- Canada

- /

- Energy Services

- /

- TSX:PHX

PHX Energy Services (TSX:PHX): Evaluating Valuation Following Mixed Q3 Earnings Results

Reviewed by Simply Wall St

PHX Energy Services (TSX:PHX) just announced its third quarter and nine-month earnings. The company reported higher sales year-over-year, but net income and earnings per share declined compared to last year.

See our latest analysis for PHX Energy Services.

After this earnings announcement, PHX Energy Services’ 1-year total shareholder return stands at -16.63%, and the share price is down 22.65% year-to-date. This signals that investor confidence has faded as profitability growth slowed. Even so, long-term holders have seen the five-year total return surge over 500%, which creates an impressive backdrop for future prospects.

If you’re on the lookout for the next opportunity, now is a perfect moment to expand your radar and discover fast growing stocks with high insider ownership

With the stock trading below analyst targets and five-year returns still strong, investors have to wonder if PHX Energy Services is currently a bargain or if the market has already accounted for its future growth prospects.

Price-to-Earnings of 6.4x: Is it justified?

With PHX Energy Services trading at a price-to-earnings (P/E) ratio of 6.4x, well below its North American Energy Services peers and its own estimated fair P/E, investors are looking at a stock the market appears to be undervaluing.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of earnings. For a company like PHX Energy Services, which has demonstrated substantial long-term profit growth, a low P/E can suggest the market is skeptical of future earnings strength or is overlooking the company’s fundamentals.

Compared to the industry average P/E of 15.1x and an internal fair P/E of 12.1x, PHX’s current valuation stands out as unusually low. This gap signals potential room for price appreciation if market sentiment turns, especially given that the company recently achieved profitability after years of rapid earnings expansion.

Explore the SWS fair ratio for PHX Energy Services

Result: Price-to-Earnings of 6.4x (UNDERVALUED)

However, slower annual revenue growth and persistently weak short-term returns could limit a near-term rebound if industry sentiment does not improve.

Find out about the key risks to this PHX Energy Services narrative.

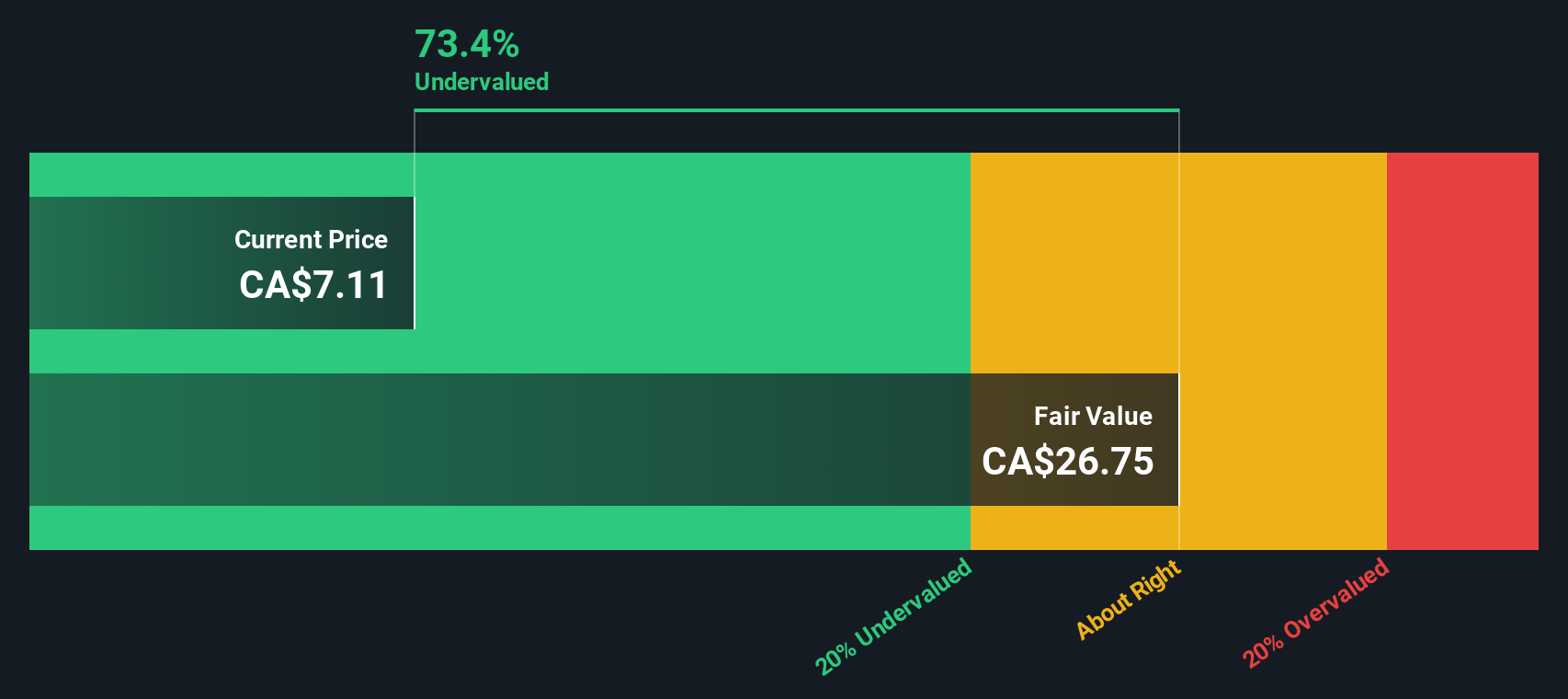

Another View: Discounted Cash Flow Signals Deeper Undervaluation

Looking through another lens, our SWS DCF model estimates PHX Energy Services’ fair value at CA$26.73, while shares trade hands at just CA$7.31. This means the stock is trading nearly 73% below its intrinsic value. Does this large gap reveal a hidden opportunity, or does it suggest there are factors investors are overlooking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PHX Energy Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PHX Energy Services Narrative

If you have a different perspective, or want to dive into the numbers yourself, you can easily craft your own investment narrative in just a few minutes. Do it your way

A great starting point for your PHX Energy Services research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to a single opportunity. New trends can spark the next big winner, and missing out could mean watching from the sidelines while others benefit. Use these hand-picked stock lists to stay ahead:

- Boost your potential returns by checking out these 870 undervalued stocks based on cash flows with stronger fundamentals at attractive prices, often overlooked by the crowd.

- Maximize your portfolio income with these 15 dividend stocks with yields > 3%, featuring companies delivering solid dividend yields above 3% for steady cash flow.

- Capitalize on the future of medicine by selecting these 32 healthcare AI stocks where health and advanced technology come together to shape tomorrow's breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PHX

PHX Energy Services

Provides horizontal and directional drilling services, rents performance drilling motors, and sells motor equipment and parts to oil and natural gas exploration and development companies in Canada, the United States, Albania, the Middle East regions, and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives