Will Sun Life (TSX:SLF) Expansion Boost Its Edge in the U.S. Benefits Market?

Reviewed by Sasha Jovanovic

- Sun Life Financial recently announced the expansion of its Family Leave Insurance (FLI) product to seven more U.S. states, increasing its reach to 24 states and offering additional coverage options for employers and employees nationwide.

- This broadened access positions Sun Life to serve a wider spectrum of employers, particularly in states lacking government-mandated paid leave programs, and enhances its offerings in the competitive group benefits market.

- We'll examine how the expansion of Family Leave Insurance enhances Sun Life's competitive position in the U.S. benefits market and investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Sun Life Financial Investment Narrative Recap

To be a shareholder in Sun Life Financial, you need to believe in the company's ability to leverage its expanding U.S. group benefits footprint, ongoing digital innovation, and international growth, particularly in Asia, to deliver steady long-term earnings. The recent Family Leave Insurance expansion supports the U.S. benefits business, but does not materially lessen near-term earnings risks tied to Medicaid pricing pressure and headwinds in the Dental segment.

The most relevant recent announcement is Sun Life’s decision to increase its quarterly common share dividend to CA$0.92. While this increase highlights management’s confidence in the overall financial position and the company’s record of delivering shareholder returns, it doesn’t directly address ongoing margin challenges posed by regulatory and funding volatility in the U.S. health benefits market.

Yet, despite growth initiatives like insurance expansion, investors should be aware that persistent Medicaid funding uncertainty could...

Read the full narrative on Sun Life Financial (it's free!)

Sun Life Financial is expected to reach CA$49.3 billion in revenue and CA$4.5 billion in earnings by 2028. This outlook is based on 13.0% annual revenue growth with an increase in earnings of CA$1.3 billion from the current CA$3.2 billion.

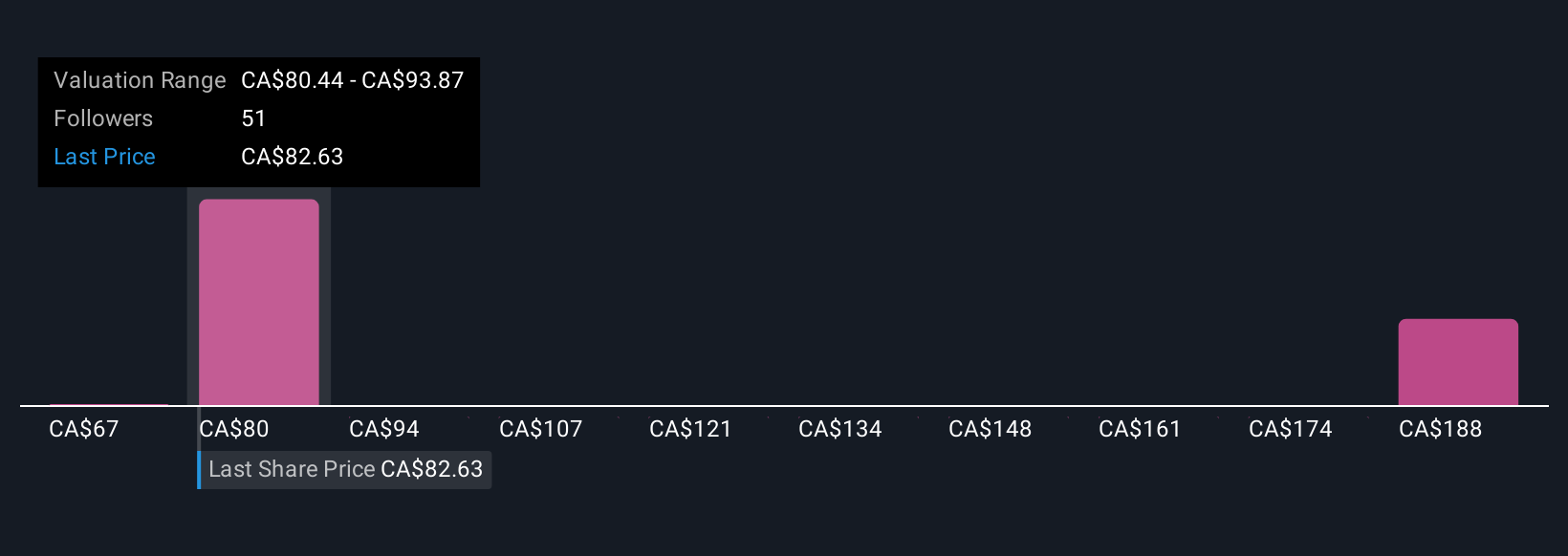

Uncover how Sun Life Financial's forecasts yield a CA$91.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Sun Life’s fair value between CA$91 and CA$213.68, based on three distinct analyses. With U.S. regulatory and Medicaid funding risks still top of mind, wider viewpoints can reveal how opinions differ about Sun Life’s long-term potential.

Explore 3 other fair value estimates on Sun Life Financial - why the stock might be worth over 2x more than the current price!

Build Your Own Sun Life Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sun Life Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sun Life Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sun Life Financial's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives