- Canada

- /

- Metals and Mining

- /

- TSX:EQX

Equinox Gold (TSX:EQX): Exploring Valuation Following Recent Operational and Merger Developments

Reviewed by Simply Wall St

Equinox Gold (TSX:EQX) has been attracting attention lately as investors size up its recent performance, with its stock climbing more than 8% over the past three months. This move comes as gold markets remain in focus and investors seek value among Canadian miners.

See our latest analysis for Equinox Gold.

Equinox Gold’s strong momentum is hard to ignore. A 110% year-to-date share price return reflects renewed optimism for gold miners and shifting sentiment around metals stocks. The company’s 1-year total shareholder return of 101% highlights a powerful turnaround, and recent news continues to generate interest.

If you're interested in what else the market has to offer beyond gold, now is a perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares posting strong gains and trading still below analysts' price targets, the key question now is whether Equinox Gold remains undervalued, or if the market has already priced in its next phase of growth.

Most Popular Narrative: 23.3% Undervalued

With the most closely watched narrative assigning Equinox Gold a fair value notably above the last closing price, discussion is heating up about what could drive a re-rating. The difference between this fair value and where shares trade now is fueling speculation about what's next for the stock.

Successful ramp-up of Greenstone and Valentine mines, combined with the recent merger, positions Equinox Gold for significantly higher output and scale. This supports meaningful revenue and cash flow growth in the coming quarters as new production fully contributes.

What is powering this bold valuation? Consider massive output gains, strategic expansion moves, and financial projections that could surprise even seasoned gold investors. The full narrative hints at unconventional numbers, including margin increases and revenue growth, that may help explain the optimism surrounding Equinox Gold. Interested in how bullish the assumptions are? Follow the trail and challenge your own expectations.

Result: Fair Value of $20.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing operational challenges and community agreement issues at key mines could hinder output. These factors could potentially undermine the current growth narrative for Equinox Gold.

Find out about the key risks to this Equinox Gold narrative.

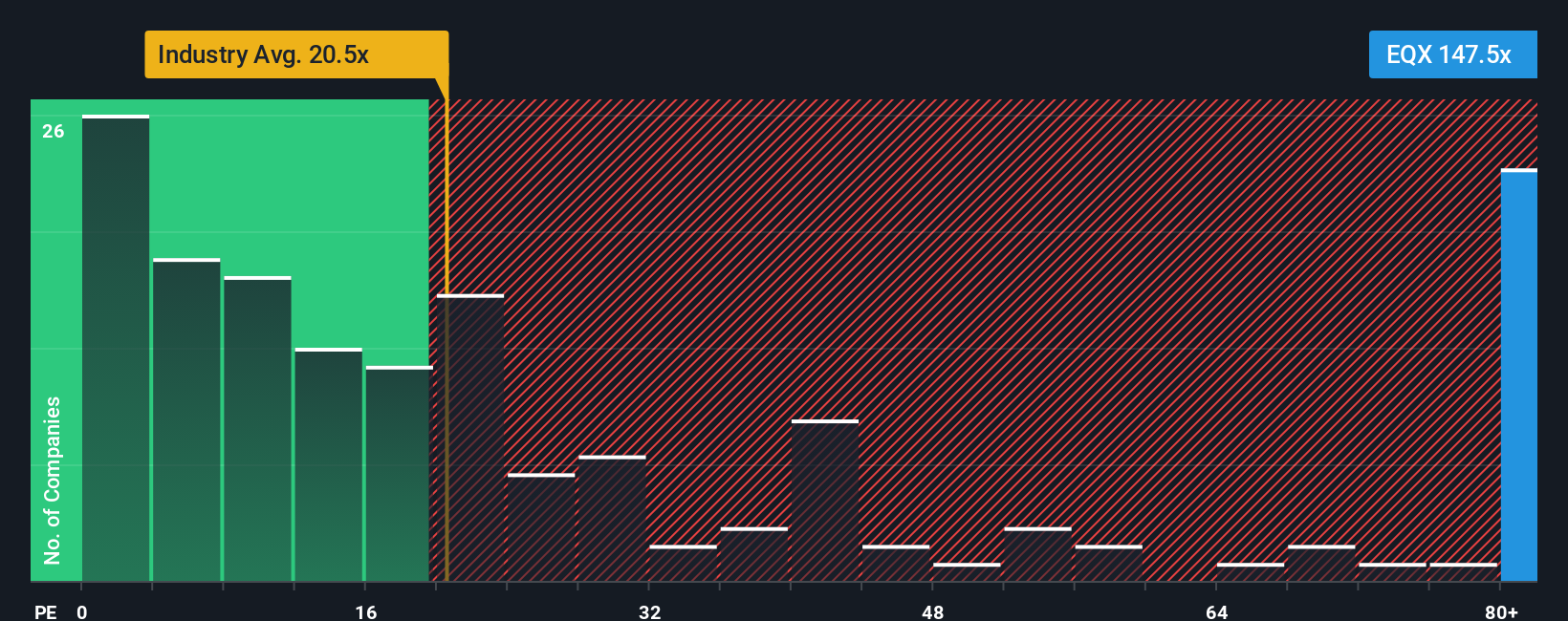

Another View: Price-to-Earnings Raises Flags

While SWS calculates fair value based on future cash flows, the current price-to-earnings ratio for Equinox Gold stands at 139.4x. This is significantly above both the Canadian Metals and Mining industry average of 20.1x and an estimated fair ratio of 29.9x. Such a premium could indicate heightened valuation risk. What would need to happen for the market to justify this gap, and could it close sooner than expected?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equinox Gold Narrative

If you have a different perspective or want to analyze the numbers firsthand, you can quickly map out your own narrative using the available tools. Do it your way.

A great starting point for your Equinox Gold research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip by. Uncover niche markets, track powerful trends, and put your money where growth, innovation, and income truly intersect.

- Boost your portfolio by targeting steady income streams with these 17 dividend stocks with yields > 3% boasting yields over 3%.

- Ride the wave of artificial intelligence innovation by checking out these 25 AI penny stocks reshaping industries and driving new growth frontiers.

- Seize undervalued gems before others catch on by browsing these 857 undervalued stocks based on cash flows for top stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinox Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EQX

Equinox Gold

Engages in the acquisition, exploration, development, and operation of mineral properties in the Americas.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives