- Canada

- /

- Energy Services

- /

- TSX:TVK

Exploring Undiscovered Canadian Stocks In July 2024

Reviewed by Simply Wall St

Recent market dynamics in Canada, characterized by a notable divergence between sectors and shifting leadership, suggest that the investment landscape is evolving. Amid these changes, small-cap stocks have shown resilience and upward momentum, making them particularly interesting for investors looking to explore potential opportunities beyond the usual market leaders. In this context, uncovering undiscovered gems within the Canadian stock market could prove rewarding, especially given the broader economic backdrop of moderating inflation and easing central bank policies.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 7.71% | 8.87% | 30.01% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 66.35% | -25.78% | ★★★★★★ |

| Taiga Building Products | NA | 7.62% | 15.46% | ★★★★★★ |

| Pizza Pizza Royalty | 15.61% | 2.83% | 3.04% | ★★★★★☆ |

| Frontera Energy | 28.78% | -0.59% | 34.36% | ★★★★★☆ |

| Mako Mining | 28.08% | 39.01% | 48.79% | ★★★★★☆ |

| Genesis Land Development | 39.50% | 22.73% | 41.36% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Senvest Capital | 54.38% | 2.12% | -0.88% | ★★★★☆☆ |

| Fairfax India Holdings | 17.90% | 2.65% | 1.15% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Dundee Precious Metals (TSX:DPM)

Simply Wall St Value Rating: ★★★★★★

Overview: Dundee Precious Metals Inc. is a gold mining company focused on the acquisition, exploration, development, mining, and processing of precious metals, with a market capitalization of CA$2.17 billion.

Operations: The company generates revenue primarily through its Ada Tepe and Chelopech mining operations, which contributed $243.33 million and $274.18 million respectively. Its business model involves managing substantial operating expenses and non-operating costs, impacting net income margins which have shown significant fluctuations over the observed periods.

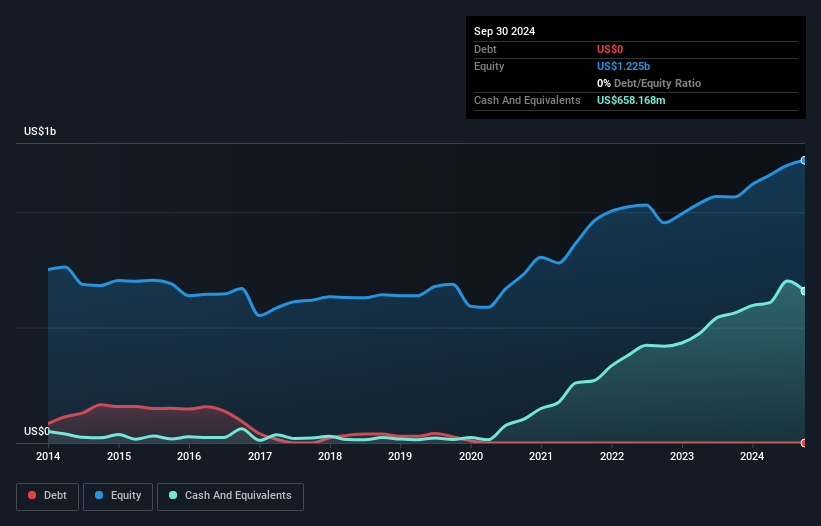

Dundee Precious Metals, a lesser-discussed player in the mining sector, has demonstrated robust performance with a 33.4% earnings growth over the past year, outpacing its industry's decline of 1.2%. This debt-free company is trading at 46% below its estimated fair value, signaling potential undervaluation. Recent corporate developments include leadership changes and reaffirmed production guidance for 2024, projecting significant gold and copper outputs which underscore its operational momentum and strategic focus on growth.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

Overview: The North West Company Inc. operates as a retailer specializing in food and everyday products and services, catering primarily to rural communities and urban neighborhood markets across northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market capitalization of CA$2.12 billion.

Operations: The company operates as a retailer of food and everyday products and services, generating revenue primarily through the sale of these items. It maintains a gross profit margin that has shown an upward trend over the years, reaching 33.02% by April 2024, reflecting its ability to manage cost of goods sold effectively relative to sales.

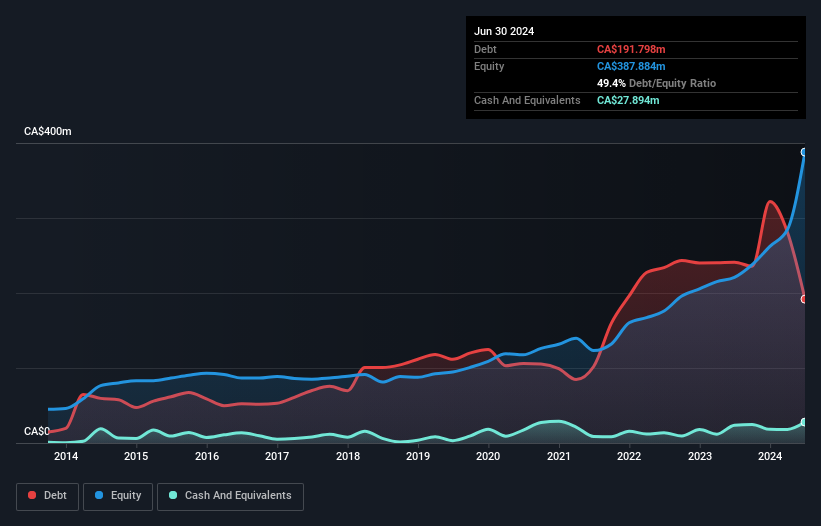

North West Company, a notable presence in the Consumer Retailing sector, has outpaced industry growth with a 15.8% earnings increase this past year, significantly higher than the industry's 5.7%. The firm has effectively managed its financial health, reducing its debt-to-equity ratio from 95.9% to 42.8% over five years and maintaining a satisfactory net debt-to-equity ratio of 31.5%. Recent quarterly results show robust performance with sales rising to CAD 617 million and net income reaching CAD 25 million, affirming dividends at $0.39 per share.

- Dive into the specifics of North West here with our thorough health report.

Explore historical data to track North West's performance over time in our Past section.

TerraVest Industries (TSX:TVK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TerraVest Industries Inc. is a diversified manufacturer providing products and services primarily to the energy, agriculture, mining, and transportation sectors in Canada and the United States, with a market capitalization of CA$1.55 billion.

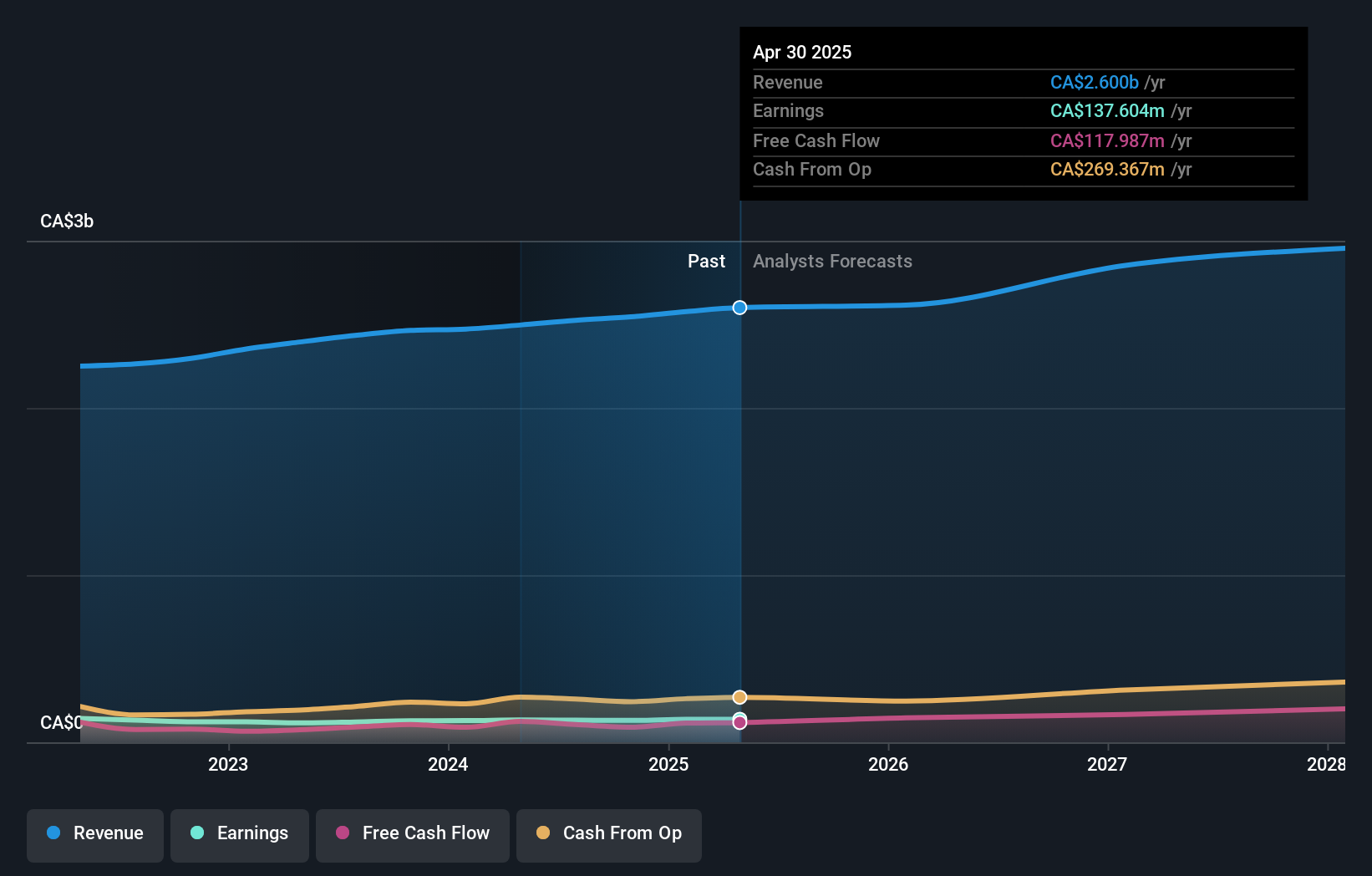

Operations: The company generates its revenue from diverse segments including Service, Processing Equipment, Compressed Gas Equipment, and HVAC and Containment Equipment. It has shown a notable increase in gross profit margin over the years, reflecting improved operational efficiency.

TerraVest Industries, a lesser-known yet compelling entity in the Canadian market, has demonstrated robust financial health and growth potential. With a 30% earnings growth surpassing its industry's 24.1%, and an impressive debt reduction from 128% to 98.8%, TerraVest stands out. Despite high net debt-to-equity at 92.4%, it trades at a significant 40.4% below estimated fair value, reflecting potential upside for discerning investors looking beyond mainstream options.

- Get an in-depth perspective on TerraVest Industries' performance by reading our health report here.

Evaluate TerraVest Industries' historical performance by accessing our past performance report.

Where To Now?

- Reveal the 47 hidden gems among our TSX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TerraVest Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVK

TerraVest Industries

Manufactures and sells goods and services to energy, agriculture, mining, transportation, and other markets in Canada and the United States.

Solid track record with excellent balance sheet.