- Canada

- /

- Metals and Mining

- /

- TSX:AYA

Will Boumadine’s Expanded Resource Estimate Rewrite Aya Gold & Silver's (TSX:AYA) Long-Term Growth Story?

Reviewed by Sasha Jovanovic

- Aya Gold & Silver recently announced and filed a new Mineral Resource Estimate and technical report for the Boumadine Polymetallic Project in Morocco, based on over 142,000 meters of drilling, with an additional 130,000 meters of recent drilling not yet included in the estimate.

- An important detail is that ongoing substantial drilling beyond the reported resource could signal further resource growth potential and support a longer mine life at Boumadine.

- We’ll now explore how these updated resource figures and ongoing drilling activity could influence Aya Gold & Silver’s investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Aya Gold & Silver Investment Narrative Recap

Investors in Aya Gold & Silver are buying into the vision that its aggressive drilling and resource growth, particularly at the Boumadine Polymetallic Project, can lay the foundation for significant future production and cash flow. The recent resource estimate confirms progress, but the most important short-term catalyst, the Boumadine Preliminary Economic Assessment (PEA) expected later this year, remains unchanged, while risks tied to operational challenges and resource conversion persist without material change for now.

One especially relevant announcement is the March 2025 completion of over 142,000 meters of drilling for Boumadine, forming the base of the new technical report. This underscores how Aya’s ongoing exploration and the results of the upcoming PEA have become central to the investment case, especially as further drilling could offer upside support for production volumes and mine life.

In contrast to resource optimism, investors should also look closely at the challenges surrounding ore grade dilution and the operational improvements required, as...

Read the full narrative on Aya Gold & Silver (it's free!)

Aya Gold & Silver's outlook anticipates $266.9 million in revenue and $92.6 million in earnings by 2028. This is based on a projected 42.2% annual revenue growth rate and an $102.8 million increase in earnings from the current -$10.2 million figure.

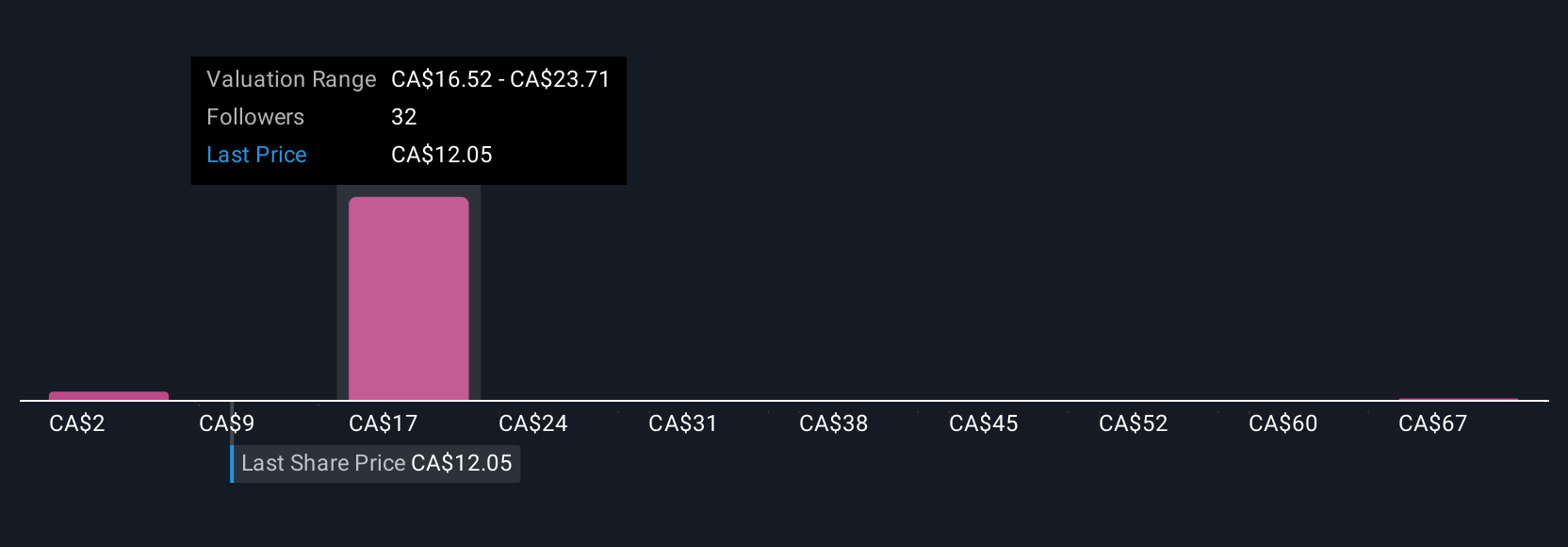

Uncover how Aya Gold & Silver's forecasts yield a CA$22.15 fair value, a 55% upside to its current price.

Exploring Other Perspectives

Eight different fair value estimates from the Simply Wall St Community range from CA$9 to CA$102 per share. This diversity of outlooks sits against the backdrop of substantial resource expansion at Boumadine, highlighting how expectations around future production can widely impact individual assessments of Aya Gold & Silver’s prospects.

Explore 8 other fair value estimates on Aya Gold & Silver - why the stock might be worth 37% less than the current price!

Build Your Own Aya Gold & Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aya Gold & Silver research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Aya Gold & Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aya Gold & Silver's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AYA

Aya Gold & Silver

Engages in the exploration, evaluation, and development of precious metals projects in Morocco.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives