- Canada

- /

- Metals and Mining

- /

- TSX:DSV

Could Porcupine Complex Drilling Results Hint at a New Growth Phase for Discovery Silver (TSX:DSV)?

Reviewed by Sasha Jovanovic

- Discovery Silver Corp. has reported initial results from four key exploration projects at its Porcupine Complex, including Hoyle Pond, Borden, Pamour Mine, and the high-priority Owl Creek target, following drilling of 85 holes between April and October 2025 as part of a broader 140,000 metre program.

- The drilling outcomes suggest ongoing resource expansion potential and guide planning for further exploration work and resource estimate updates across these assets.

- We will look at how the promising resource growth potential at Porcupine Complex shapes Discovery Silver’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Discovery Silver's Investment Narrative?

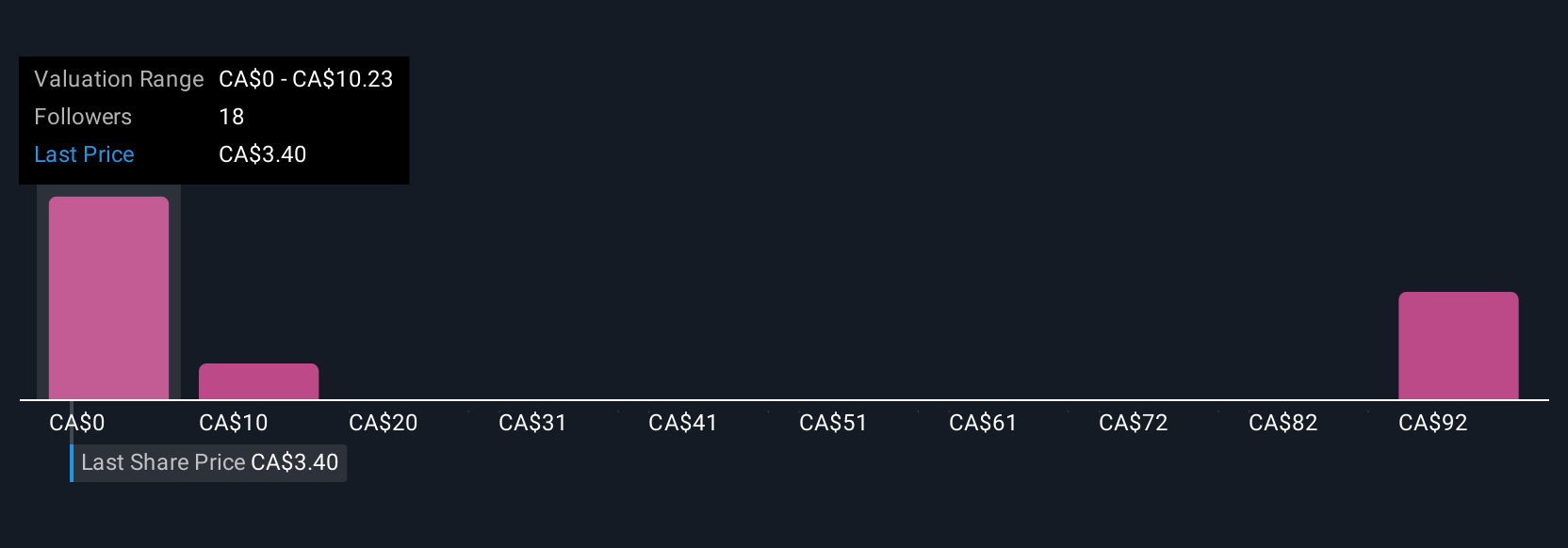

For Discovery Silver, the big picture is about whether investors believe in the company's ability to turn exploration into lasting value and move closer to sustainable profitability. The latest drill results from the Porcupine Complex could change the narrative in the short term by supporting the potential for resource growth, which is often a key catalyst in mining stocks, especially with upcoming updates to mineral resource estimates. These results also arrive at a time when the company has been unprofitable but showing signs of improvement, and amid recent index inclusions, credit facility expansions, and earnings volatility. However, investors still need to weigh ongoing operational risks, such as further required drilling and the need to convert resources to reserves, against an already expensive valuation and recent dilution. The recent news might increase optimism, but it does not remove the core risks related to profitability and management execution, especially considering the company's relatively young executive team.

Yet, beneath these promising drill results, some key risks remain for shareholders to consider. Discovery Silver's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 12 other fair value estimates on Discovery Silver - why the stock might be worth just CA$11.00!

Build Your Own Discovery Silver Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Discovery Silver research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Discovery Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Discovery Silver's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSV

Discovery Silver

A mineral exploration company, engages in the acquisition, exploration, and development of mineral properties in Canada.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives