- Canada

- /

- Personal Products

- /

- TSX:JWEL

Jamieson Wellness (TSX:JWEL): Assessing Valuation After Strong Q3 Sales, Earnings, and Dividend Update

Reviewed by Simply Wall St

Jamieson Wellness (TSX:JWEL) just released its third quarter results, showing double-digit growth in both revenue and net income. The company’s branded products and international markets fueled these gains for investors.

See our latest analysis for Jamieson Wellness.

Jamieson Wellness has kept investors on their toes this year, with strong Q3 results and a fresh dividend helping offset earlier share price weakness. While the stock saw a modest one-day share price lift of 2.5% after recent news, its longer-term momentum tells a steadier story. The 12-month total shareholder return stands at 0.7%, and its three-year total return sits at 14.3%, underlining that progress has been solid if unspectacular. Momentum appears to be rebuilding as the company delivers on growth promises and continues to invest in international expansion.

If the mix of steady returns and resilient performance has you interested in what else is out there, now’s the perfect moment to discover fast growing stocks with high insider ownership

With Jamieson’s shares still trading at a discount to analyst targets despite impressive earnings momentum, the question remains: is all this growth fully reflected in today's price, or could investors be overlooking a buying opportunity?

Price-to-Earnings of 23.5x: Is it justified?

Jamieson Wellness shares currently trade at a 23.5x price-to-earnings multiple, which stands well above key peer group averages and industry norms. At the last close of CA$35.09, the stock appears expensive compared to its listed benchmarks.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for a dollar of current earnings. For a consumer health and wellness company like Jamieson, the P/E multiple reflects what the market expects from future growth and current profitability.

This premium valuation prompts questions about whether investors are paying up for recent profit momentum or overestimating the company's continued earnings expansion. The high multiple may be a signal that the market is optimistic about Jamieson's prospects, but it also raises the bar for future financial performance.

Compared to peers, Jamieson's 23.5x P/E far exceeds the peer average of 13.5x and the North American Personal Products industry average of 20.5x. The premium is clear; investors are valuing the company more richly than competitors, suggesting heightened expectations for sustained growth or defensiveness.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 23.5x (OVERVALUED)

However, weaker momentum in recent quarters and global economic uncertainty could put pressure on Jamieson's premium valuation in the future.

Find out about the key risks to this Jamieson Wellness narrative.

Another View: Our DCF Model Suggests Undervaluation

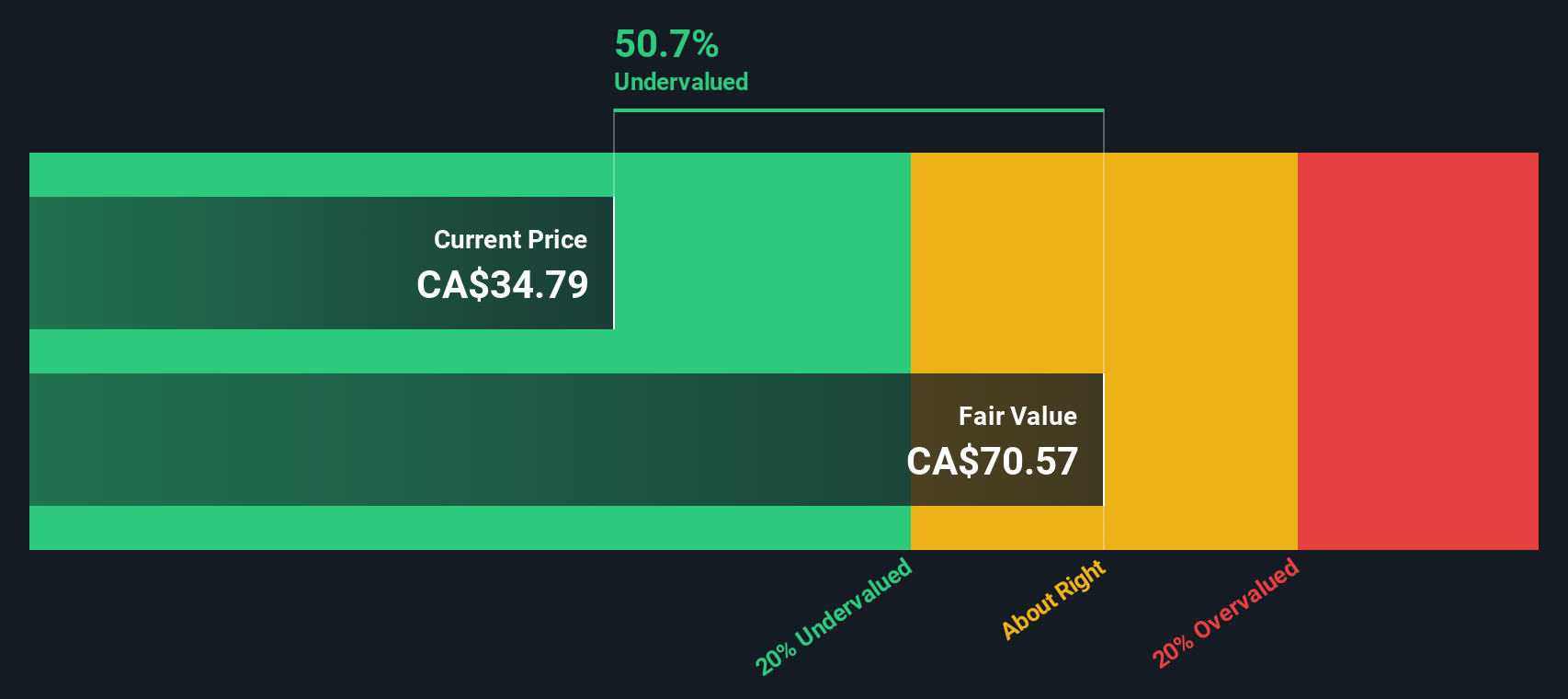

While the price-to-earnings ratio hints at overvaluation, our SWS DCF model presents a very different perspective. According to this approach, Jamieson Wellness is trading at a steep 55.3% discount to its estimated fair value. This suggests significant upside if market sentiment eventually aligns with cash flow fundamentals. Could this disconnect between valuation methods present an opportunity for long-term investors, or does it signal risks in current market assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jamieson Wellness for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jamieson Wellness Narrative

If you see things differently or want to dig into the numbers yourself, it's quick and straightforward to build your own view in just a few minutes. Do it your way

A great starting point for your Jamieson Wellness research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their radar up for fresh opportunities. Set yourself apart by checking out targeted stock ideas poised to deliver strong potential right now.

- Unlock the future of medicine and innovation when you examine these 32 healthcare AI stocks, which is solving real health challenges with artificial intelligence breakthroughs.

- Grow your portfolio’s income stream by reviewing these 16 dividend stocks with yields > 3%, which offers high yields and steady returns above 3%.

- Catch the wave of tomorrow’s blockchain revolution by investigating these 82 cryptocurrency and blockchain stocks, found at the cutting edge of digital asset technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:JWEL

Jamieson Wellness

Develops, manufactures, distributes, markets, and sells the natural health products for human in Canada, the United States, China, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives