Stock Analysis

- Canada

- /

- Oil and Gas

- /

- TSX:FRU

Undiscovered Gems Three Canadian Stocks To Watch In August 2024

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has risen 1.1%, driven by gains of 1.4% in one sector. The market is up 15% over the last 12 months, with earnings expected to grow by 16% per annum over the next few years. In this promising environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding. Here are three Canadian stocks that stand out as undiscovered gems to watch in August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Jaguar Mining | 1.19% | 5.49% | 5.12% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Tornado Global Hydrovacs | 14.62% | 24.52% | 64.90% | ★★★★★☆ |

| Reconnaissance Energy Africa | NA | 31.73% | -6.92% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Firan Technology Group | 17.91% | 3.75% | 23.32% | ★★★★★☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Freehold Royalties (TSX:FRU)

Simply Wall St Value Rating: ★★★★☆☆

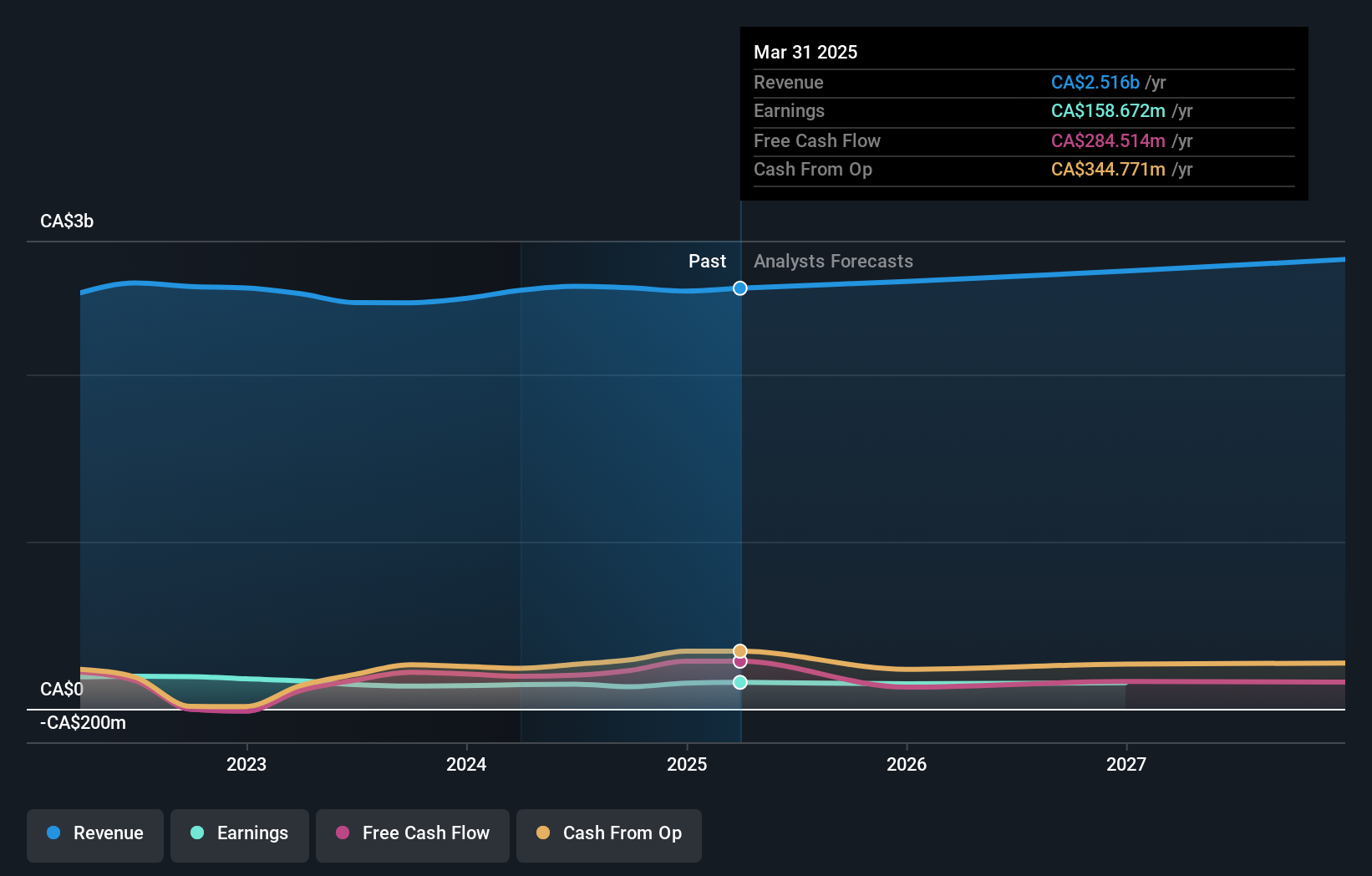

Overview: Freehold Royalties Ltd. acquires and manages royalty interests in crude oil, natural gas, natural gas liquids, and potash properties in Western Canada and the United States, with a market cap of CA$2.09 billion.

Operations: Freehold Royalties Ltd. generates revenue primarily from its oil and gas exploration and production segment, amounting to CA$323.04 million. The company focuses on managing royalty interests across various energy resources in Western Canada and the United States.

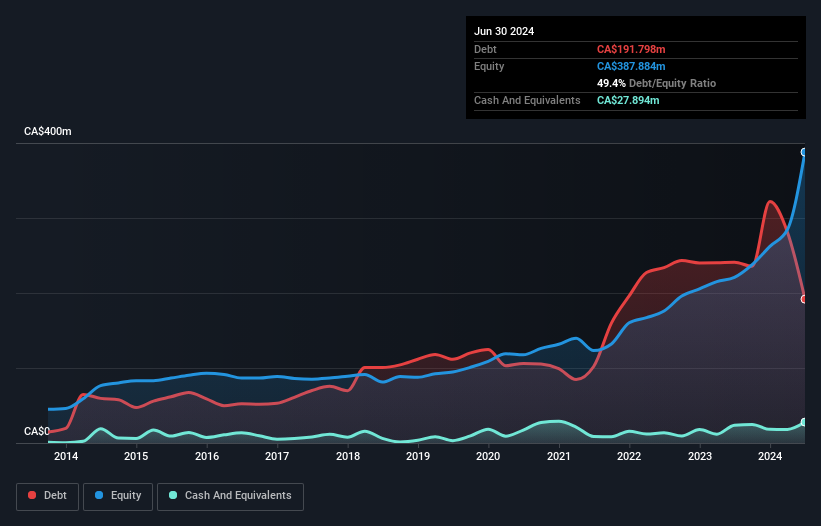

Freehold Royalties, a small-cap Canadian entity, reported impressive Q2 2024 results with CAD 39.3 million in net income, up from CAD 24.26 million the previous year. Their production increased by 4% quarter-over-quarter to 15,221 boe/d and oil production rose by 7% to 7,899 bbls/d. The company trades at a significant discount (57.8%) below estimated fair value and has high-quality earnings with EBIT covering interest payments by 15.3 times. Net debt to equity ratio stands at a satisfactory level of 24.6%.

- Take a closer look at Freehold Royalties' potential here in our health report.

Assess Freehold Royalties' past performance with our detailed historical performance reports.

Leon's Furniture (TSX:LNF)

Simply Wall St Value Rating: ★★★★★★

Overview: Leon's Furniture Limited, along with its subsidiaries, operates as a retailer of home furnishings, mattresses, appliances, and electronics in Canada with a market cap of approximately CA$2.04 billion.

Operations: Leon's Furniture generates revenue primarily from the sale of home furnishings, mattresses, appliances, and electronics totaling CA$2.53 billion. The company has a market cap of approximately CA$2.04 billion.

Leon's Furniture, a promising small-cap stock in Canada, has demonstrated robust financial health and growth potential. Recent earnings showed sales of CAD 617.66 million for Q2 2024, up from CAD 593.84 million last year, with net income rising to CAD 30.17 million from CAD 27.42 million. The company also announced a dividend increase to $0.20 per share and has reduced its debt-to-equity ratio from 20% to 10% over five years while maintaining high-quality earnings and strong interest coverage (11x EBIT).

- Click to explore a detailed breakdown of our findings in Leon's Furniture's health report.

Gain insights into Leon's Furniture's past trends and performance with our Past report.

TerraVest Industries (TSX:TVK)

Simply Wall St Value Rating: ★★★★★☆

Overview: TerraVest Industries Inc. manufactures and sells goods and services to energy, agriculture, mining, transportation, and other markets in Canada and the United States with a market cap of CA$1.81 billion.

Operations: TerraVest generates revenue primarily from HVAC and Containment Equipment (CA$292.90 million), Compressed Gas Equipment (CA$243.77 million), Service (CA$201.78 million), and Processing Equipment (CA$117.58 million). The Corporate segment shows a negative contribution of CA$0.93 million.

TerraVest Industries has shown impressive growth, with earnings up 43.6% over the past year, outpacing its industry’s -4.7%. The company reported CAD 238.13 million in revenue for Q3 2024, a significant jump from CAD 150.36 million last year, while net income rose to CAD 11.92 million from CAD 7.97 million. Despite a high net debt to equity ratio of 42.3%, TerraVest's interest payments are well covered by EBIT at five times coverage, reflecting strong financial health and quality earnings.

Next Steps

- Unlock our comprehensive list of 45 TSX Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FRU

Freehold Royalties

Engages in the acquiring and managing royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Western Canada and the United States.