- Canada

- /

- Oil and Gas

- /

- TSX:PPL

Is Pembina Pipeline (TSX:PPL) Undervalued? A Fresh Look at Current Valuation Drivers

Reviewed by Simply Wall St

Pembina Pipeline (TSX:PPL) stock has caught the attention of investors lately, especially with recent trading activity showing some mild swings. Let us take a quick look at how the shares are performing and what might be on the horizon for this energy infrastructure giant.

See our latest analysis for Pembina Pipeline.

Pembina Pipeline’s share price has shown some lively trading lately, rising 0.92% over one day and adding 10.14% over the past 90 days, even after a recent pullback in the last month. While the year-to-date price return has been modest, long-term shareholders have seen a rewarding 139.58% total return over five years. This reflects steady business momentum in the energy infrastructure space.

If Pembina’s steady long-term performance has you thinking bigger, consider expanding your investment universe and uncovering fast growing stocks with high insider ownership

But with a modest share price gain this year and strong long-term returns, investors may question whether Pembina Pipeline’s stock is trading at a bargain today or if the market is already anticipating future growth in its valuation.

Most Popular Narrative: 8.4% Undervalued

With Pembina Pipeline’s fair value based on the most popular narrative sitting at $58.78, analysts see noticeable upside from the last close at $53.86. This sets the stage for a closer look at what is driving this optimism about the company's prospects.

Regulatory and societal challenges limiting new pipeline construction across North America enhance the value and pricing power of Pembina's extensive existing infrastructure, supporting long-term net margin resilience and providing the basis for higher returns on capital.

What’s leading this valuation? Imagine a company set to boost margins, hold revenue steady, and unlock higher profit multiples in an industry facing big barriers. Want to see the exact financial drivers and future assumptions included in this target? Click through for the surprising upside story that underpins this attractive fair value.

Result: Fair Value of $58.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory hurdles or unexpected competition could erode Pembina’s margins and challenge the upbeat valuation narrative highlighted by analysts.

Find out about the key risks to this Pembina Pipeline narrative.

Another View: Is the Market Willing to Pay More?

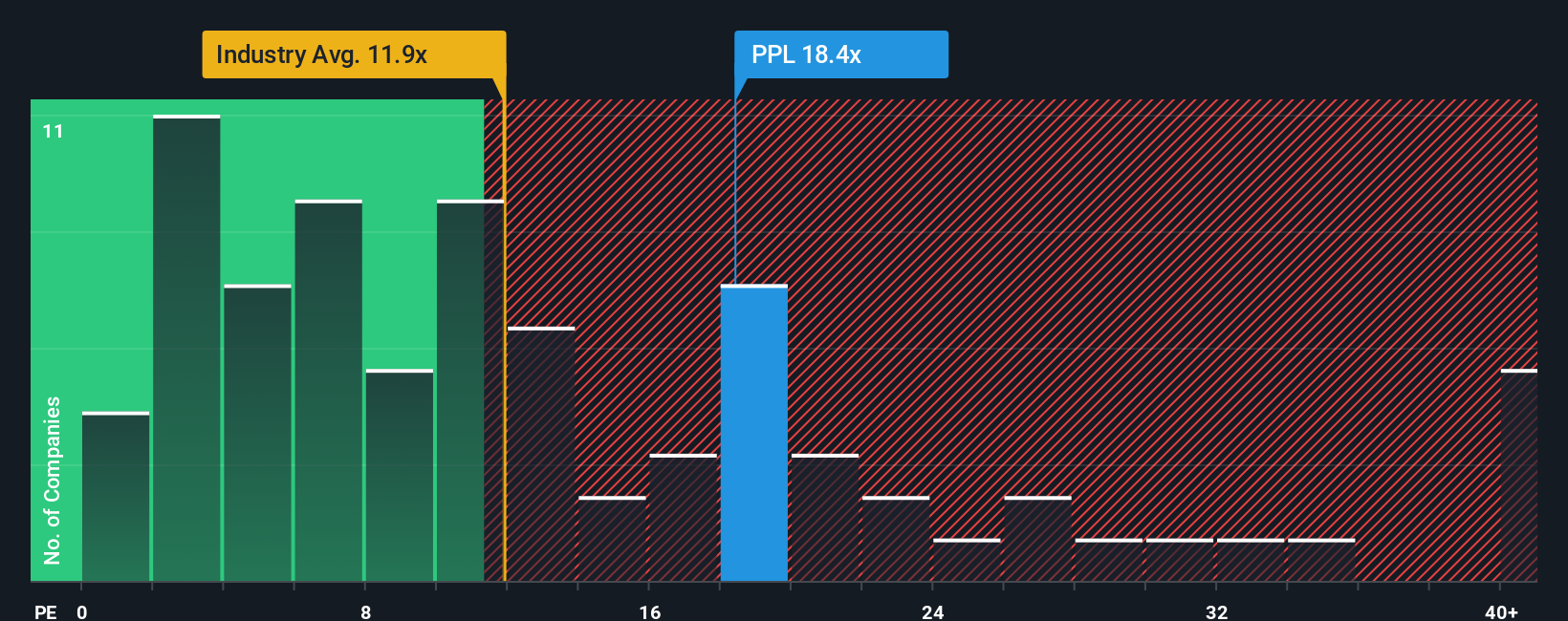

Looking at how the market values Pembina today, its price-to-earnings ratio stands at 18.1 times. That is a premium not only to its fair ratio of 15.9 times, but also above the Canadian Oil and Gas industry average of 13.5 times. Such a gap could suggest investors see future growth that others have not, or it may just mean more downside risk if those expectations are not met. Are these optimism-fueled multiples sustainable?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pembina Pipeline Narrative

If you see things differently or want to test your own ideas against the numbers, you can quickly build your narrative in just a few minutes. Do it your way

A great starting point for your Pembina Pipeline research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your portfolio horizons and get ahead of emerging market themes. The right investments can set you apart, so do not miss out on these opportunities Simply Wall Street surfaces every day.

- Capitalize on the explosive growth potential of artificial intelligence by reviewing these 24 AI penny stocks, poised to transform industries through automation, smarter analytics, and advanced learning technologies.

- Boost your passive income by sorting for these 17 dividend stocks with yields > 3% that offer consistent yields above 3 percent and strong fundamentals to support real long-term rewards.

- Secure undervalued gems the market is overlooking by screening for these 861 undervalued stocks based on cash flows, driven by robust cash flows and hidden upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PPL

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives