- Canada

- /

- Diversified Financial

- /

- TSXV:AFCC.H

3 TSX Penny Stocks With Under CA$30M Market Cap

Reviewed by Simply Wall St

As Canadian markets continue to brush off potential volatility, closing October near record highs, investors are increasingly exploring diverse opportunities. Penny stocks, while often seen as a niche investment area, remain relevant for those seeking growth potential in smaller or newer companies. These stocks can offer a blend of affordability and opportunity when backed by strong financial health; let's explore three examples that stand out for their balance sheet strength and long-term promise.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.26 | CA$58.9M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.22 | CA$236.76M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.425 | CA$3.55M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.03 | CA$671.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.08 | CA$20.61M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.16 | CA$936.88M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.86 | CA$148.2M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.06 | CA$196.03M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.73 | CA$9.08M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 412 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Automotive Finco (TSXV:AFCC.H)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Automotive Finco Corp. is a specialty finance company that focuses on the auto retail sector in Canada and internationally, with a market cap of CA$20.61 million.

Operations: The company generates CA$3.05 million in revenue from debt financing and other investments within the auto retail sector.

Market Cap: CA$20.61M

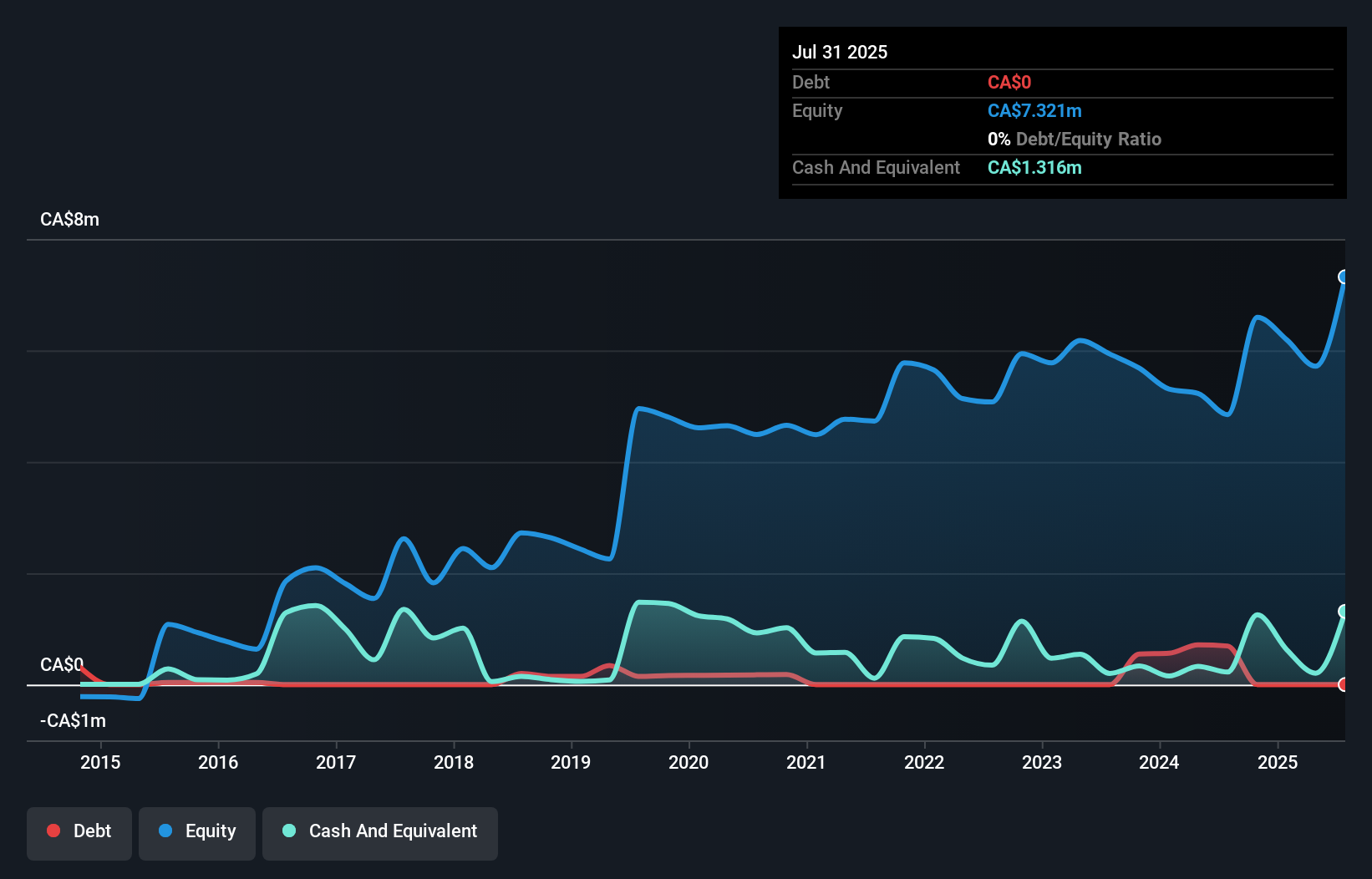

Automotive Finco Corp., with a market cap of CA$20.61 million, operates in the auto retail sector, generating CA$3.05 million in revenue. It has no long-term liabilities and is debt-free, which positions it well financially despite its low Return on Equity of 8.2%. The company trades below its estimated fair value but offers a high dividend yield that isn't fully covered by free cash flows, indicating potential sustainability concerns. Recent earnings show stable performance with net income slightly increasing over six months to CA$1.04 million, while dividends remain consistent at an annual rate of CA$0.205 per share.

- Dive into the specifics of Automotive Finco here with our thorough balance sheet health report.

- Explore historical data to track Automotive Finco's performance over time in our past results report.

Latin Metals (TSXV:LMS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Latin Metals Inc. is an exploration stage company focused on acquiring, exploring, and evaluating mineral properties in South America, with a market cap of CA$27.32 million.

Operations: Latin Metals Inc. currently does not report any revenue segments as it is in the exploration stage of its operations.

Market Cap: CA$27.32M

Latin Metals Inc., with a market cap of CA$27.32 million, is in the exploration stage and pre-revenue, focusing on mineral properties in South America. Recent developments include a binding agreement with Daura Gold Corp., allowing Daura to earn up to an 80% interest in two projects by completing 28,000m of drilling over 38 months. The company has no debt and covers short-term liabilities with CA$1.6 million in assets but faces high volatility and less than one year of cash runway if current cash flow trends persist. AngloGold's withdrawal from an option agreement highlights strategic shifts impacting partnerships.

- Click here and access our complete financial health analysis report to understand the dynamics of Latin Metals.

- Gain insights into Latin Metals' past trends and performance with our report on the company's historical track record.

Nova Leap Health (TSXV:NLH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nova Leap Health Corp. operates in the United States and Canada, offering home and home health care services, with a market cap of CA$24.45 million.

Operations: The company's revenue is primarily generated from its operations in the United States, contributing $23.12 million, and Canada, contributing $4.99 million.

Market Cap: CA$24.45M

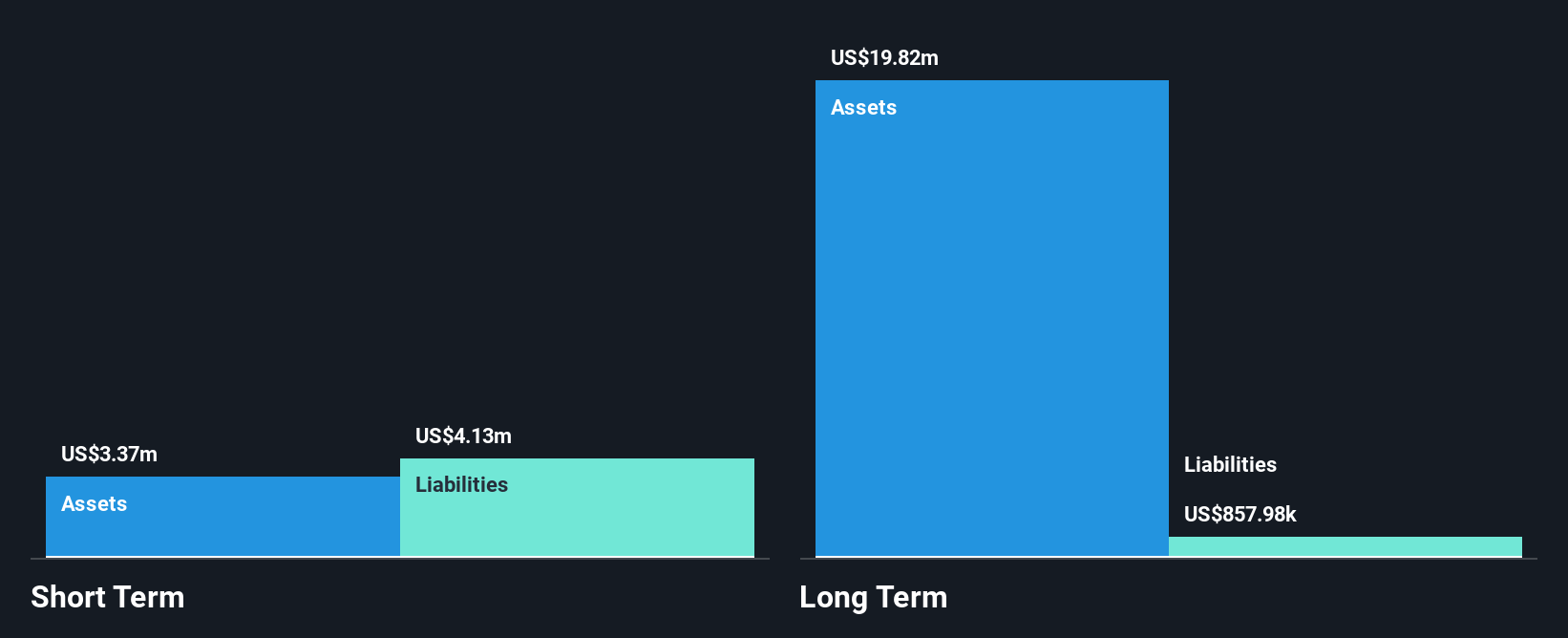

Nova Leap Health Corp., with a market cap of CA$24.45 million, operates in the home health care sector across the U.S. and Canada, generating US$23.12 million and US$4.99 million in revenue respectively. The company has reduced its debt to equity ratio significantly over five years to 12.5%, while maintaining satisfactory coverage of interest payments through EBIT (3.4x). However, it faces challenges such as negative earnings growth and declining net profit margins (0.4%). Recent quarterly results show improvement with a net income of US$0.43 million compared to a loss last year, though nine-month figures reflect an overall loss.

- Click here to discover the nuances of Nova Leap Health with our detailed analytical financial health report.

- Gain insights into Nova Leap Health's historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Investigate our full lineup of 412 TSX Penny Stocks right here.

- Curious About Other Options? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AFCC.H

Automotive Finco

A specialty finance company, focuses on the auto retail sector in Canada and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives