- Canada

- /

- Oil and Gas

- /

- TSX:TVE

Why Tamarack Valley Energy (TSX:TVE) Raised Its Dividend Despite a C$248 Million Loss and Leadership Changes

Reviewed by Sasha Jovanovic

- Tamarack Valley Energy recently reported a third quarter net loss of C$248.77 million, announced upcoming leadership changes, raised its dividend, completed a substantial share repurchase, and reaffirmed 2025 production guidance following higher heavy oil output.

- The mix of financial loss and executive transitions combined with increased shareholder returns and confirmed operational targets presents a complex picture for investors evaluating Tamarack’s outlook.

- With the company increasing its dividend despite a recent net loss, we’ll examine what this means for Tamarack Valley Energy’s investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Tamarack Valley Energy Investment Narrative Recap

To be a Tamarack Valley Energy shareholder right now, you need to believe that the company’s heavy oil growth and capital allocation decisions can offset ongoing net losses and balance-sheet risks, particularly amid volatile oil prices and high debt levels. The recent earnings report with a sizeable net loss and leadership change does not appear to materially alter the current short-term production catalyst, but it does put added focus on the risk of financial leverage potentially limiting future flexibility.

The company’s announcement of a 5% dividend increase, despite reporting a third quarter net loss, stands out. For investors, this renewed commitment to shareholder returns may serve as a counterweight to the headline loss, but also raises questions about payout sustainability considering recent unprofitability and ongoing cash demands required by the business.

However, against this renewed capital return, investors should be aware that persistent debt and capital intensity could still constrain earnings if ...

Read the full narrative on Tamarack Valley Energy (it's free!)

Tamarack Valley Energy is forecast to reach CA$1.7 billion in revenue and CA$80.5 million in earnings by 2028. Achieving this will require annual revenue growth of 4.8%, but represents a CA$178.7 million decrease in earnings from the current level of CA$259.2 million.

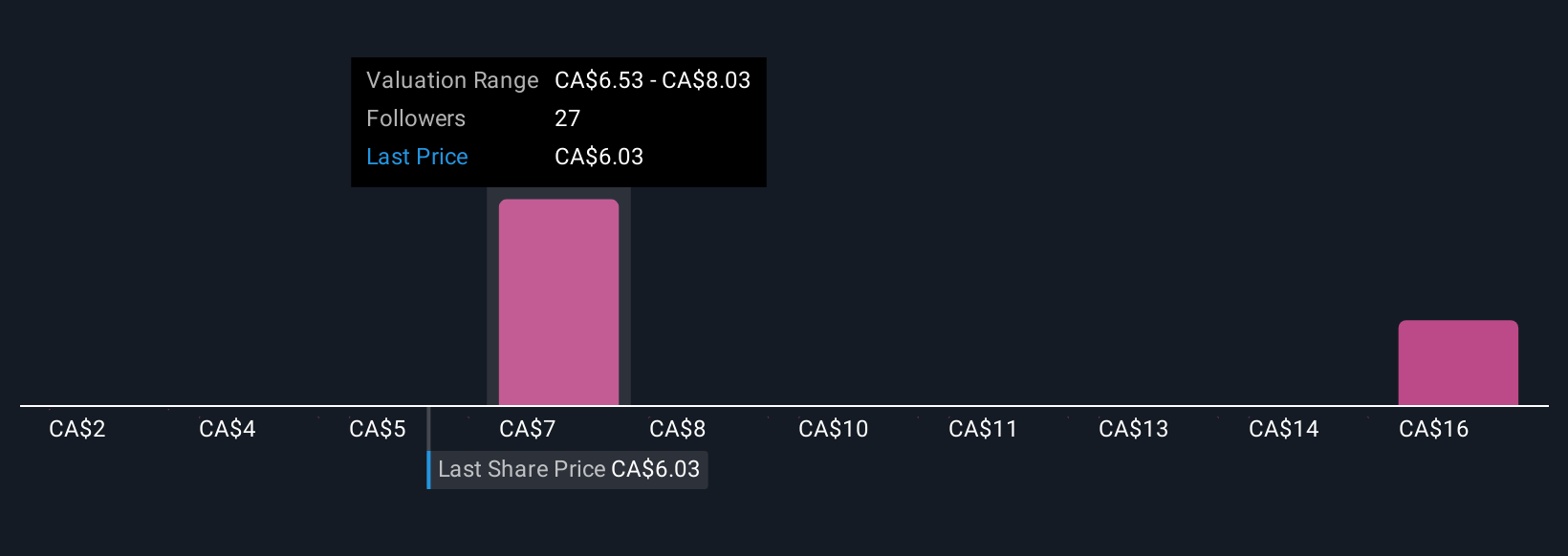

Uncover how Tamarack Valley Energy's forecasts yield a CA$7.72 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Tamarack Valley Energy’s fair value between C$7.73 and C$20.31 across two individual forecasts. High debt levels, alongside aggressive capital allocation, may influence actual outcomes beyond these personal projections, reminding you to review multiple perspectives before forming your own view.

Explore 2 other fair value estimates on Tamarack Valley Energy - why the stock might be worth just CA$7.72!

Build Your Own Tamarack Valley Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tamarack Valley Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tamarack Valley Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tamarack Valley Energy's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tamarack Valley Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVE

Tamarack Valley Energy

Engages in the exploration, development, production, and sale of oil, natural gas, and natural gas liquids in the Western Canadian sedimentary basin.

Excellent balance sheet and good value.

Market Insights

Community Narratives