Stock Analysis

- Canada

- /

- Paper and Forestry Products

- /

- TSX:GFP

GreenFirst Forest Products Inc.'s (TSE:GFP) Shares Not Telling The Full Story

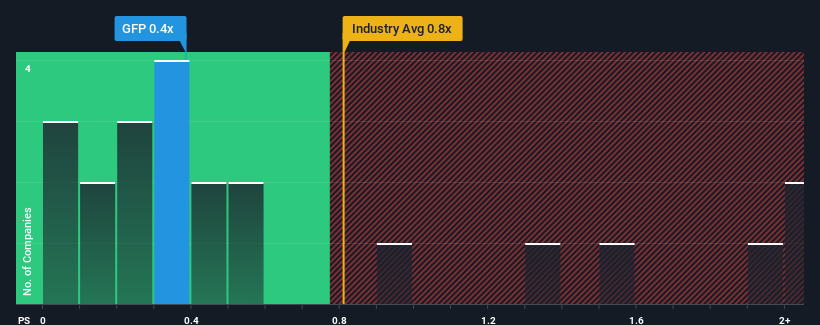

There wouldn't be many who think GreenFirst Forest Products Inc.'s (TSE:GFP) price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S for the Forestry industry in Canada is very similar. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for GreenFirst Forest Products

What Does GreenFirst Forest Products' P/S Mean For Shareholders?

With only a limited decrease in revenue compared to most other companies of late, GreenFirst Forest Products has been doing relatively well. Perhaps the market is expecting future revenue performance fall back in line with the poorer industry performance, which has kept the P/S contained. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. But at the very least, you'd be hoping the company doesn't fall back into the pack if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think GreenFirst Forest Products' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like GreenFirst Forest Products' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 19% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 1.2%, which is noticeably less attractive.

With this in consideration, we find it intriguing that GreenFirst Forest Products' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, GreenFirst Forest Products' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 2 warning signs for GreenFirst Forest Products that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether GreenFirst Forest Products is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GFP

GreenFirst Forest Products

Engages in the manufacture and sale of forest products in Canada, and the United States.

Low with mediocre balance sheet.