- Canada

- /

- Metals and Mining

- /

- TSX:ESM

We're A Little Worried About Euro Sun Mining's (TSE:ESM) Cash Burn Rate

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So, the natural question for Euro Sun Mining (TSE:ESM) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Euro Sun Mining

When Might Euro Sun Mining Run Out Of Money?

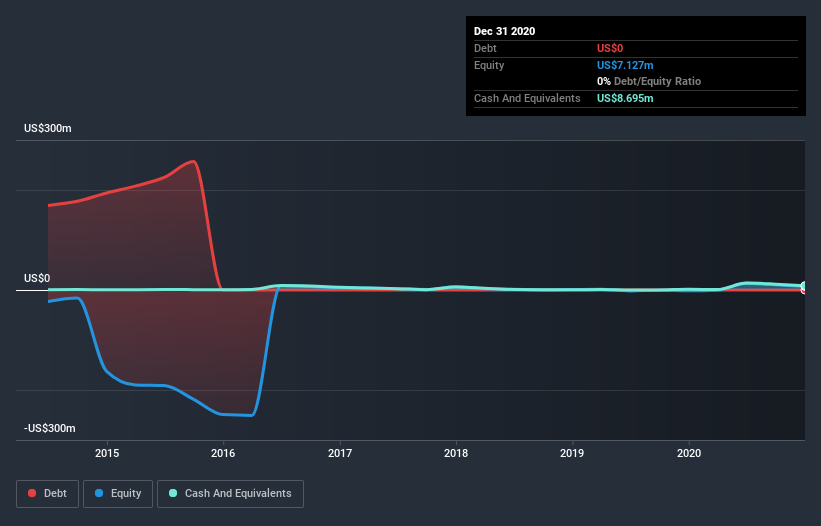

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Euro Sun Mining last reported its balance sheet in December 2020, it had zero debt and cash worth US$8.7m. Looking at the last year, the company burnt through US$12m. That means it had a cash runway of around 9 months as of December 2020. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. The image below shows how its cash balance has been changing over the last few years.

How Is Euro Sun Mining's Cash Burn Changing Over Time?

Because Euro Sun Mining isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. The skyrocketing cash burn up 129% year on year certainly tests our nerves. That sort of spending growth rate can't continue for very long before it causes balance sheet weakness, generally speaking. Admittedly, we're a bit cautious of Euro Sun Mining due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can Euro Sun Mining Raise More Cash Easily?

Since its cash burn is moving in the wrong direction, Euro Sun Mining shareholders may wish to think ahead to when the company may need to raise more cash. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$44m, Euro Sun Mining's US$12m in cash burn equates to about 27% of its market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

How Risky Is Euro Sun Mining's Cash Burn Situation?

Euro Sun Mining is not in a great position when it comes to its cash burn situation. While its cash burn relative to its market cap wasn't too bad, its increasing cash burn does leave us rather nervous. Considering all the measures mentioned in this report, we reckon that its cash burn is fairly risky, and if we held shares we'd be watching like a hawk for any deterioration. Taking a deeper dive, we've spotted 4 warning signs for Euro Sun Mining you should be aware of, and 3 of them make us uncomfortable.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade Euro Sun Mining, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Euro Sun Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ESM

Euro Sun Mining

Operates as a gold and copper exploration and development mining company in Romania.

Moderate risk with acceptable track record.

Market Insights

Community Narratives