- Canada

- /

- Metals and Mining

- /

- TSX:AYA

How Boumadine PEA Results at Aya Gold & Silver (TSX:AYA) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Aya Gold & Silver Inc. recently announced it will publish the Boumadine Preliminary Economic Assessment (PEA) results before market opens on November 4, 2025, accompanied by a management webinar for analysts, shareholders, and investors.

- The anticipated release offers new insights into Aya's exploration initiatives and operational forecasts, underlining its ongoing expansion and integration within Morocco's mining sector.

- With the Boumadine PEA release drawing near, we'll examine how this key milestone could influence Aya Gold & Silver’s investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Aya Gold & Silver Investment Narrative Recap

To be a shareholder in Aya Gold & Silver, you need to believe in the company's ability to deliver sustainable production growth and resource expansion from its Moroccan assets, especially through successful exploration at Boumadine and operational improvements at Zgounder. The upcoming Boumadine PEA is the most important near-term catalyst, with its results likely to influence market perception and valuation, while the biggest short-term risk remains the potential for operational setbacks or permitting delays in Morocco. The recently announced PEA timing offers transparency but does not materially alter the near-term risk profile or the primary catalyst for the stock.

Among the recent developments, Aya's ongoing drilling success at Boumadine, highlighted by high-grade silver and gold discoveries, aligns directly with the releases expected from the PEA. Continued positive exploration results could play an essential role in validating Boumadine's economic potential and underpin future growth expectations tied to this assessment.

However, investors should also be aware that, despite new milestones, challenges related to Morocco-specific regulatory or permitting delays remain a factor that could affect timelines and project outcomes...

Read the full narrative on Aya Gold & Silver (it's free!)

Aya Gold & Silver's narrative projects $266.9 million revenue and $92.6 million earnings by 2028. This requires 42.2% yearly revenue growth and an $102.8 million earnings increase from current earnings of $-10.2 million.

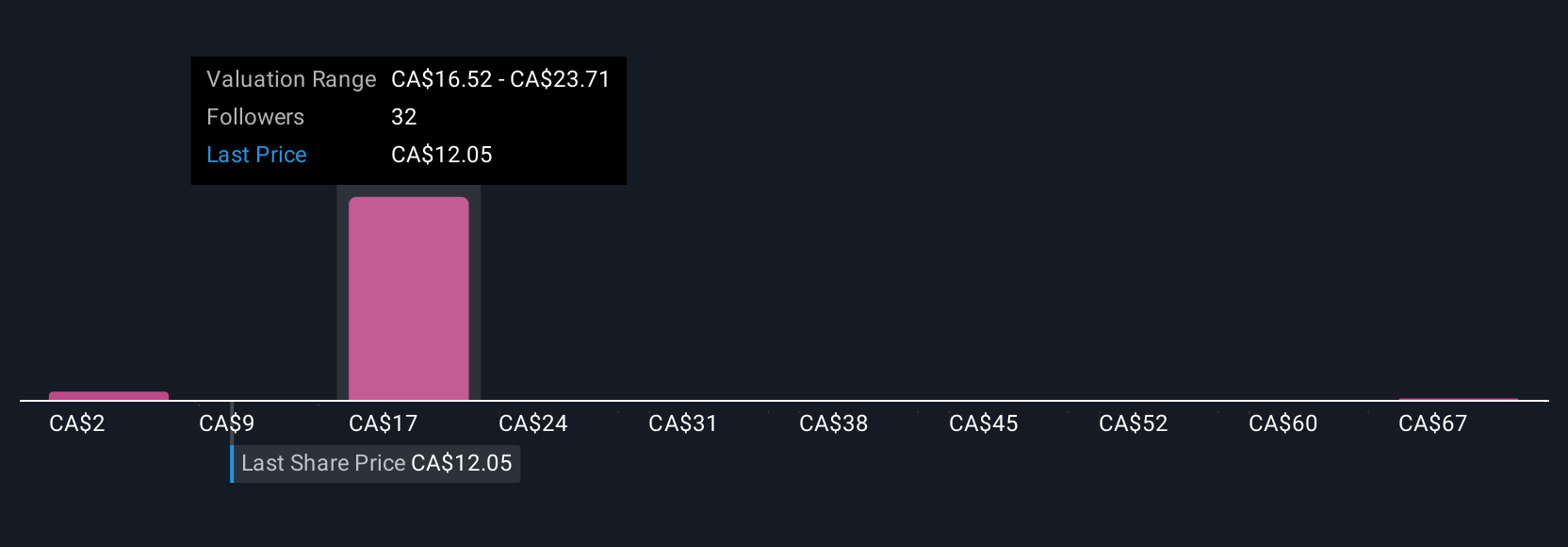

Uncover how Aya Gold & Silver's forecasts yield a CA$21.32 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Eight individual Simply Wall St Community members currently estimate Aya's fair value anywhere from CA$7.92 to CA$102 per share. While project success could propel long-term growth, ongoing reliance on Moroccan operations underscores the importance of monitoring risks linked to jurisdiction.

Explore 8 other fair value estimates on Aya Gold & Silver - why the stock might be worth over 6x more than the current price!

Build Your Own Aya Gold & Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aya Gold & Silver research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Aya Gold & Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aya Gold & Silver's overall financial health at a glance.

No Opportunity In Aya Gold & Silver?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AYA

Aya Gold & Silver

Engages in the exploration, evaluation, and development of precious metals projects in Morocco.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives