- Canada

- /

- Metals and Mining

- /

- TSXV:SMD

Helium Evolution And 2 Other Promising Penny Stocks On TSX

Reviewed by Simply Wall St

As the Canadian market navigates potential challenges from tariffs and trade uncertainties, diversification remains a key strategy for investors seeking stability and growth. Penny stocks, although an older term, continue to capture interest due to their affordability and potential for significant returns when backed by strong financials. In this article, we explore several penny stocks that stand out for their financial strength and long-term potential amidst current market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.71 | CA$1B | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$177.31M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.70 | CA$439.49M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.45 | CA$120.49M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.51 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$628.96M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.39 | CA$236.24M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$0.99 | CA$26.06M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.17 | CA$228.22M | ★★★★☆☆ |

Click here to see the full list of 940 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Helium Evolution (TSXV:HEVI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Helium Evolution Incorporated focuses on the exploration and production of helium in southern Saskatchewan, with a market cap of CA$19.21 million.

Operations: Helium Evolution Incorporated has not reported any revenue segments.

Market Cap: CA$19.21M

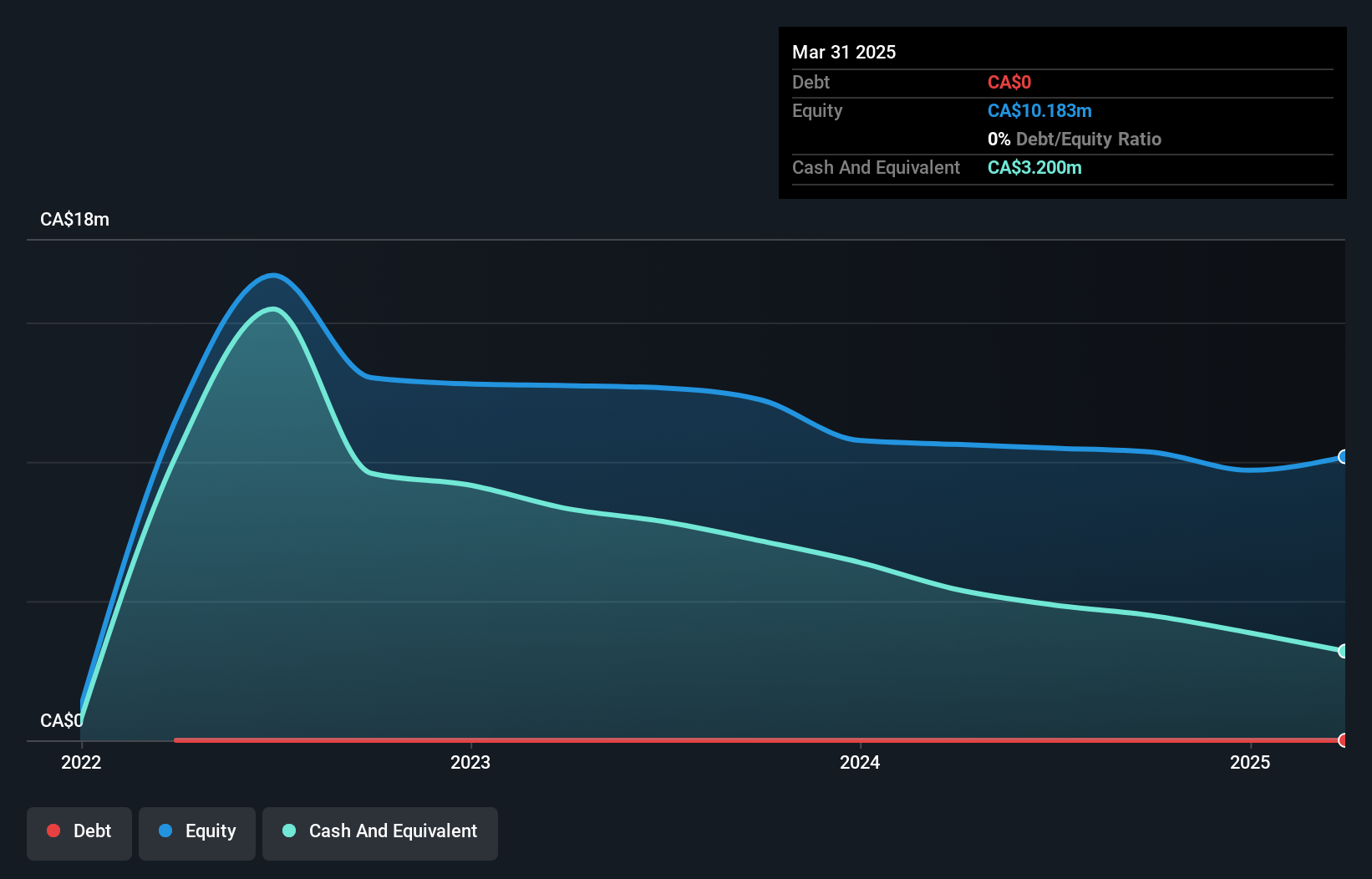

Helium Evolution Incorporated, with a market cap of CA$19.21 million, is pre-revenue and focuses on helium exploration in Saskatchewan. Recent developments include promising test results from its 10-36 Well, showing production rates of 11.5 MMscf/d with a helium content of 0.81%, well above the commercial threshold. The company holds a 20% interest in several wells alongside North American Helium Inc., indicating potential growth opportunities despite high share price volatility and current unprofitability. With sufficient cash runway for over a year and no debt, Helium Evolution is positioned to pursue further exploration activities in the Mankota area.

- Get an in-depth perspective on Helium Evolution's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Helium Evolution's track record.

Strategic Metals (TSXV:SMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Strategic Metals Ltd. acquires, explores, and evaluates mineral properties in Canada with a market cap of CA$19.42 million.

Operations: Strategic Metals Ltd. does not report any revenue segments.

Market Cap: CA$19.42M

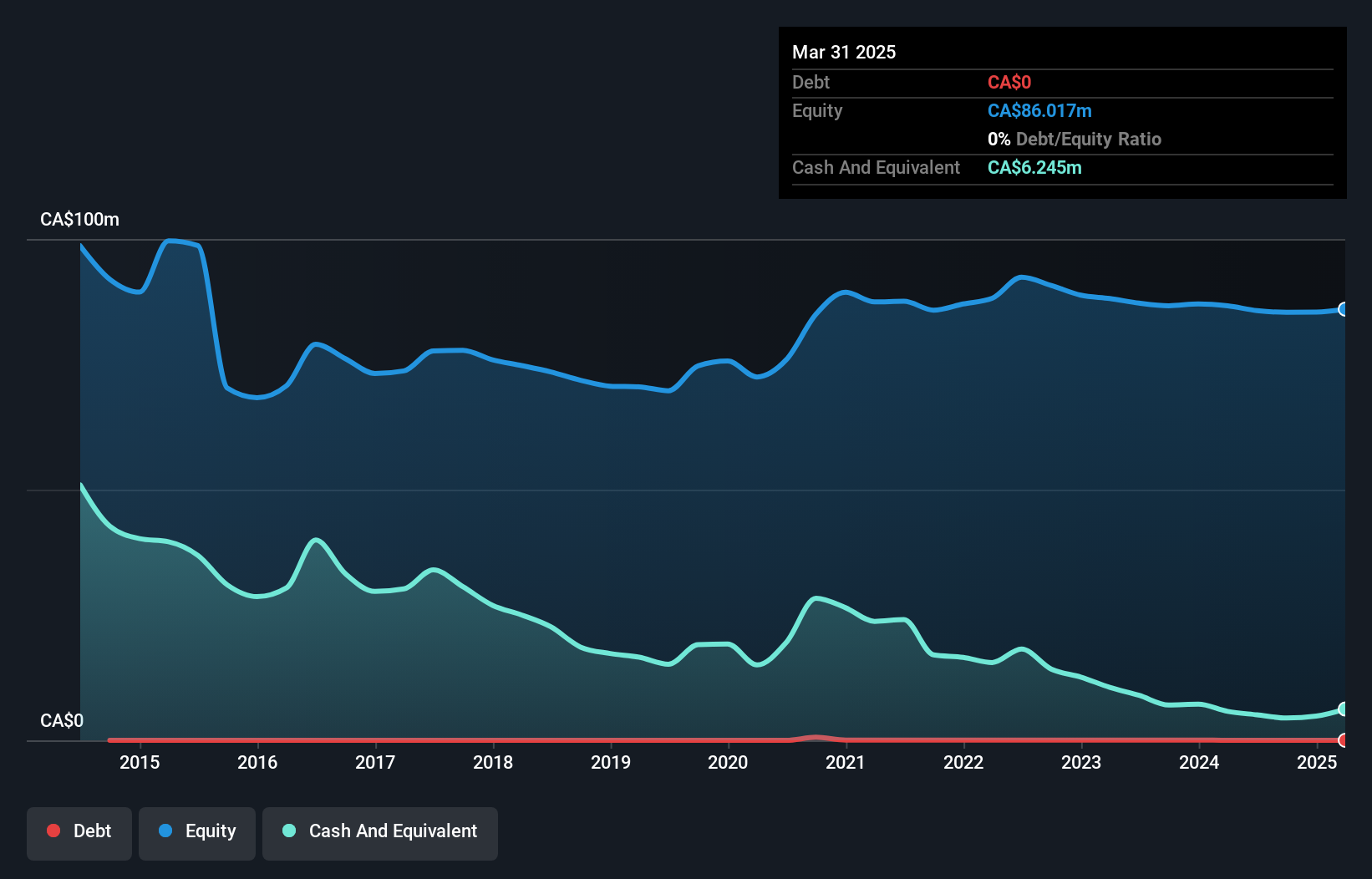

Strategic Metals Ltd., with a market cap of CA$19.42 million, is pre-revenue and focused on mineral exploration in Canada. The company recently announced a share repurchase program to buy back up to 8,500,000 shares, aiming to capitalize on potential price weaknesses using unallocated cash resources. Despite being debt-free and having experienced management and board members, the company remains unprofitable with declining earnings over the past five years at a rate of 18.9% annually. Strategic Metals has sufficient cash runway for more than a year but faces challenges covering long-term liabilities with its current assets.

- Click here and access our complete financial health analysis report to understand the dynamics of Strategic Metals.

- Assess Strategic Metals' previous results with our detailed historical performance reports.

Yangarra Resources (TSX:YGR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangarra Resources Ltd. is a junior oil and gas company focused on the exploration, development, and production of oil and natural gas properties in Western Canada, with a market cap of CA$100.71 million.

Operations: The company generates revenue from the production, exploration, and development of resource properties, amounting to CA$128.67 million.

Market Cap: CA$100.71M

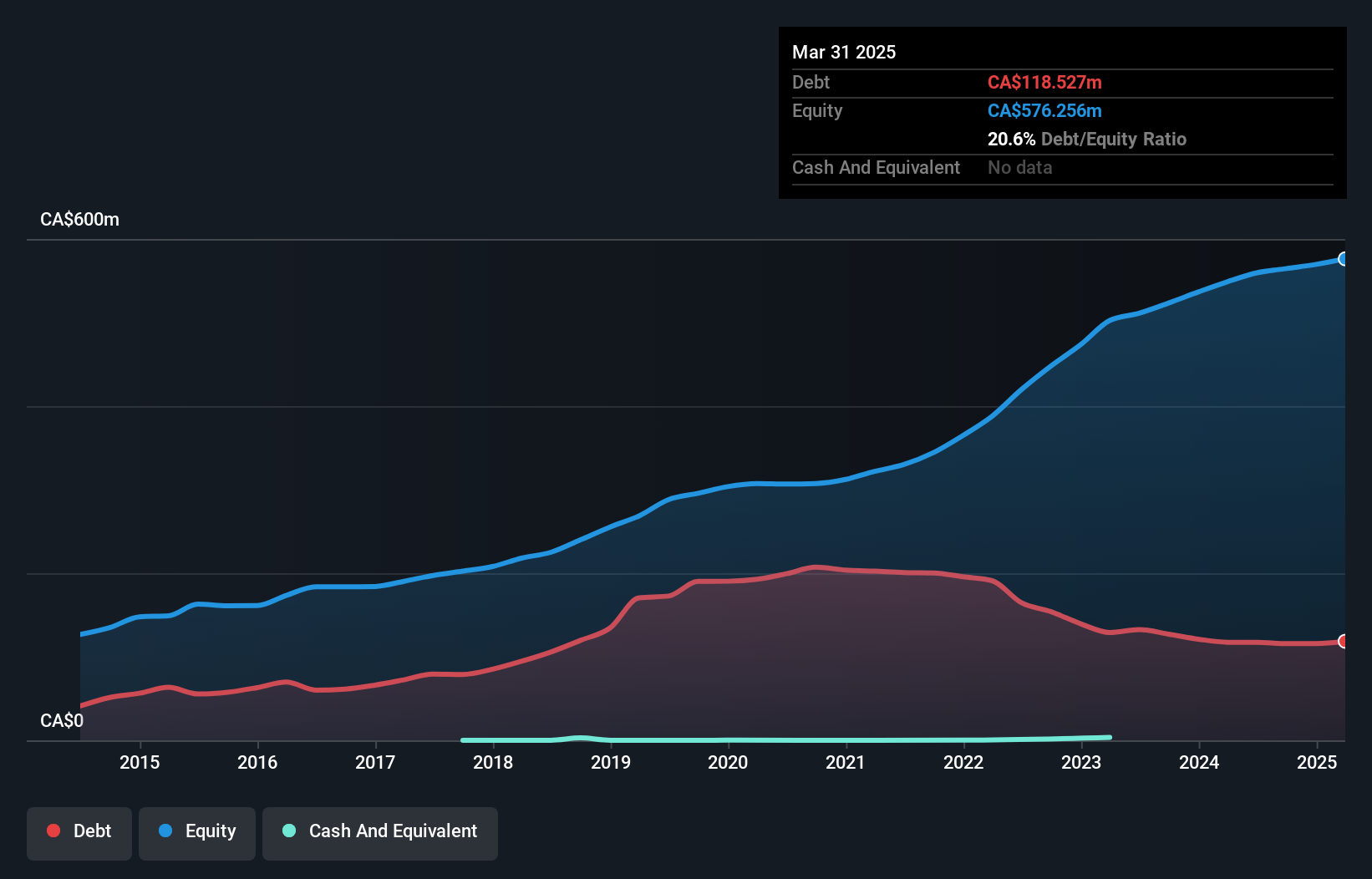

Yangarra Resources, with a market cap of CA$100.71 million, has shown mixed financial performance. While its short-term assets exceed short-term liabilities and it maintains a satisfactory net debt to equity ratio of 20.5%, long-term liabilities remain uncovered by current assets. The company's interest payments are well covered by EBIT, indicating manageable debt servicing capabilities. Despite high-quality earnings and stable weekly volatility, Yangarra reported negative earnings growth over the past year and lower profit margins compared to the previous year. Analysts predict potential stock price appreciation, but challenges persist in aligning growth with industry trends.

- Navigate through the intricacies of Yangarra Resources with our comprehensive balance sheet health report here.

- Evaluate Yangarra Resources' prospects by accessing our earnings growth report.

Summing It All Up

- Reveal the 940 hidden gems among our TSX Penny Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SMD

Strategic Metals

An exploration stage company, acquires, explores for, and evaluates mineral properties in Canada.

Flawless balance sheet with low risk.

Market Insights

Community Narratives