- Canada

- /

- Metals and Mining

- /

- TSX:AII

A Fresh Look at Almonty Industries (TSX:AII) Valuation Following Q3 Profit Surge and Major Growth Milestones

Reviewed by Simply Wall St

Almonty Industries (TSX:AII) just posted third-quarter results that caught the eye with a sizeable profit swing and robust revenue growth compared to last year. These numbers reflect changes unfolding across several fronts.

See our latest analysis for Almonty Industries.

Fresh off a year of major milestones, including the ramp-up at Sangdong, a new U.S. public offering, and active drilling in Portugal, Almonty’s share price has surged, boasting a 545% year-to-date price return and a tremendous 705% total shareholder return over the past twelve months. This kind of momentum suggests that investors are increasingly optimistic about Almonty’s growth trajectory and the company’s strengthening position as a crucial tungsten supplier outside China.

If you’re curious about what other ambitious companies and insiders are capturing the market’s attention, take your next step and discover fast growing stocks with high insider ownership

The big question now is whether Almonty’s remarkable run leaves further upside for investors, or if current prices already reflect all the company’s future promise. Could this be a rare buying opportunity, or is the market a step ahead?

Price-to-Book Ratio of 12.2x: Is it justified?

Almonty Industries is trading at a price-to-book ratio of 12.2x, which is notably higher than its peers and industry benchmarks. With a last close price of CA$9.78, the market is assigning a premium valuation compared to other Canadian metals and mining companies.

The price-to-book ratio measures how much investors are willing to pay for each dollar of net assets. In capital-heavy sectors like mining, this metric often helps assess whether enthusiasm for future prospects overshadows current fundamentals.

Almonty's ratio stands far above the Canadian metals and mining industry average of 2.5x and the peer average of 6.2x. This signals that the market expects outsized growth or is pricing in unique strategic value. Such a high premium could be driven by long-term tungsten market opportunities, operational ramp-up, or investor confidence in management’s execution. However, it also raises the bar for delivering tangible results.

Without a fair value ratio benchmark for comparison, there is limited guidance for where the market might rationally settle. Almonty's current multiple may reflect high expectations, but these valuations are rarely static.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 12.2x (OVERVALUED)

However, significant risks remain if market expectations prove overblown or execution stumbles, such as operational delays or weaker-than-expected tungsten prices.

Find out about the key risks to this Almonty Industries narrative.

Another View: What Does Our DCF Model Reveal?

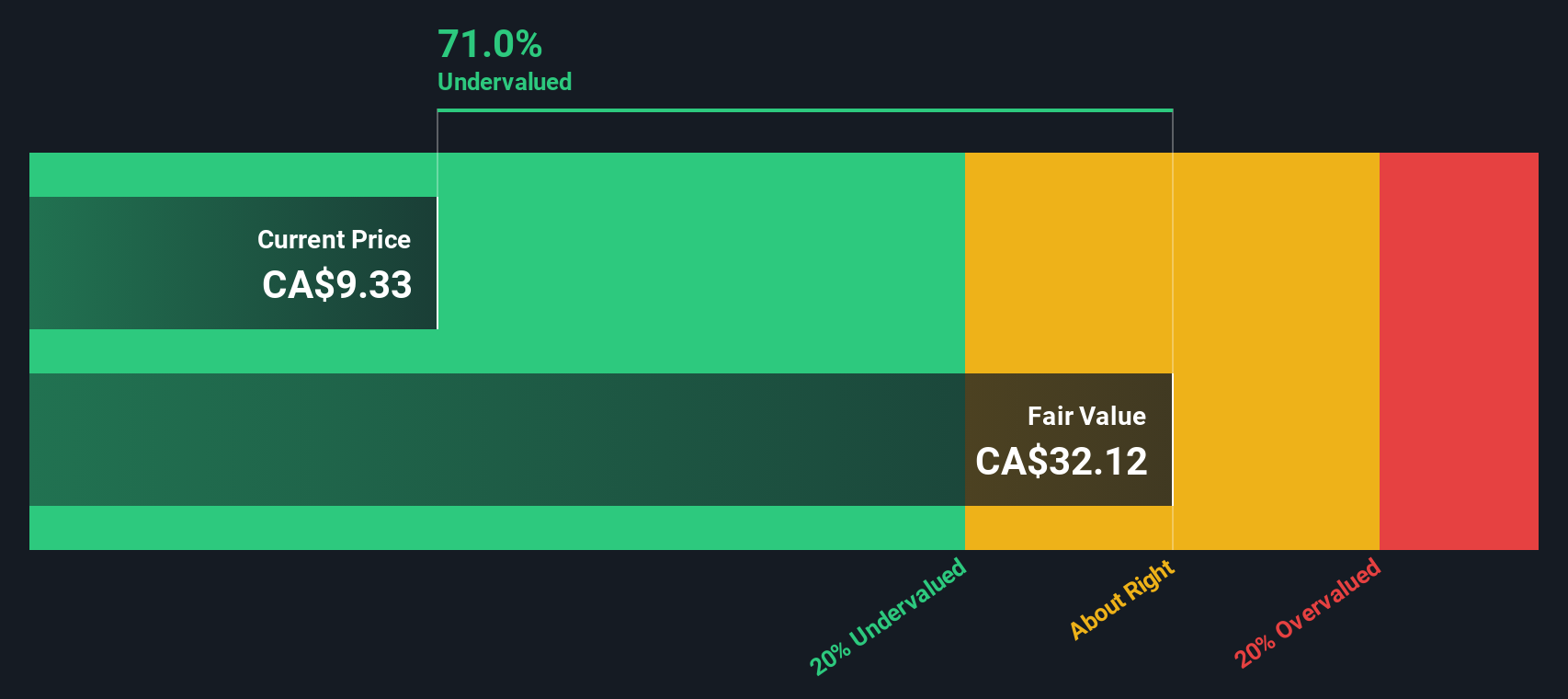

While the price-to-book ratio points to overvaluation, the SWS DCF model takes a broader view of Almonty's long-term cash flow potential. Surprisingly, our DCF model estimates fair value at CA$28.63. This suggests the shares trade about 68% below this level and could be undervalued. Which outcome will the market ultimately trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Almonty Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 869 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Almonty Industries Narrative

If you’re keen to challenge our conclusions or simply prefer your own research approach, you can create and share your personal take in under three minutes. Do it your way

A great starting point for your Almonty Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Standout Opportunities?

Stock markets never stand still, and fresh winners emerge every day. Supercharge your search for the next big idea with targeted screeners tailored for smart, forward-looking investors.

- Tap into high growth potential and spot undervalued companies primed for a turnaround by using these 869 undervalued stocks based on cash flows.

- Capitalize on emerging healthcare breakthroughs by hunting for dynamic possibilities with these 32 healthcare AI stocks.

- Target robust income streams and stability by focusing on reliable performers through these 17 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AII

Almonty Industries

Engages in mining, processing, and shipping of tungsten concentrate.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives