- Canada

- /

- Healthcare Services

- /

- TSX:QIPT

Quipt Home Medical (TSE:QIPT) pops 15% this week, taking five-year gains to 185%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on a lighter note, a good company can see its share price rise well over 100%. Long term Quipt Home Medical Corp. (TSE:QIPT) shareholders would be well aware of this, since the stock is up 185% in five years. It's even up 15% in the last week. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Quipt Home Medical

Quipt Home Medical wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Quipt Home Medical saw its revenue grow at 28% per year. Even measured against other revenue-focussed companies, that's a good result. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 23% per year, in that time. This suggests the market has well and truly recognized the progress the business has made. Quipt Home Medical seems like a high growth stock - so growth investors might want to add it to their watchlist.

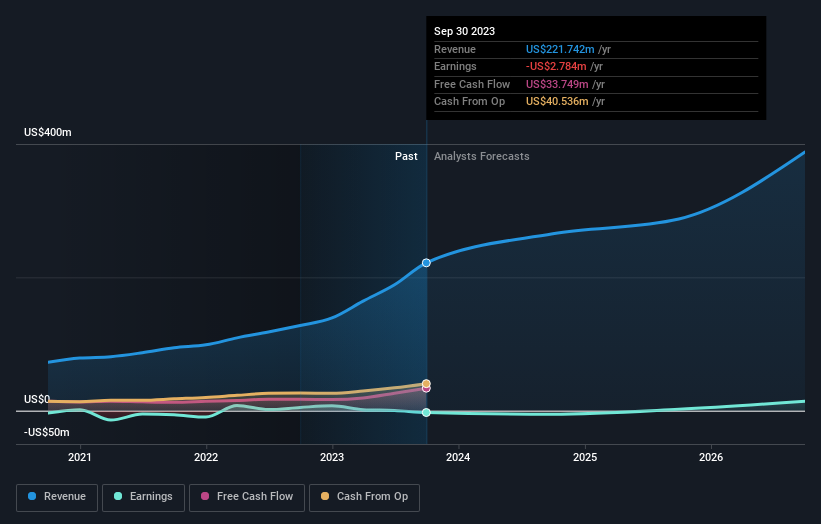

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Quipt Home Medical stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Quipt Home Medical provided a TSR of 8.2% over the year. That's fairly close to the broader market return. It has to be noted that the recent return falls short of the 23% shareholders have gained each year, over half a decade. Although the share price growth has slowed, the longer term story points to a business well worth watching. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Quipt Home Medical that you should be aware of.

We will like Quipt Home Medical better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Quipt Home Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:QIPT

Quipt Home Medical

Through its subsidiaries, engages in the provision of durable and home medical equipment and supplies in the United States.

Undervalued with excellent balance sheet.