- Canada

- /

- Metals and Mining

- /

- TSX:HBM

Is Hudbay Minerals’ (TSX:HBM) Resilient Profit Margins Enough to Offset Near-Term Earnings Pressure?

Reviewed by Sasha Jovanovic

- Hudbay Minerals recently announced that analysts expect a 53.8% decline in earnings per share and a 19.2% revenue decrease for the upcoming quarter, reflecting a challenging period for the copper-focused miner.

- Despite these anticipated declines, the company continues to display strong profitability margins and maintains a moderate buy rating from analysts, highlighting persistent optimism amid financial headwinds.

- We'll explore how the anticipated earnings and revenue drop may reshape Hudbay Minerals' longer-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Hudbay Minerals Investment Narrative Recap

To be a shareholder in Hudbay Minerals, you need to believe in the company's ability to execute large-scale copper projects and manage the cyclical risks of mining, especially with growing global demand for copper tied to electrification trends. Recent analyst expectations for a sharp decline in earnings per share and revenue may temporarily affect sentiment, but unless these financial results signal underlying operational or project setbacks, they are unlikely to materially threaten the company’s core production catalysts, especially the ramp-up and permitting progress at key sites. The most immediate risk remains potential execution and cost overruns at major projects, such as Copper World, which could have a more pronounced long-term impact than short-term financial fluctuations.

One of the most relevant announcements is Hudbay’s reaffirmation of its full-year 2025 production and cost guidance despite recent operational disruptions. This suggests management continues to expect stable production levels for the year, which partially offsets concerns about near-term earnings declines and reinforces the importance of project delivery and execution as key drivers for future value. Maintaining production targets amid headwinds also keeps the focus squarely on large-scale project milestones as the critical short-term catalyst investors are watching.

Yet, despite ongoing execution focus, investors should be alert to the risk that permitting delays or increased costs at major projects like Copper World could...

Read the full narrative on Hudbay Minerals (it's free!)

Hudbay Minerals' narrative projects $2.4 billion in revenue and $373.5 million in earnings by 2028. This requires 2.6% yearly revenue growth and an $84.5 million earnings increase from the current earnings of $289.0 million.

Uncover how Hudbay Minerals' forecasts yield a CA$25.13 fair value, a 8% upside to its current price.

Exploring Other Perspectives

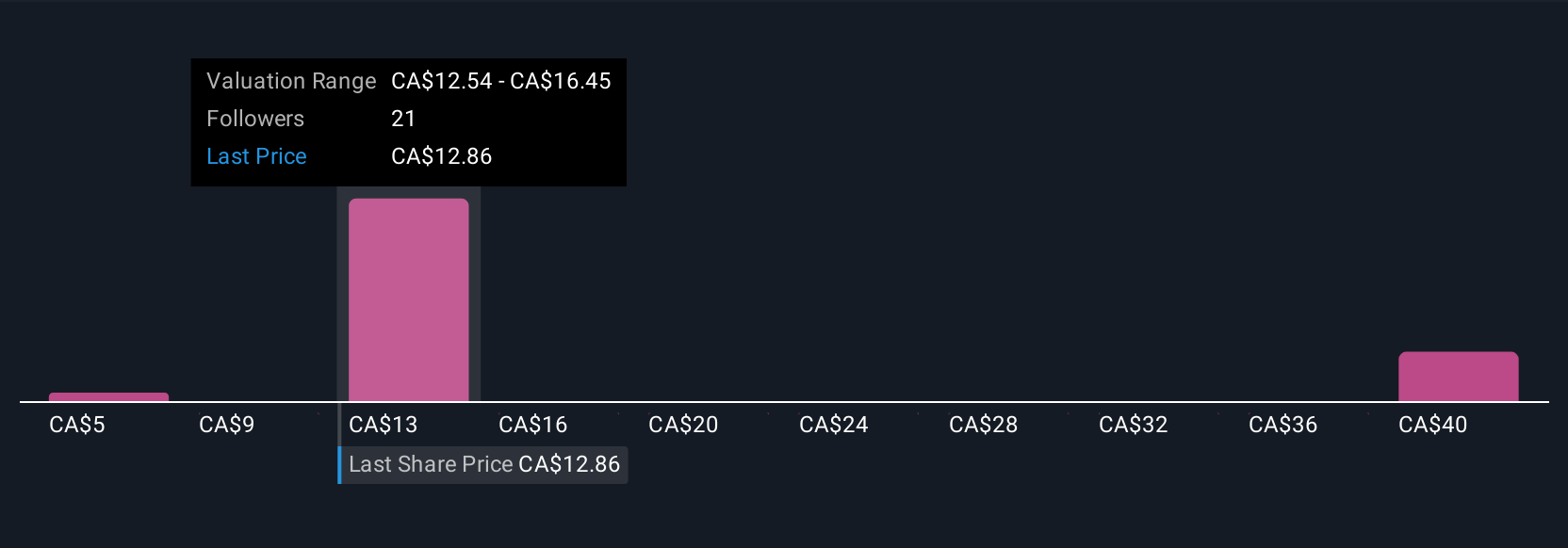

Six fair value estimates from the Simply Wall St Community range from CA$6.60 to CA$53.95, spanning a broad set of investor views. While you’re weighing this diversity, keep in mind that execution and cost risks on major projects could pose significant challenges to the company’s future growth trajectory.

Explore 6 other fair value estimates on Hudbay Minerals - why the stock might be worth less than half the current price!

Build Your Own Hudbay Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hudbay Minerals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Hudbay Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hudbay Minerals' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hudbay Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HBM

Hudbay Minerals

A diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives