Should You Be Adding Manulife Financial (TSE:MFC) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Manulife Financial (TSE:MFC), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Manulife Financial

How Quickly Is Manulife Financial Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Manulife Financial has grown EPS by 20% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

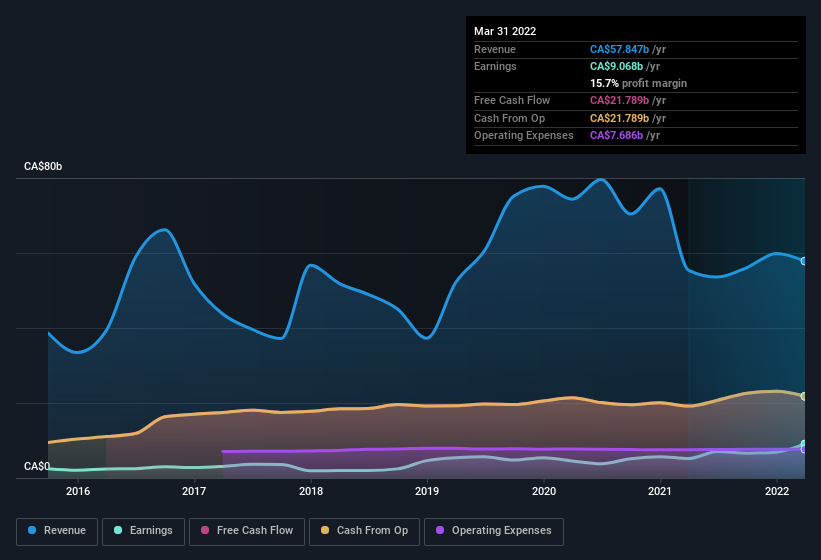

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Manulife Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Manulife Financial shareholders can take confidence from the fact that EBIT margins are up from 13% to 21%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Manulife Financial's future EPS 100% free.

Are Manulife Financial Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold CA$82k worth of shares. But that's far less than the CA$1.3m insiders spent purchasing stock. We find this encouraging because it suggests they are optimistic about Manulife Financial'sfuture. Zooming in, we can see that the biggest insider purchase was by Independent Corporate Director Claude Prieur for CA$1.3m worth of shares, at about CA$23.26 per share.

Along with the insider buying, another encouraging sign for Manulife Financial is that insiders, as a group, have a considerable shareholding. To be specific, they have CA$28m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.06%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Is Manulife Financial Worth Keeping An Eye On?

For growth investors, Manulife Financial's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. Astute investors will want to keep this stock on watch. It is worth noting though that we have found 1 warning sign for Manulife Financial that you need to take into consideration.

Keen growth investors love to see insider buying. Thankfully, Manulife Financial isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MFC

Manulife Financial

Provides financial products and services in the United States, Canada, Asia, and internationally.

Excellent balance sheet established dividend payer.