- Canada

- /

- Metals and Mining

- /

- TSX:EDR

A Look at Endeavour Silver (TSX:EDR) Valuation Following Strong Sales Growth but Wider Losses in Latest Results

Reviewed by Simply Wall St

Endeavour Silver (TSX:EDR) just released its third quarter numbers. Sales jumped sharply both for the quarter and the year so far, even as net losses widened from last year’s results.

See our latest analysis for Endeavour Silver.

Investors have clearly taken notice of Endeavour Silver’s surging revenue, with momentum picking up since mid-year. The recent 38.3% 90-day share price return pushed the stock’s year-to-date gain to 79.1%. Longer term, the total shareholder return stands at a solid 119% over three years, hinting at persistent optimism even as quarterly losses weigh on sentiment.

If strong moves like these pique your curiosity, now is a great opportunity to see what’s next and discover fast growing stocks with high insider ownership

With shares soaring and revenue climbing, is Endeavour Silver still an undervalued opportunity, or has the market already priced in expectations for future growth?

Most Popular Narrative: 31.9% Undervalued

With Endeavour Silver’s fair value estimate at CA$15.13, nearly a third above its last close of CA$10.30, momentum appears strong for further upside if analyst projections hold true.

With the Terronera mine nearing commercial production and optimization of recoveries on track, Endeavour is poised for a significant, step-change increase in production and operating cash flows. This should drive revenue and margin expansion as the mine transitions from commissioning losses to full contribution.

Want to know the growth blueprint behind this bullish price target? The fair value calculation leans on ambitious forecasts for sales, profit margins, and a premium future multiple. Curious which financial leaps and sector dynamics underpin the analysts’ optimism? Uncover the details that could reshape the narrative.

Result: Fair Value of $15.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in bringing Terronera to full production or continued liquidity constraints could quickly shift the optimism around Endeavour Silver's growth outlook.

Find out about the key risks to this Endeavour Silver narrative.

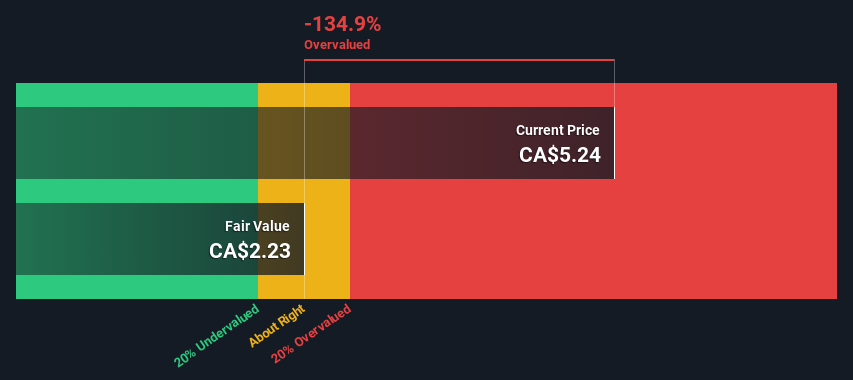

Another View: DCF Model Weighs In

While the analyst price target method suggests Endeavour Silver is undervalued, our DCF model presents a different perspective. According to the SWS DCF model, the company's shares are actually trading well above fair value, indicating potential downside if growth projections fall short. Which narrative will prevail?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Endeavour Silver for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Endeavour Silver Narrative

If this perspective isn't quite your own, or you’d rather dive into the numbers yourself, you can easily craft a personal take in minutes with Do it your way

A great starting point for your Endeavour Silver research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors check multiple angles before making a move. Let Simply Wall Street’s powerful screener point you to fresh opportunities that match your goals and spark new possibilities.

- Catch high-yield trends and unlock steady income by checking out these 17 dividend stocks with yields > 3% among reliable stocks with strong payouts.

- Unleash your portfolio’s future potential by targeting promising breakthroughs in these 24 AI penny stocks, where artificial intelligence is reshaping entire industries.

- Spot undervalued companies with room to grow when you scan these 861 undervalued stocks based on cash flows for compelling bargains based on cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endeavour Silver might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EDR

Endeavour Silver

A silver mining company, engages in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mineral properties in Mexico, Chile, Peru, and the United States.

Exceptional growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives