- Canada

- /

- Metals and Mining

- /

- TSX:APM

Can Insider Selling at Andean Precious Metals (TSX:APM) Reframe the Story of Operational Progress?

Reviewed by Sasha Jovanovic

- In recent days, Andean Precious Metals experienced increased insider selling, diverging from reports of stronger third-quarter production and continued optimization improvements. This combination has generated unusual interest around the stock as insider actions appear at odds with the company's operational momentum.

- The contrast between insider decisions and underlying business improvements may be shaping investor perceptions and contributing to market volatility for Andean Precious Metals.

- We’ll explore how the rise in insider selling activity may color the investment narrative for Andean Precious Metals moving forward.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Andean Precious Metals Investment Narrative Recap

To remain a shareholder in Andean Precious Metals, investors generally need to believe in the company’s ability to increase production volumes while managing its concentrated exposure to Bolivia and executing on exploration and expansion plans. The recent spike in insider selling, despite better Q3 production and continued processing optimization, is not likely to materially change short-term momentum, but it does introduce uncertainty around investor sentiment, a key risk to watch is potential delays in securing needed permits for the COMIBOL ore agreement, which could affect future expansion plans.

The recent announcement updating 2025 exploration activities at both Golden Queen and San Bartolomé stands out, as it directly supports the company’s stated goals of extending mine life and maximizing production output. With ongoing drilling and the shift to a mineral purchase model, Andean is aiming to further strengthen resource stability, which remains tied to upcoming catalysts like the ramp-up in ore supply under the San Bartolomé-COMIBOL agreement.

In contrast, while operational improvements continue, any setback around permitting for additional ore supply from COMIBOL is something investors should...

Read the full narrative on Andean Precious Metals (it's free!)

Andean Precious Metals' outlook anticipates $352.0 million in revenue and $83.1 million in earnings by 2028. This is based on an annual revenue growth rate of 8.3% and represents a $41.2 million increase in earnings from the current $41.9 million.

Uncover how Andean Precious Metals' forecasts yield a CA$9.89 fair value, a 39% upside to its current price.

Exploring Other Perspectives

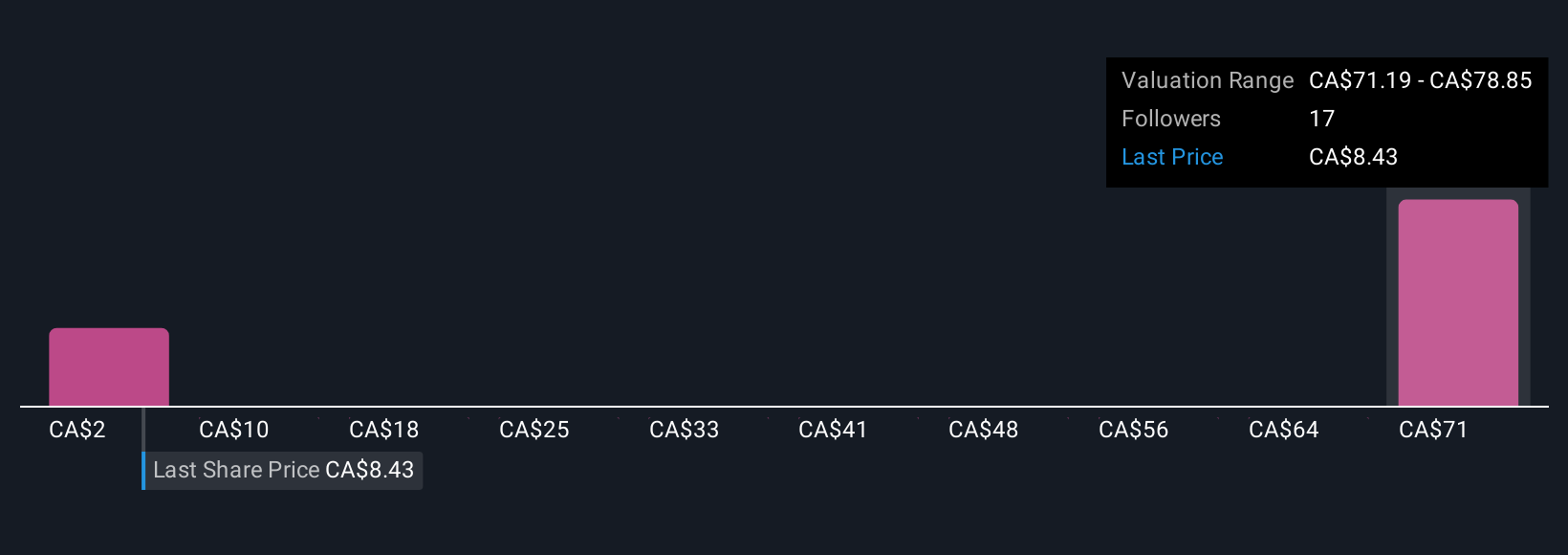

Simply Wall St Community members have posted four fair value estimates for Andean Precious Metals, ranging widely from CA$2.30 to CA$94.84 per share. With uncertainty about environmental permits now looming, you are encouraged to review these varied viewpoints to better understand the risks facing future production growth.

Explore 4 other fair value estimates on Andean Precious Metals - why the stock might be worth less than half the current price!

Build Your Own Andean Precious Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Andean Precious Metals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Andean Precious Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Andean Precious Metals' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:APM

Andean Precious Metals

Engages in the acquisition, exploration, development, and processing of mineral resource properties in the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives