Manulife (TSX:MFC): Is There Still Value After a Year of Steady Gains?

Reviewed by Simply Wall St

Most Popular Narrative: 10.4% Undervalued

According to the most closely tracked narrative, Manulife Financial is viewed as undervalued by more than 10% compared to its estimated fair value. This outlook is shaped by powerful business drivers across Asia and the US, as well as digital advances and industry trends pointing to further revenue growth ahead.

Ongoing investments in digital transformation, including AI-enabled customer solutions and digitized operational platforms, are enhancing productivity and customer engagement. This positions Manulife to capture share as financial services become increasingly digital and also lowers acquisition and administrative costs. These factors should provide operating leverage and margin expansion over the long term.

What is behind this bold valuation call? The narrative hinges on aggressive growth assumptions, future profit expansion, and a pivotal shift in how Manulife may be priced against its peers. Hungry for the numbers and key assumptions that lead analysts to see such upside even after the recent rally? The drivers, projections, and controversial targets are all waiting for readers who want to dig deeper.

Result: Fair Value of $47.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges such as declining fee revenues in Asia or increased credit losses in the US could quickly undermine this optimistic outlook for Manulife.

Find out about the key risks to this Manulife Financial narrative.Another View: DCF Model Perspective

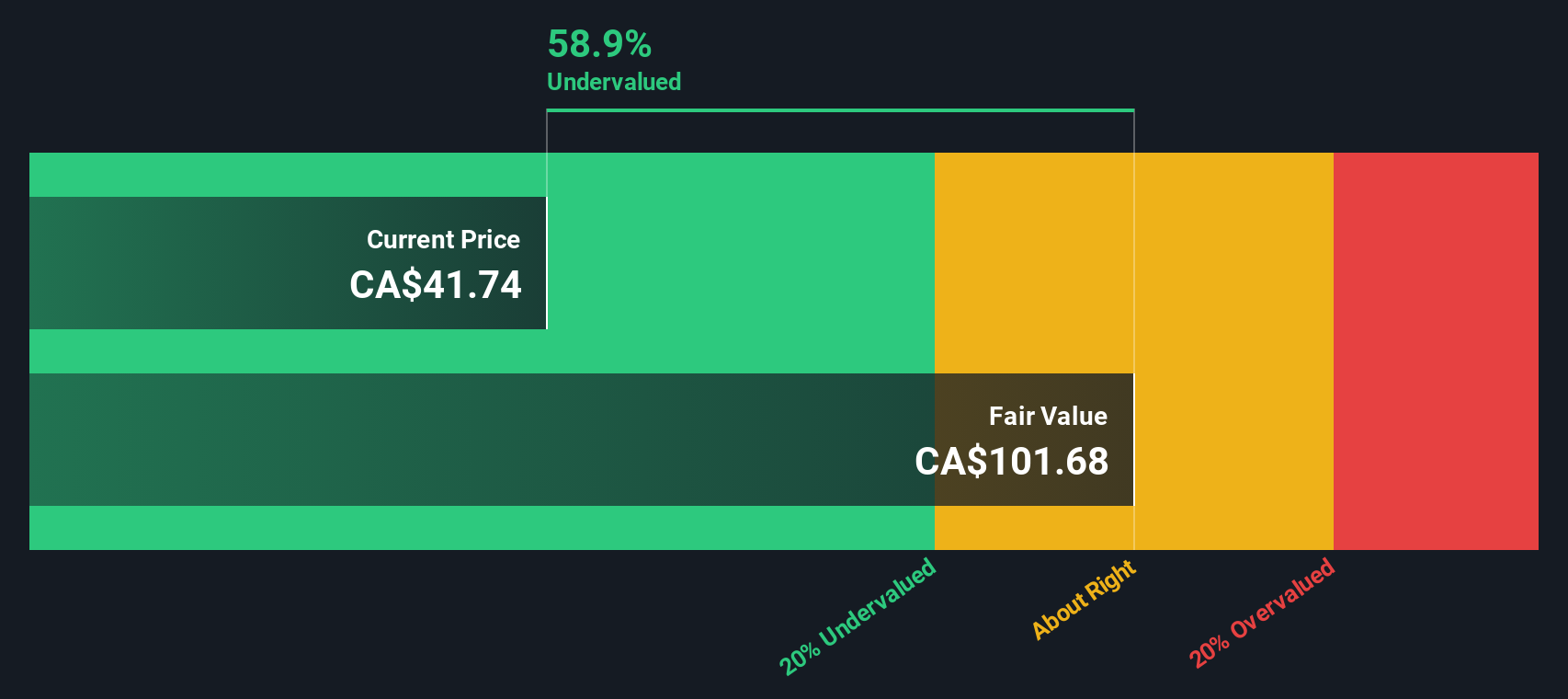

While analysts may see upside through earnings and growth assumptions, our SWS DCF model also suggests the shares are undervalued if you look at the company’s cash flows into the future. However, does this tell the whole story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Manulife Financial Narrative

If you see things differently or would rather follow your own data trail, you can build a personalized perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Manulife Financial.

Looking for More Unique Investment Ideas?

Great opportunities rarely wait around. Use the Simply Wall Street Screener to uncover bold ideas and stay a step ahead in your investing strategy.

- Unlock fresh value by spotting opportunities with undervalued stocks based on cash flows. See which companies are trading below their true potential based on future cash flows.

- Pounce on breakthrough tech trends by searching for AI penny stocks. Discover companies shaping tomorrow with innovations in artificial intelligence.

- Grow your income stream by seeking out dividend stocks with yields > 3% and find stocks offering robust dividend yields for steady long-term gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:MFC

Manulife Financial

Provides financial products and services in the United States, Canada, Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives