For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like iA Financial (TSE:IAG). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for iA Financial

iA Financial's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, iA Financial has grown EPS by 11% per year. That's a good rate of growth, if it can be sustained.

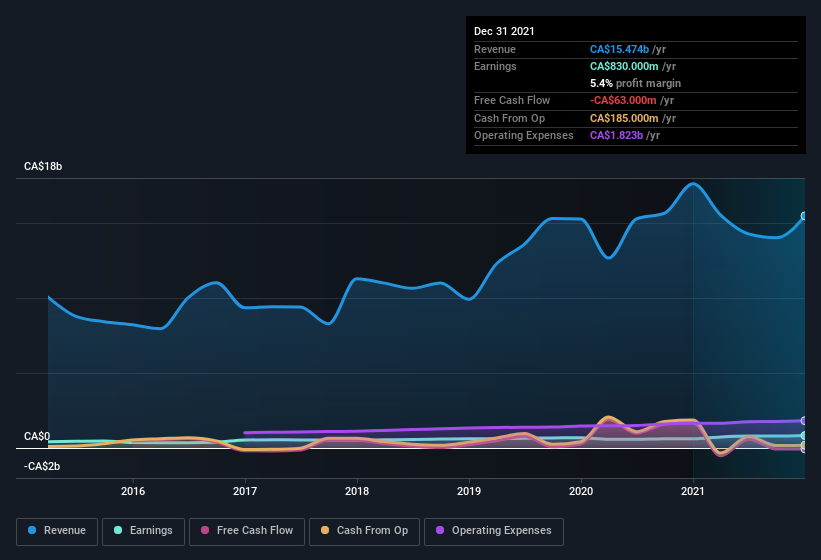

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that iA Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Unfortunately, iA Financial's revenue dropped 12% last year, but the silver lining is that EBIT margins improved from 4.8% to 7.6%. That falls short of ideal.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of iA Financial's forecast profits?

Are iA Financial Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite -CA$128k worth of sales, iA Financial insiders have overwhelmingly been buying the stock, spending CA$904k on purchases in the last twelve months. You could argue that level of buying implies genuine confidence in the business. It is also worth noting that it was Executive VP & Chief Growth Officer Michael Stickney who made the biggest single purchase, worth CA$352k, paying CA$68.96 per share.

Is iA Financial Worth Keeping An Eye On?

One positive for iA Financial is that it is growing EPS. That's nice to see. While some companies are struggling to grow EPS, iA Financial seems free from that morose affliction. The cherry on top is the insider share purchases, which provide an extra impetus to keep and eye on this stock, at the very least. We should say that we've discovered 1 warning sign for iA Financial that you should be aware of before investing here.

The good news is that iA Financial is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if iA Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IAG

iA Financial

Provides insurance and wealth management services in Canada and the United States.

Established dividend payer with proven track record.