Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSX:CMMC

What Type Of Shareholder Owns Copper Mountain Mining Corporation's (TSE:CMMC)?

The big shareholder groups in Copper Mountain Mining Corporation (TSE:CMMC) have power over the company. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

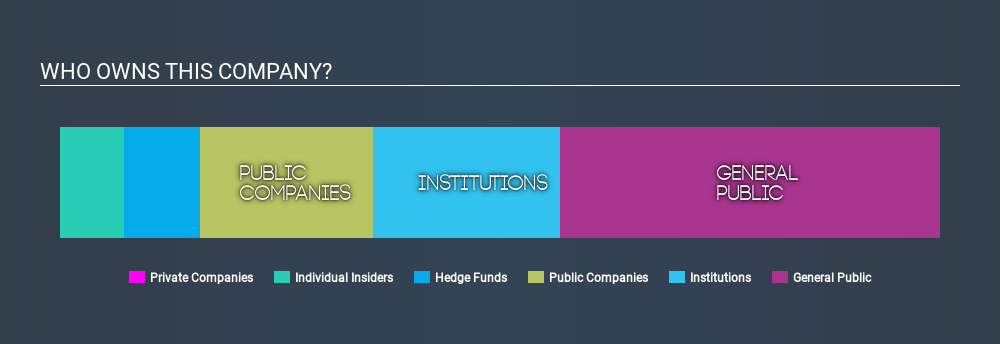

With a market capitalization of CA$68m, Copper Mountain Mining is a small cap stock, so it might not be well known by many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutional investors have bought into the company. Let's take a closer look to see what the different types of shareholder can tell us about Copper Mountain Mining.

Check out our latest analysis for Copper Mountain Mining

What Does The Institutional Ownership Tell Us About Copper Mountain Mining?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

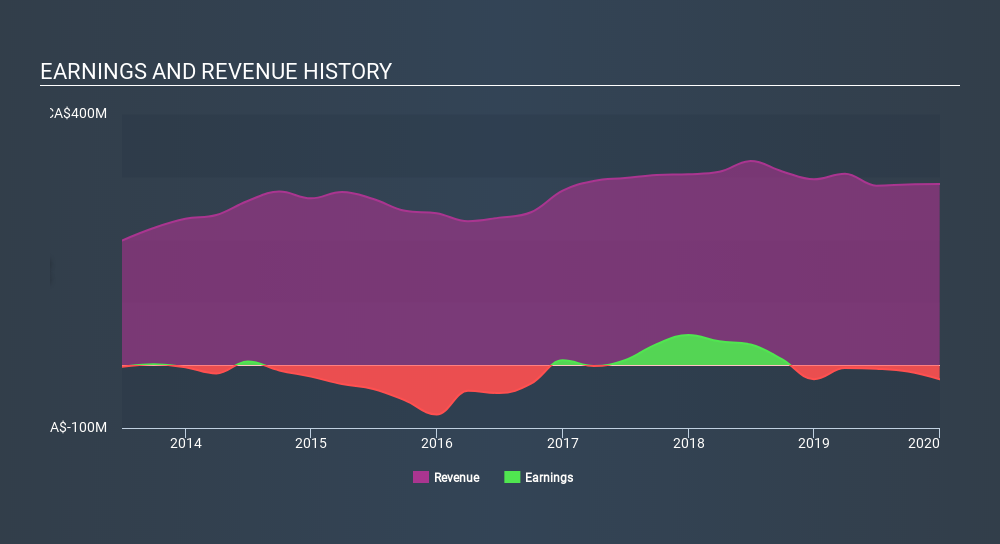

Copper Mountain Mining already has institutions on the share registry. Indeed, they own 21% of the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Copper Mountain Mining's earnings history, below. Of course, the future is what really matters.

It looks like hedge funds own 8.6% of Copper Mountain Mining shares. That's interesting, because hedge funds can be quite active and activist. Many look for medium term catalysts that will drive the share price higher. The company's largest shareholder is Zeta Resources Limited, with ownership of 20%, With 10% and 8.6% of the shares outstanding respectively, Mackenzie Financial Corporation and Anchor Bolt Capital, LP are the second and third largest shareholders.

On further inspection, we found that 51% of the share register is owned by the top 7 shareholders, suggesting that the interests of the larger shareholders are balanced out to an extent by the smaller ones.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Copper Mountain Mining

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

We can see that insiders own shares in Copper Mountain Mining Corporation. It has a market capitalization of just CA$68m, and insiders have CA$4.9m worth of shares, in their own names. Some would say this shows alignment of interests between shareholders and the board, though I generally prefer to see bigger insider holdings. But it might be worth checking if those insiders have been selling.

General Public Ownership

The general public holds a 43% stake in CMMC. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Public Company Ownership

It appears to us that public companies own 20% of CMMC. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Copper Mountain Mining you should be aware of.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:CMMC

Copper Mountain Mining

Copper Mountain Mining Corporation engages in the mining, exploration, and development of mineral properties in Canada.

Good value with reasonable growth potential.