- Canada

- /

- Oil and Gas

- /

- TSX:SDE

Spartan Delta (TSX:SDE) Is Up 8.1% After Surpassing Q3 Production Guidance Is Growth Gaining Traction?

Reviewed by Sasha Jovanovic

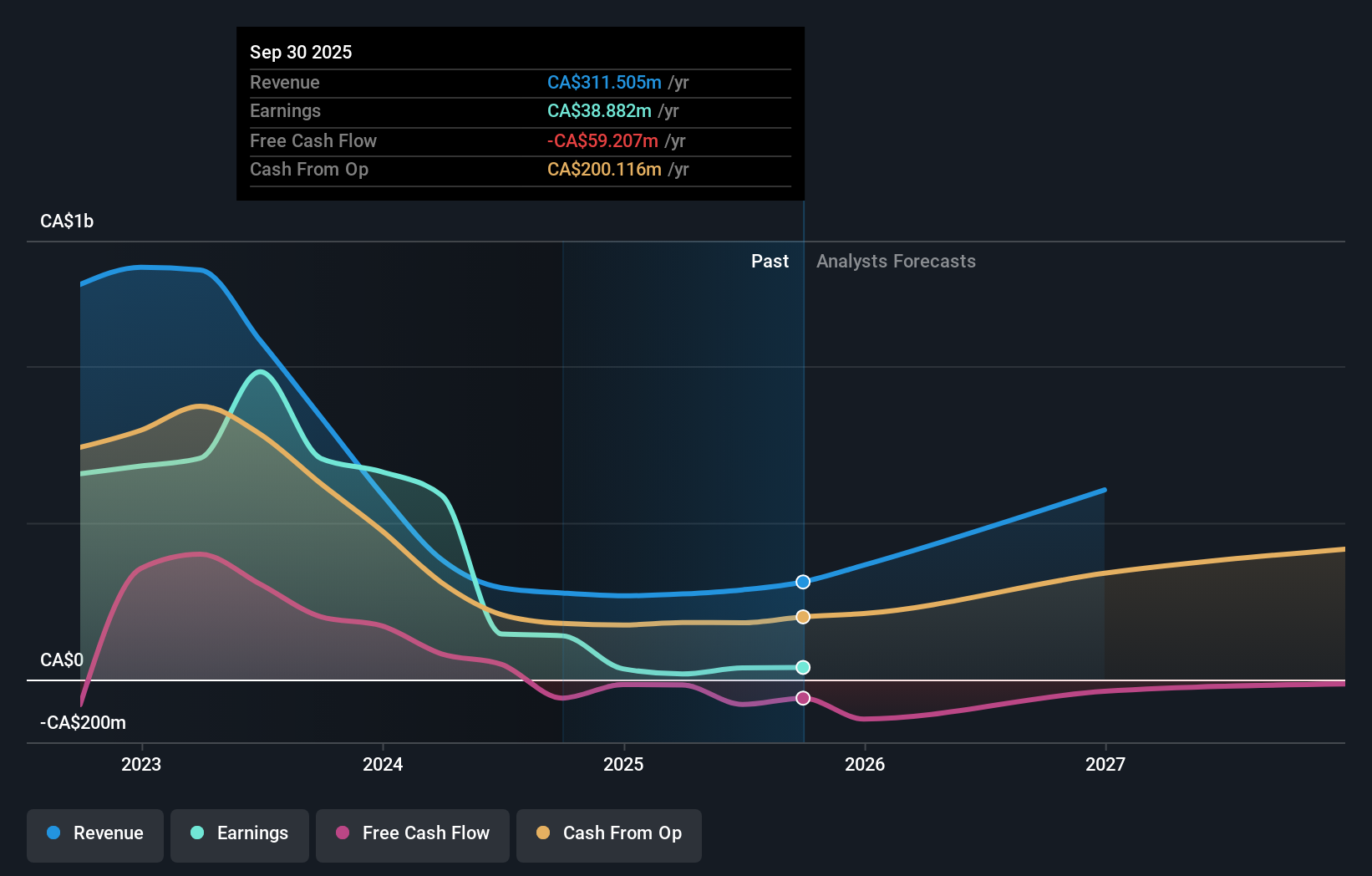

- Spartan Delta Corp. recently reported its third quarter and nine-month 2025 results, highlighting a rise in net income to C$5.33 million for the quarter and increased total average daily production to 43,193 BOE/d compared to a year ago.

- Alongside these results, the company updated its guidance, signaling expectations to achieve or surpass the high end of its annual production range, which reflects operational momentum and management confidence.

- With the company expecting to reach its highest projected production levels, we'll explore what this means for Spartan Delta's investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Spartan Delta's Investment Narrative?

Owning Spartan Delta means believing in the company’s ability to execute on growth in the oil and gas sector despite its recent earnings volatility and historically low return on equity. The third quarter’s rise in net income and a sharp uptick in production, paired with management’s updated guidance calling for production at the top end of its range, could prove to be a pivotal short-term catalyst. For shareholders, this operational momentum may temporarily ease concerns tied to recent declines in profit margins and earnings, which previously stood out as major risks along with shareholder dilution and an expensive valuation relative to peers. If production outperformance translates into lasting improvements in profitability, that would mark a shift in the company’s risk profile. Yet, these results are just one quarter, and persistent questions around margin quality and capital allocation remain important to watch.

But board turnover remains low, which could mean limited new perspectives for the company. According our valuation report, there's an indication that Spartan Delta's share price might be on the expensive side.Exploring Other Perspectives

Explore another fair value estimate on Spartan Delta - why the stock might be worth just CA$7.50!

Build Your Own Spartan Delta Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spartan Delta research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Spartan Delta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spartan Delta's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SDE

Spartan Delta

Engages in the exploration, development, and production of crude oil and natural gas properties in Western Canada.

Adequate balance sheet with low risk.

Market Insights

Community Narratives