- Canada

- /

- Metals and Mining

- /

- TSX:PAAS

What Pan American Silver (TSX:PAAS)'s Higher Earnings Forecasts Mean For Shareholders

Reviewed by Sasha Jovanovic

- Pan American Silver is expected to report quarterly earnings of US$0.49 per share and revenues of US$867.76 million, with analyst forecasts showing significant upward revisions compared to the prior-year period.

- The consensus earnings estimate was raised considerably in the last 30 days, suggesting analysts have become more optimistic about the company’s near-term financial outlook.

- With analysts newly confident in Pan American Silver’s prospective earnings, we’ll consider how this optimism influences its investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Pan American Silver's Investment Narrative?

For anyone considering Pan American Silver, the fundamental case has always hinged on believing in the long-term demand for precious metals, the company’s ability to expand production, and management’s execution in maximizing the value of substantial silver and gold reserves. The latest analyst upgrades, especially the sharp rise in expected earnings and revenue for the upcoming quarter, suggest short-term optimism is running higher than it has in months. This increased confidence could become a near-term catalyst if the company surpasses forecasts, potentially supporting further price recovery after recent declines. However, the significant uptick in bearish options activity and weak short-term sentiment reflect that not all investors are convinced that good news is fully priced in. While the news of strong earnings potential is meaningful, the underlying risks, such as the company’s relatively high valuation and recent insider selling, remain relevant, and sudden moves in silver or gold prices could still have a material impact. On the other hand, recent insider selling may be a signal investors shouldn't ignore.

Pan American Silver's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

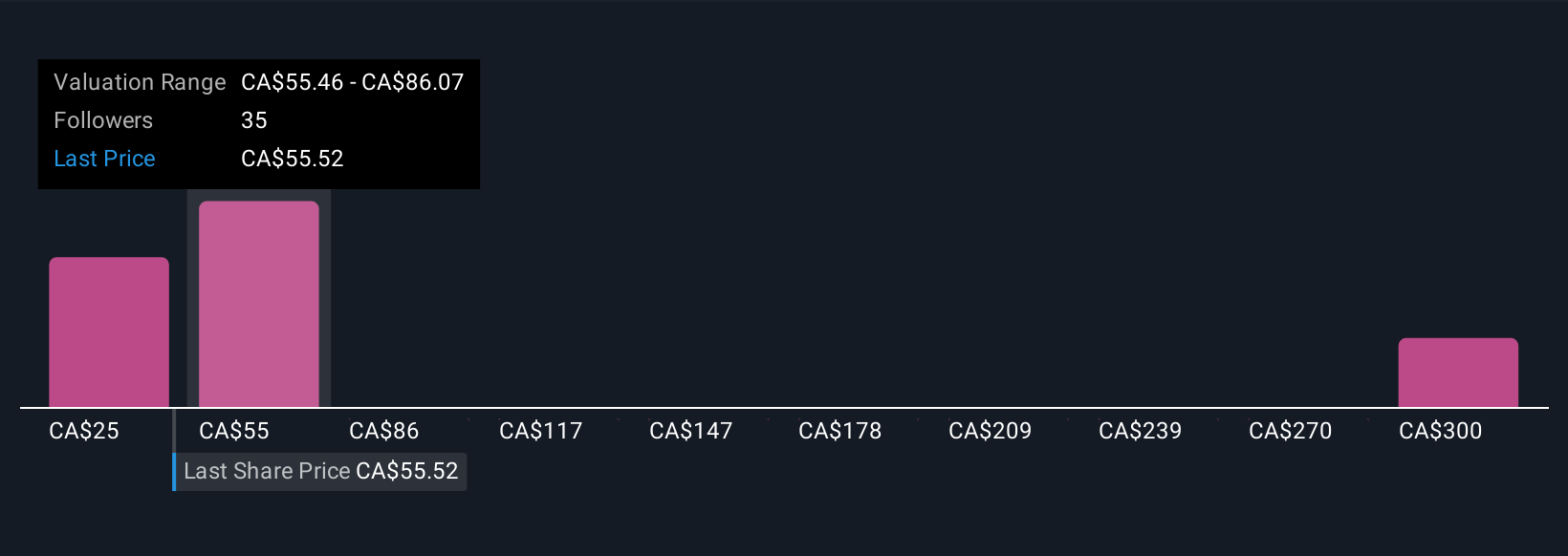

Explore 5 other fair value estimates on Pan American Silver - why the stock might be worth 49% less than the current price!

Build Your Own Pan American Silver Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pan American Silver research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pan American Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pan American Silver's overall financial health at a glance.

No Opportunity In Pan American Silver?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PAAS

Pan American Silver

Engages in the exploration, mine development, extraction, processing, refining, and reclamation of mines in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives