- China

- /

- Electrical

- /

- SZSE:002130

ShenZhen Woer Heat-Shrinkable MaterialLtd And 2 Other High Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

In a week marked by volatility and mixed economic signals, global markets have shown resilience amid concerns over growth and technical factors. With major indices experiencing significant swings, investors are increasingly seeking companies with strong fundamentals and insider confidence. In this context, high-growth companies with substantial insider ownership can offer a compelling investment narrative. Insider ownership often indicates that those who know the company best have a vested interest in its success, aligning their goals with those of external shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.6% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Medley (TSE:4480) | 34% | 28.8% |

| On Holding (NYSE:ONON) | 28.4% | 24.7% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 54.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Vow (OB:VOW) | 31.7% | 97.7% |

Let's uncover some gems from our specialized screener.

ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130)

Simply Wall St Growth Rating: ★★★★★★

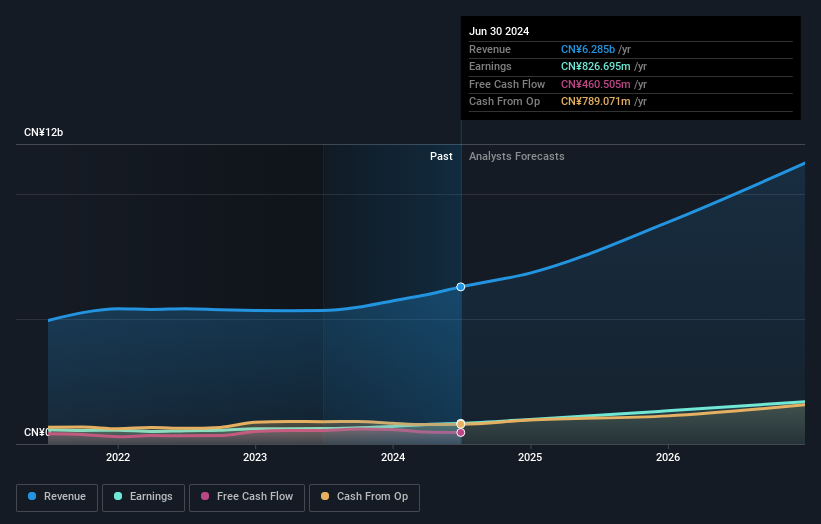

Overview: ShenZhen Woer Heat-Shrinkable Material Co., Ltd. (SZSE:002130) specializes in the production and distribution of heat-shrinkable materials, with a market cap of CN¥17.88 billion.

Operations: Revenue Segments (in millions of CN¥): Heat-Shrinkable Materials: 2,500; Insulation Products: 1,200; Electrical Equipment: 800.

Insider Ownership: 19%

Return On Equity Forecast: 20% (2027 estimate)

ShenZhen Woer Heat-Shrinkable Material Ltd. demonstrates strong growth potential with earnings forecasted to grow 27.9% annually and revenue expected to increase by 23.6% per year, outpacing the Chinese market. Despite a highly volatile share price recently, it trades at a good value with a P/E ratio of 23.2x compared to the CN market's 27.4x. Insider ownership remains significant, although recent buyback activity has been minimal and its dividend track record is unstable.

- Delve into the full analysis future growth report here for a deeper understanding of ShenZhen Woer Heat-Shrinkable MaterialLtd.

- In light of our recent valuation report, it seems possible that ShenZhen Woer Heat-Shrinkable MaterialLtd is trading behind its estimated value.

Persol HoldingsLtd (TSE:2181)

Simply Wall St Growth Rating: ★★★★☆☆

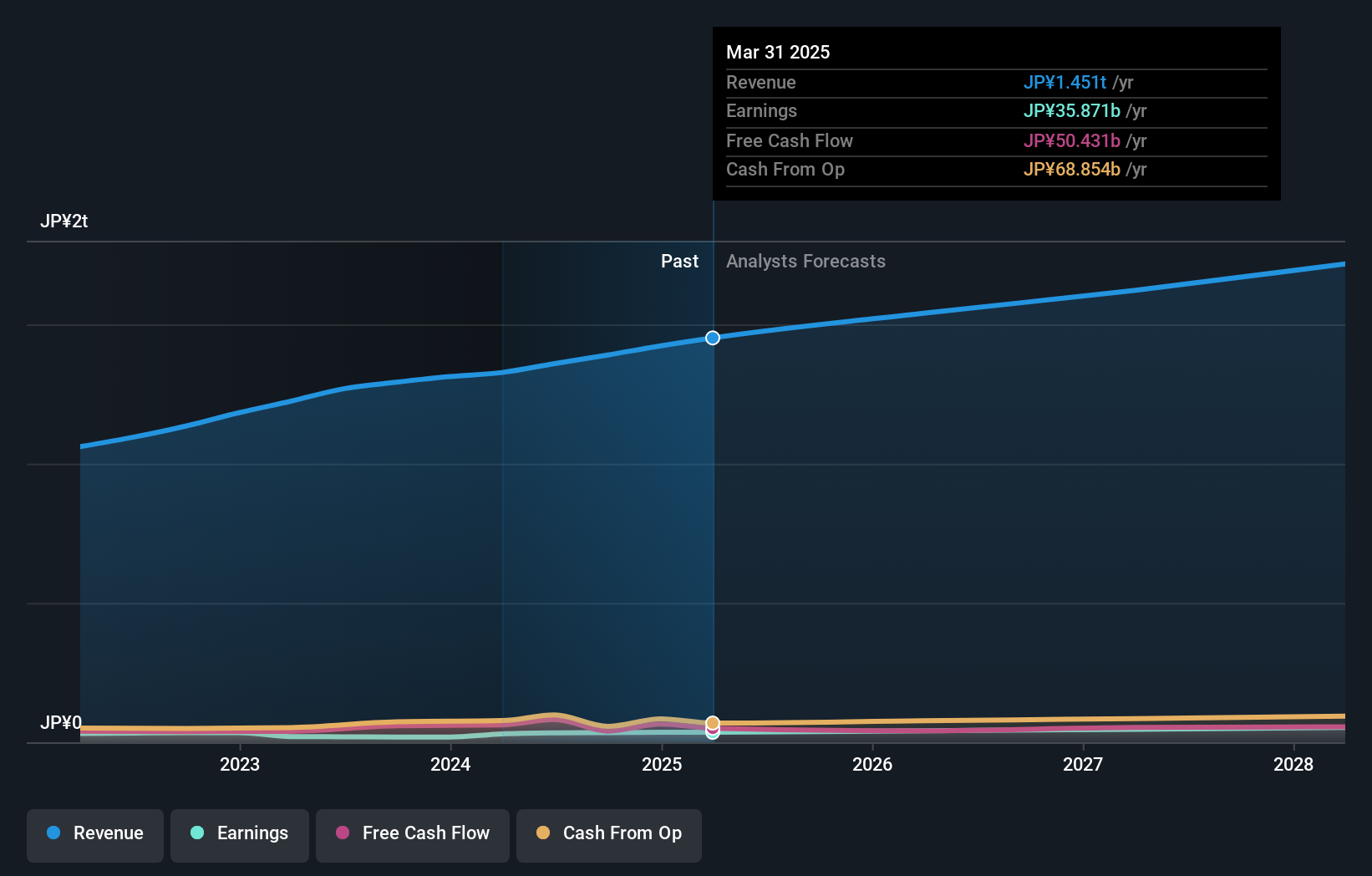

Overview: Persol Holdings Co., Ltd. provides human resource services under the PERSOL brand worldwide and has a market cap of ¥626.51 billion.

Operations: The company's revenue segments include Staffing (Excluding BPO) at ¥575.80 billion, Asia Pacific at ¥412.77 billion, Career at ¥128.28 billion, Technology at ¥102.38 billion, and BPO at ¥110.80 million.

Insider Ownership: 11.8%

Return On Equity Forecast: 20% (2027 estimate)

Persol Holdings Ltd. shows promising growth potential with earnings forecasted to grow 10.42% annually, surpassing the JP market's 8.6%. The company has completed a share buyback worth ¥3,589.49 million, indicating confidence in its valuation as it trades at 53.6% below estimated fair value. Despite an unstable dividend track record and slower revenue growth (5.1%) compared to high-growth benchmarks, insider ownership remains significant without recent substantial insider trading activity.

- Dive into the specifics of Persol HoldingsLtd here with our thorough growth forecast report.

- Our valuation report here indicates Persol HoldingsLtd may be undervalued.

TerraVest Industries (TSX:TVK)

Simply Wall St Growth Rating: ★★★★☆☆

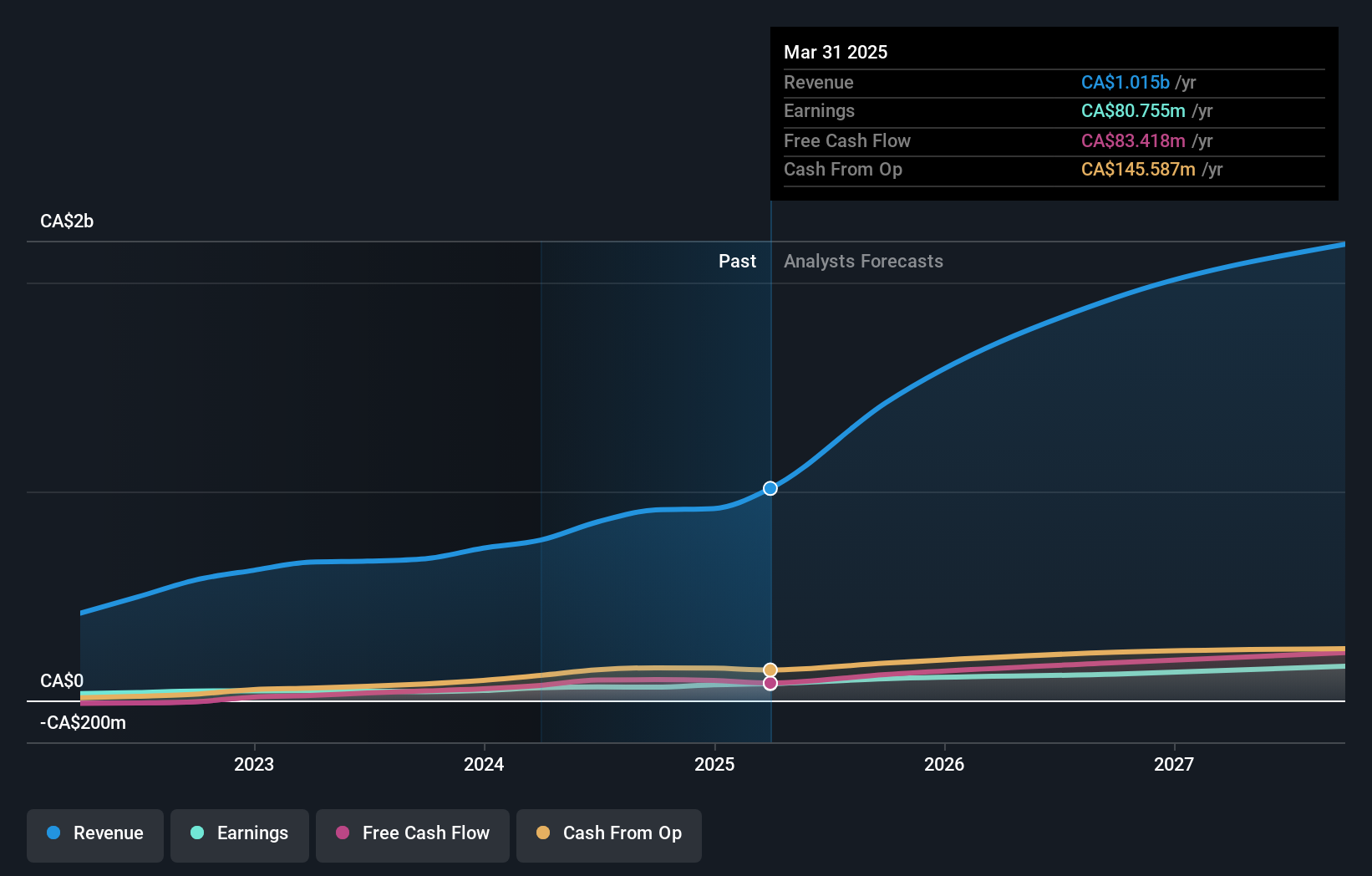

Overview: TerraVest Industries Inc. manufactures and sells goods and services to energy, agriculture, mining, transportation, and other markets in Canada and the United States with a market cap of CA$1.53 billion.

Operations: The company's revenue segments include CA$184.52 million from Service, CA$123.25 million from Processing Equipment, CA$216.10 million from Compressed Gas Equipment, and CA$244.50 million from HVAC and Containment Equipment.

Insider Ownership: 21.9%

Return On Equity Forecast: N/A (2027 estimate)

TerraVest Industries has shown impressive growth, with Q3 sales increasing to CAD 238.13 million from CAD 150.36 million last year and net income rising to CAD 11.92 million from CAD 7.97 million. Earnings per share also improved significantly over the same period. Despite some substantial insider selling recently, the company is trading below its estimated fair value and forecasts suggest earnings will grow at a robust 21.88% annually, outpacing the Canadian market's growth rate of 14.9%.

- Get an in-depth perspective on TerraVest Industries' performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that TerraVest Industries is trading beyond its estimated value.

Next Steps

- Get an in-depth perspective on all 1484 Fast Growing Companies With High Insider Ownership by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002130

ShenZhen Woer Heat-Shrinkable MaterialLtd

ShenZhen Woer Heat-Shrinkable Material Co.,Ltd.

Exceptional growth potential with flawless balance sheet and pays a dividend.