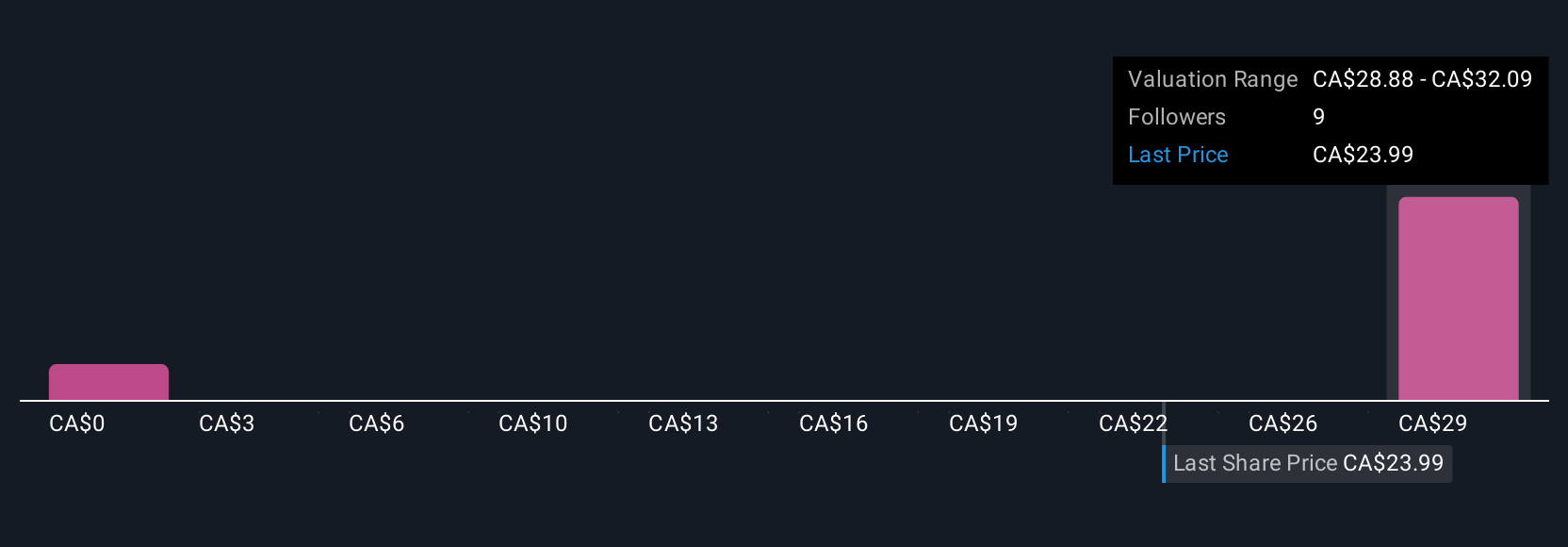

On the other hand, legal uncertainties are still a factor that investors should be aware of. Our comprehensive valuation report raises the possibility that Perpetua Resources is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 7 other fair value estimates on Perpetua Resources - why the stock might be worth less than half the current price!

Build Your Own Perpetua Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perpetua Resources research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Perpetua Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perpetua Resources' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PPTA

Perpetua Resources

A development-stage company, engages in the acquisition of mining properties in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives