- Canada

- /

- Metals and Mining

- /

- TSX:AAUC

Did Allied Gold’s (TSX:AAUC) Stronger Q3 and Sadiola Expansion Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Allied Gold Corporation recently reported its third quarter 2025 results, revealing sales of US$305.62 million and a net loss of US$17.92 million, both improved over the prior year, alongside updates on major expansion projects at its Sadiola Mine in Mali.

- The combination of stronger operational performance and the advancing Sadiola expansion further highlights Allied Gold's significant resource potential and future production growth initiatives within its portfolio.

- We'll explore how Allied Gold's improved quarterly financials and positive Sadiola Mine developments may shape its investment outlook and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Allied Gold Investment Narrative Recap

To be a shareholder in Allied Gold, you generally need confidence in the company’s ability to translate project expansions, especially at Sadiola, into sustainable, profitable production growth despite operating in higher-risk West African jurisdictions. The latest financial results point to continued operational improvement and progress at Sadiola, but do not materially alter the short-term catalyst, which remains successful execution and ramp-up of Phase 1 at the Sadiola Mine, nor do they shift the core risk of geopolitical instability.

The recent earnings announcement, showing sharply reduced net losses alongside increased sales, is most relevant to assessing Allied Gold’s progress toward financial stability as Sadiola’s expansion advances. With the ramp-up phase expected to boost output and provide greater flexibility, Allied Gold’s near-term upside will depend on delivering the promised production increase and realizing further efficiency improvements.

Yet, in contrast, investors should also be aware of the ongoing material jurisdictional risks across Mali and Côte d’Ivoire, where sudden instability could result in ...

Read the full narrative on Allied Gold (it's free!)

Allied Gold's narrative projects $2.1 billion in revenue and $838.9 million in earnings by 2028. This requires 30.2% yearly revenue growth and a $967.4 million increase in earnings from the current level of -$128.5 million.

Uncover how Allied Gold's forecasts yield a CA$37.56 fair value, a 74% upside to its current price.

Exploring Other Perspectives

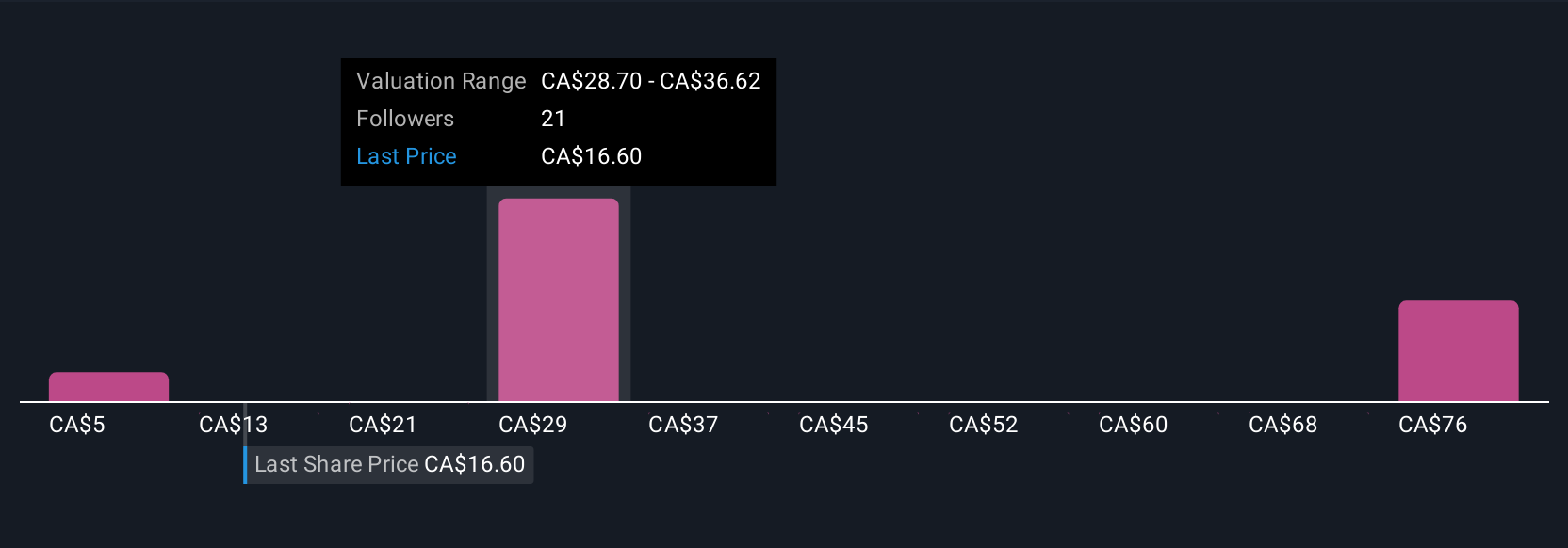

Fair value estimates from eight members of the Simply Wall St Community range widely between CA$6.93 and CA$556.34 per share. While upcoming Sadiola milestones remain a key catalyst, this spread shows how much views can differ on Allied Gold’s risk and return, explore these contrasting perspectives to inform your own assessment.

Explore 8 other fair value estimates on Allied Gold - why the stock might be worth less than half the current price!

Build Your Own Allied Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allied Gold research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Allied Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allied Gold's overall financial health at a glance.

No Opportunity In Allied Gold?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAUC

Very undervalued with high growth potential.

Market Insights

Community Narratives